This Sunday, Turkey will elect 600 Members of Parliament and a president. Will there be a change in power after 20 years of rule by the AKP party, headed by Recep Tayyip Erdogan?

Some key facts

-

On 14 May, Turks will go to the polls to elect their representatives to parliament and the president. 64 million Turks are eligible to vote

- If no candidate receives 50% of the vote, a second round of elections will be held on 18 June

-

Erdogan remains 20 years in power, but this will be the first election after the change from a parliamentary to a presidential system, which took place in 2018

-

Erdogan was prime minister for 11 years, while he became president in 2014

-

The AKP party is likely to win the election, but may not be given the opportunity to govern on its own

-

The Justice and Development Party (AKP) is losing support heavily due to significant inflation and a massive drop in the exchange rate. In addition, the opposition has accused the ruling party of poorly managing the problem after a series of earthquakes this year

-

Inflation in Turkey fell to 50.5% for March from 85.5% in October, a 24-year high. Erdogan is known for his unconventional approach to inflation and pushing for interest rate cuts

-

Kemel Kilindaroglu of the Republican People's Party (CHP) is Erdogan's biggest rival in the presidential race. Most polls put him in a position to win the first round, but a second round could be more evenly matched

-

The chances of defeating the AKP have increased significantly due to the first coalition bloc of as many as six parties in years, which has backed Kemal Kilindaroglu

-

The opposition candidate is a supporter of democracy and is known for his anti-corruption rhetoric. Domestically, however, he is accused of having too many connotations with the 'West', he would like more integration with the EU.

The economy is the most important issue

There is no talk of war or NATO in Turkey at the moment. By far the most important problem is the economy, and its problems were reinforced by the earthquakes at the beginning of February in which 50,000 people died and 14 million people, or about 16% of the total population, were affected. Many have criticized the government for failing to deal with the problem, and the presidential system has failed since 2018. The opposition wants a return to a parliamentary system. At the same time, the opposition finds it difficult to present its critical view of the government due to the fact that 90% of the media is influenced by Erdogan's party.

Kilindaroglu has announced a desire to fight inflation and improve conditions for foreign capital in the country. The opposition also has far fewer objections over NATO enlargement, although even in the event of Erdogan's victory, the opposition is likely to agree to Sweden joining NATO. This may happen because of Turkey's willingness to purchase fighter jets from the United States. However, the conflict between Turkey and the United States has been exacerbated in recent years due to Turkey's desire to purchase a missile system from Russia.

Average support for candidates in Turkey's presidential election. However, the withdrawal of one of the candidates in recent weeks makes it increasingly likely that Kilindaroglu will win in the first round. Source: politpro.eu

Market sees massive risks

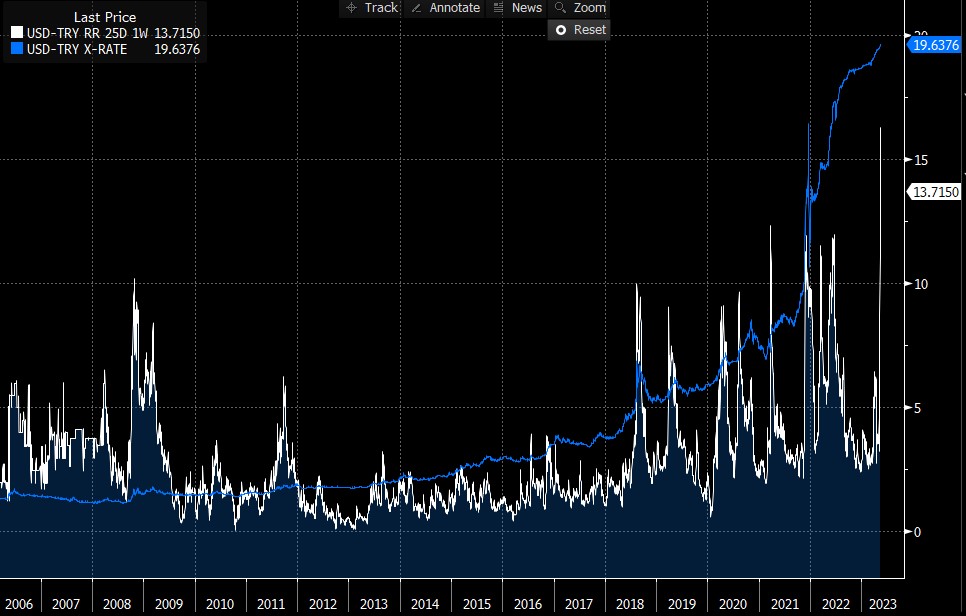

Looking at the behavior of the options market, the market sees potential massive volatility in the week ahead. The Weekly Risk Reversal was trading near the 15 level, the highest reading on record, which shows how strongly the market is hedging against a potential further rise in the lira. At the same time, an opposition win could lead to a massive strengthening of the lira. The lira has lost almost 50% of its value since the beginning of 2022.

The market is hedging against a potential further rise. Some commentators believe that the AKP and Erdogan staying in power could mean the 'bankruptcy' of the country within the next few months, given the continued withdrawal of foreign capital from the country. Source: Bloomberg

The market is hedging against a potential further rise. Some commentators believe that the AKP and Erdogan staying in power could mean the 'bankruptcy' of the country within the next few months, given the continued withdrawal of foreign capital from the country. Source: Bloomberg

The lira exchange rate has been stabilized by the central bank since October, when we had the highest inflation in 24 years. Despite this, the lira has continued to lose, although it is "only" around 6% drop since October. Source: xStation5

The lira exchange rate has been stabilized by the central bank since October, when we had the highest inflation in 24 years. Despite this, the lira has continued to lose, although it is "only" around 6% drop since October. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.