DE30

Looking at the H4 chart of the German DAX index (DE30) from a technical point of view, the price has recently left the downtrend channel and managed to break above the resistance at 14,300 points. However, the upward movement halted around the resistance zone at 14,590 points, which acted as a major obstacle for buyers. Should break higher occur, the highs from the end of March - around 14,860 points - will become the next target for the market bulls. On the other hand, should a correction move occur, the zone around 14,300 points remains the key support. Its negation could push the index towards 14,000 points, where the lower limit of the 1:1 structure is located.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app DE30 H4 interval. Source: xStation5

DE30 H4 interval. Source: xStation5

Bitcoin

Monday's session brought a dynamic rally on the cryptocurrency market. Bitcoin price managed to leave the local consolidation, however the market bulls' enthusiasm cooled down quickly. Looking at the D1 interval, the technical situation remained basically unchanged. Despite a large D1 demand candlestick, the price remains below the key resistance at $33,000. Only the break above could spark a bigger rebound towards $37,600. On the other hand, if sellers take the lead and the support at $29,000 is broken, Bitcoin could return to the downtrend and hit the recent lows at $25,000.

Bitcoin interval D1 Source: xStation5

Bitcoin interval D1 Source: xStation5

GOLD

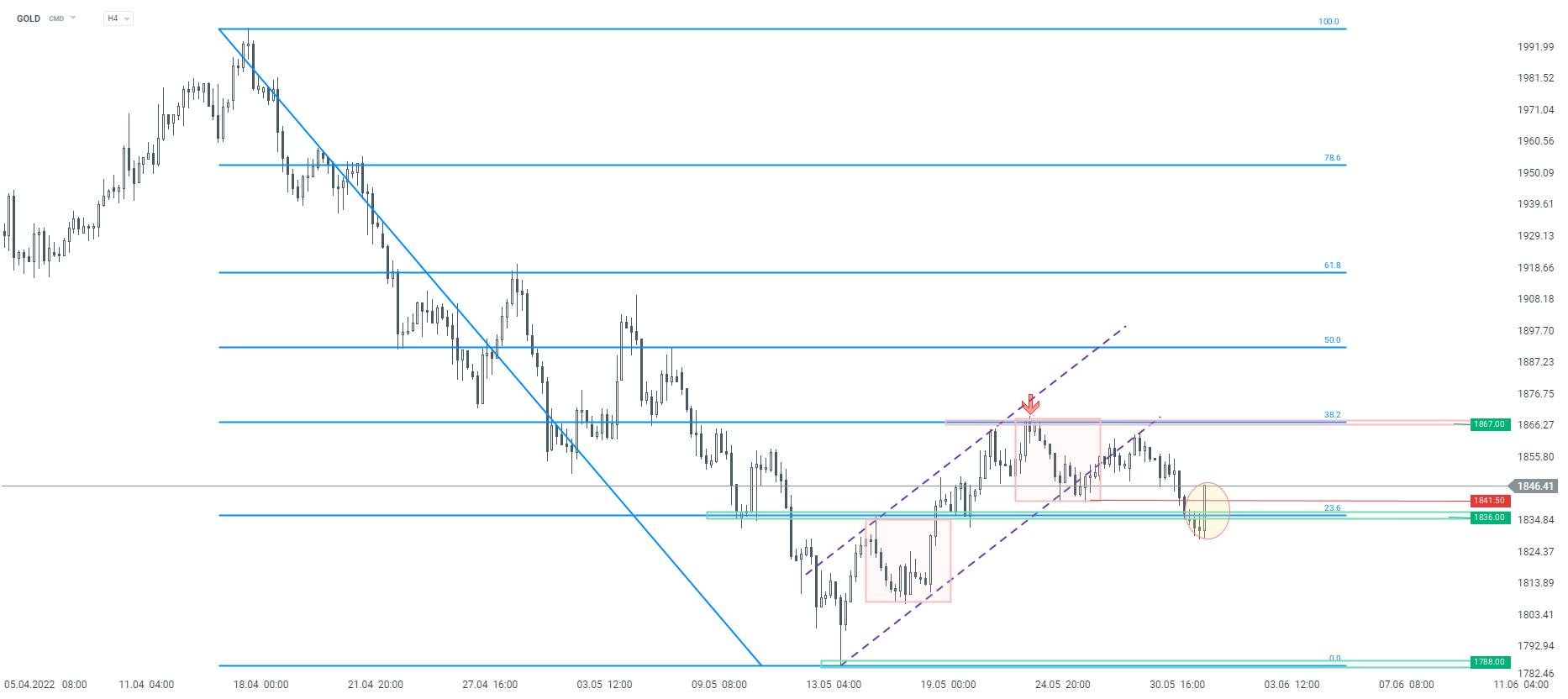

When it comes to the gold market, the last correction stopped at the measurement of 38.2% of the downtrend wave, which started in mid-April. Technical analysis may support the continuation of the downtrend. Important for the further price direction will be whether the price will remain below the zone $1841.50 - $1836.00. If so, another downward impulse towards the recent low at $1788.00 should be on the cards. On the other hand, if buyers regain control, it may lead to a retest of the resistance at $ 1867.

GOLD interval H4. Source: xStation5

GOLD interval H4. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.