Inflation in the UK made it back to the 2% target rate after all. It may have taken 3 years, but headline inflation has done it with the help of falling food prices, which offset a slight increase in fuel prices compared to a year ago. Food price growth was more than 18% a year ago, today it eased to a 1.7% annual rate. While this highlights the extent of the gains made in the fight against inflation, it is unlikely to move the dial for the Bank of England.

Egg prices creep higher, but those with a sweet tooth are in for a (cheaper) treat

Digging a bit deeper into the inflation data, 9 out of 11 foods saw price decreases in May relative to a year ago. This includes cereals and vegetables, which fell to their lowest level since 2021 and sugar, jams, chocolates, and confectionary, which fell to their lowest level since 2022. In contrast, eggs and cheese saw price rises compared to a year ago, along with the price of oil.

Core service prices miss analyst estimates

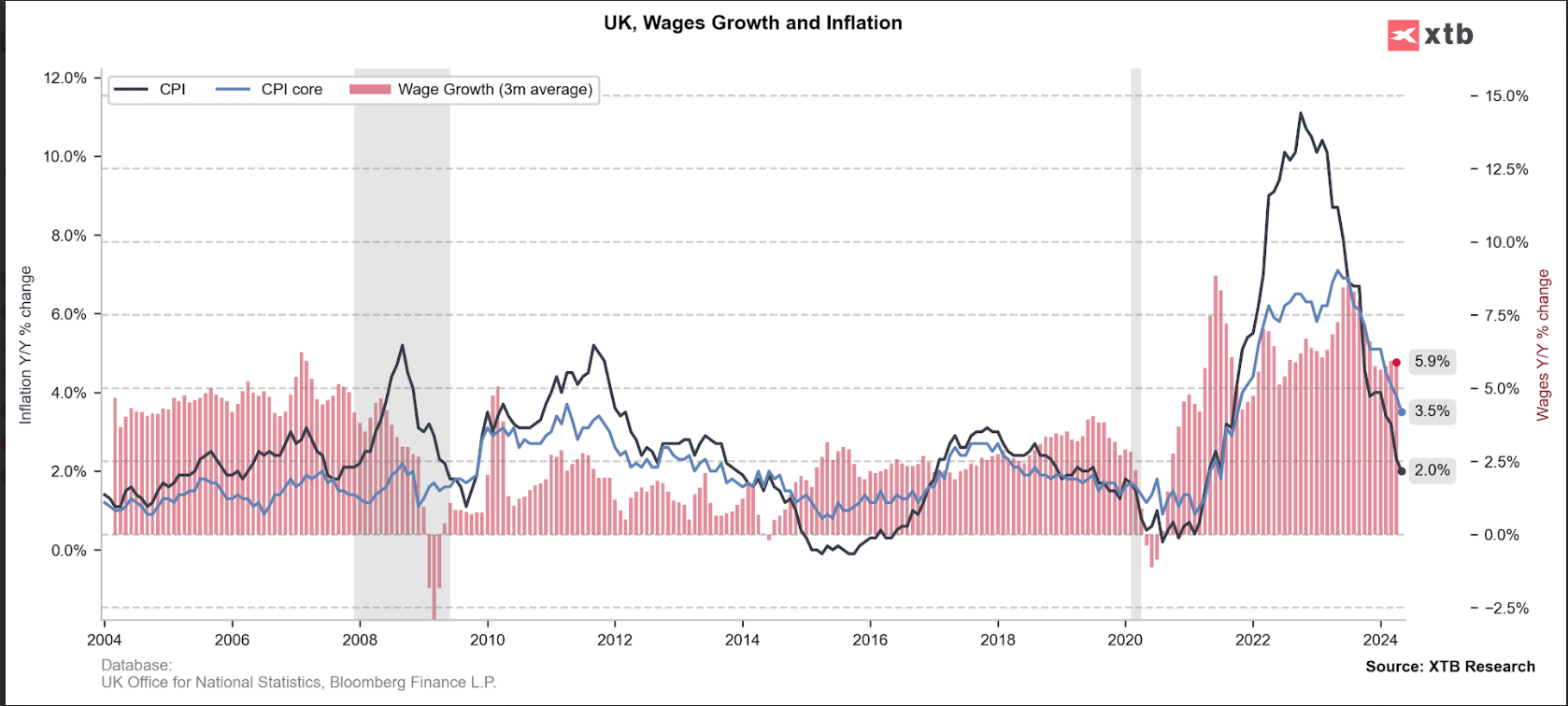

The core rate of inflation eased as expected to 3.5% from 3.9%, this was driven by a sharp decline in core goods prices, which fell by 1.3% last month compared to a year earlier. However, core service prices remain elevated and missed analyst estimates for a decline to 5.5%, instead they grew by 5.7% YoY. The lack of progress made on core service prices, which include the costs of recreation and culture, eating out and staying in hotels, is keeping the Bank of England cautious when it comes to cutting interest rates. It also explains the muted reaction to the pound on the back of this report, GBP/USD has risen in the immediate aftermath and is back above $1.2720.

Chart 1:

Source: XTB

The BOE may signal a rate cut in August is coming

This inflation report may solidify a rate cut in August, however, the outlook for rate cuts after that remains murky, even with headline inflation falling to 2%. The market has ruled out a cut to rates this month, it is too close to the election and there is only an 8% chance of a cut tomorrow. The focus will now shift to tomorrow’s meeting, and whether the BOE will prepare the market for a one-off cut to rates in August when it releases its monetary policy summary and its minutes at midday tomorrow. We think that they will especially because the criteria for headline inflation to fall to 2% has been met. There is currently a 43% chance of an August rate cut.

BOE: One and Done

We think that the BOE will acknowledge the progress made on inflation at their meeting tomorrow, and they may even signal that a rate cut is possible, however, it may be a one-off cut like we saw at the ECB earlier in June, especially since inflation is set to be bumpy in the coming months. Currently there are just under two rate cuts priced in for 2024, and we don’t think that will move too much in the next few days, as we expect the Bank of England to avoid unbridled talk about rate cuts.

EU points spotlight on French fiscal woes

Elsewhere, France is likely to be in focus as the EU Commission makes it verdict about the ‘punishments’ that should be imposed on EU member states that are on the ‘Excessive Deficit Procedure List’. France, with its 5.5% budget deficit and debt at 111% of GDP, is likely to be admonished by the EU Commission and may face fines for breaching the bloc’s budget deficit rules, with just over one week to go before the first round of voting in the French Parliamentary election. The National Rally party, headed by Marine Le Pen, are leading these elections, and have touted measures that could boost the budget deficit, they also campaign on greater freedom from Europe. Thus, today’s verdict from the EU Commission, could see jitters creep into the French bond market, and we will be watching the French – German bond yield spread closely to see if this rises on the back of the focus on European debt levels. The spread between French and German 10-year yields is 78 basis points, a breach of 80 basis points could trigger another sell off in French stocks.

Up, up, and away, is Nvidia only getting going?

Nvidia returned to being the world’s most valuable company on Tuesday and it is now worth a staggering $3.34 trillion. How far can this stock go? Some argue that the GPUs that Nvidia have a 98% market share of are only getting going, and demand for them will continue to surge throughout this decade. In the past year, Nvidia’s performance has been exceptional. In May 2023 it reached a $1 trillion valuation, in February 2024 it reached a $2 trillion valuation and in June its valuation topped $3.3 trillion. This can be an exceptionally volatile stock, and much more volatile than the overall market. However, the volatility in the past 12 months has mostly been to the upside. Momentum is also helping Nvidia and other tech stocks to drive the S&P 500 to multiple record highs this year. It is the biggest factor driving the S&P 500 YTD at 11.2%. While momentum is great until it is not, it is also worth noting the financial fundamentals at Nvidia could also drive its stock price higher. The company has a valuation of $3.3 trillion, and a debt load of $11bn, which means there is ample room for chunky shareholder returns in the future, which may also attract more people to the stock.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.