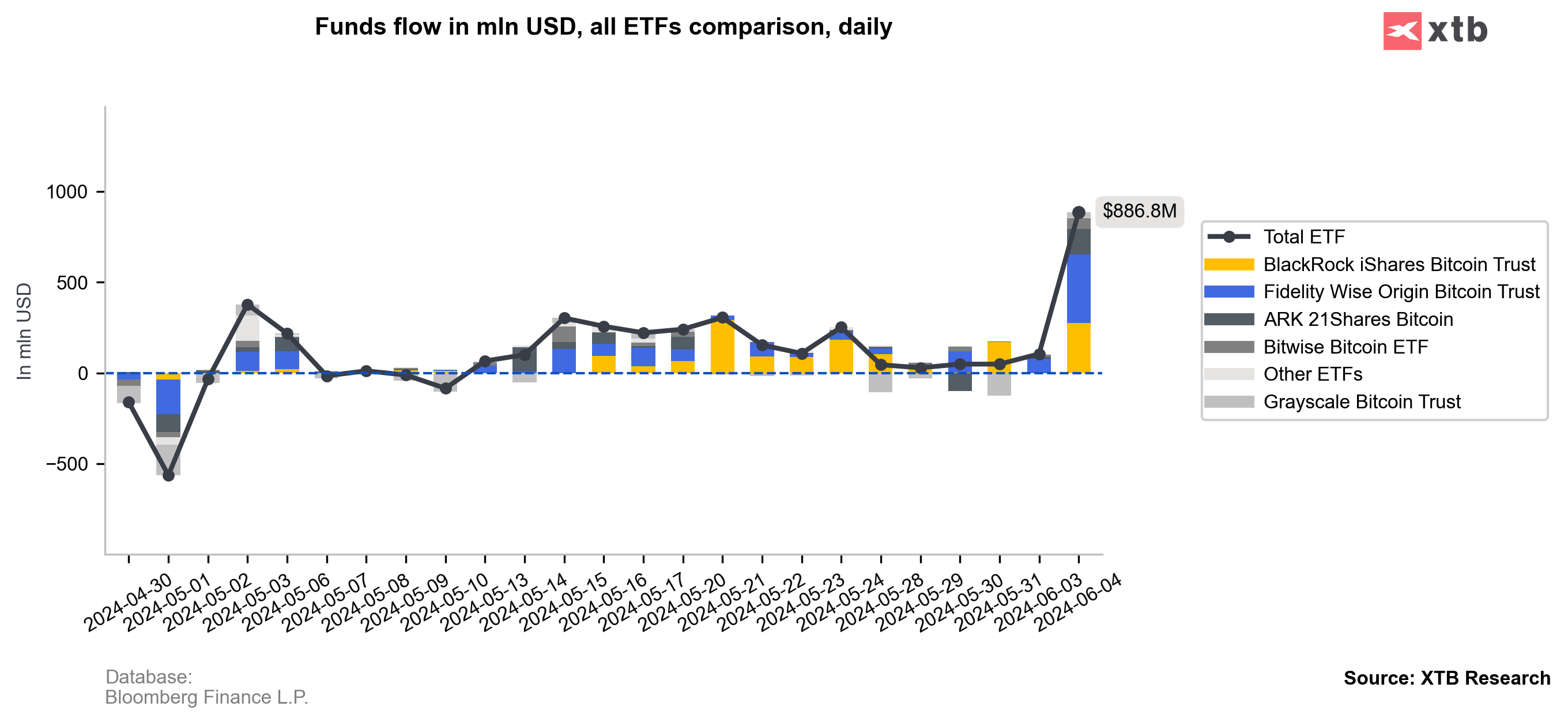

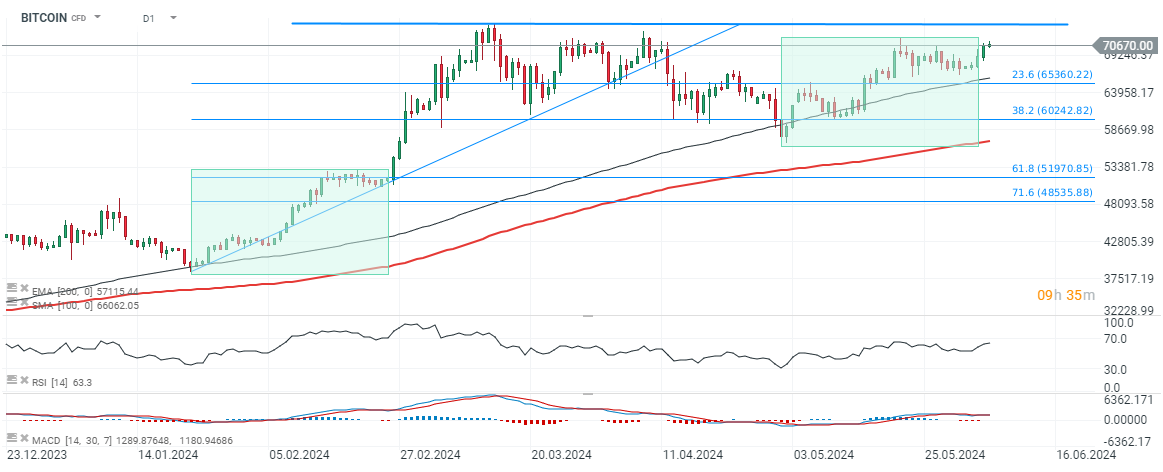

Yesterday, 10 US spot Bitcoin ETFs noted record $886.8 million net inflows, which helped the biggest cryptocurrency bounce back above $70.000. More than $800 million in short positions were liquidated yesterday, but it's still unclear why inflows were so large inside both BlackRock's IBIT and Fidelity FBTC funds. Some speculations signal that perspective of creating Texas-based stock exchange (Texas Stock Exchange) by Citadel Securities and BlackRock, which will 'specialize' in Exchange Traded Products, may fuel the market, but the fact is that yesterday inflows were probably affected by some large buyers - despite weakness on Wall Street and precious metals. Also, weaker macro data from US (and US dollar) may be a trigger to awaited Fed pivot and falling treasury yields, which can increase demand for so-called risky assets.

Source: Bloomberg Finance L.P. , XTB Reserach

Source: Bloomberg Finance L.P. , XTB Reserach

Source: xStation5

Source: xStation5

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.