- A remarkably strong US labour market report for January has significantly dampened expectations for a June rate cut by the Federal Reserve.

- Index futures extended their gains following the NFP release, as investors bet on the continued resilience of the US economy.

- Technology shares are leading a robust recovery in early trading.

- A remarkably strong US labour market report for January has significantly dampened expectations for a June rate cut by the Federal Reserve.

- Index futures extended their gains following the NFP release, as investors bet on the continued resilience of the US economy.

- Technology shares are leading a robust recovery in early trading.

Blockbuster Payrolls Report

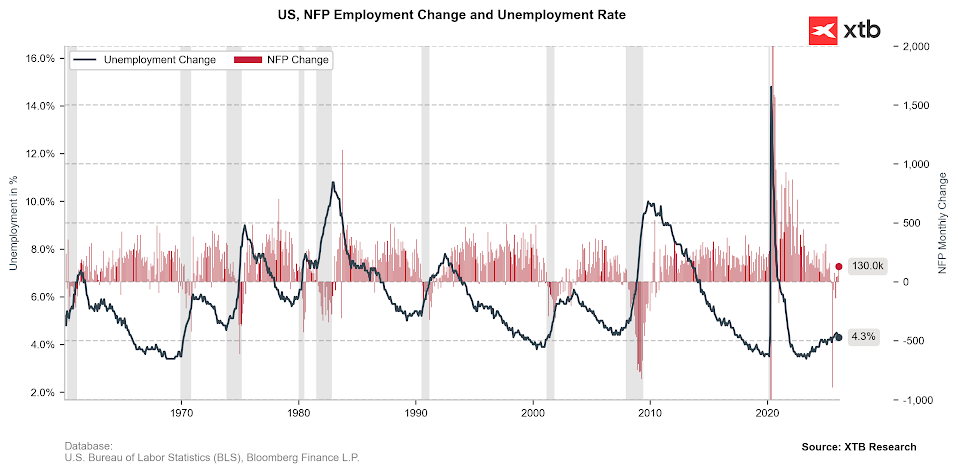

The non-farm payrolls (NFP) report showed an increase of 130,000 jobs, nearly doubling the market consensus. It is worth noting that expectations were widely dispersed; while few predicted a reading above 100,000, several institutions had actually forecast a contraction in employment. Although January is traditionally a volatile month subject to various technical adjustments, this report suggests a labour market that remains fundamentally robust despite recent soft patches in other data. Furthermore, the unemployment rate—derived from a separate household survey—unexpectedly edged down to 4.3%.

These buoyant figures are reshaping expectations for the Fed's next move. Money markets now price in the first rate cut for July, even though by June the Fed will be under the leadership of Kevin Warsh, who is theoretically perceived to have a preference for lower rates.

US500 Nears Record Territory

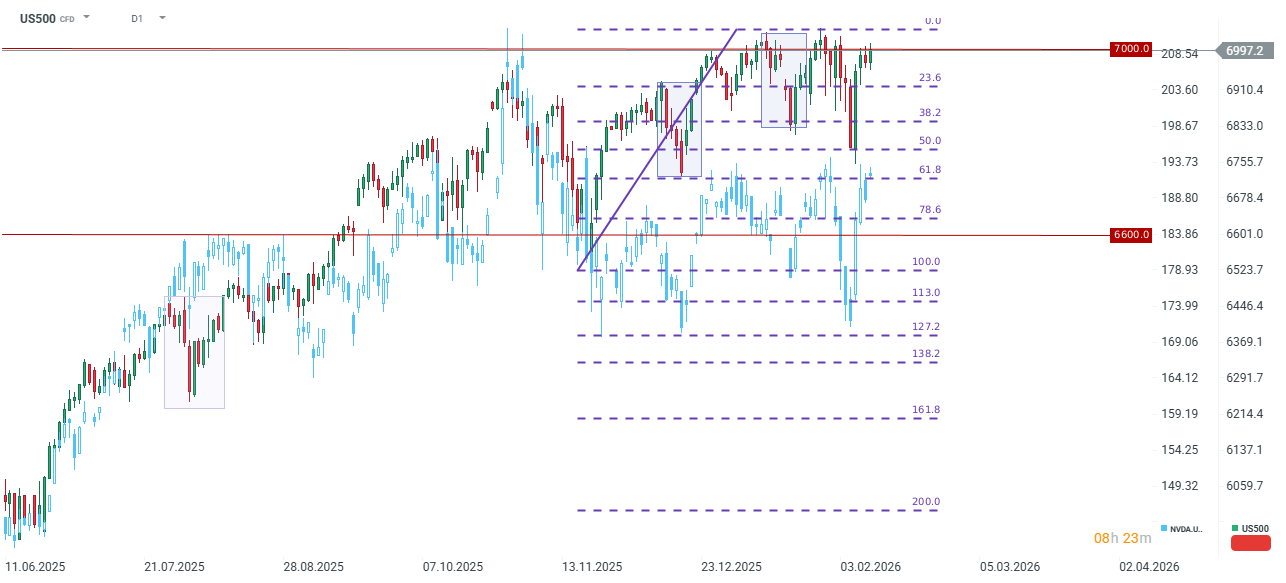

Equities resumed their upward trajectory today following a brief pause in the previous session. The advance is primarily being driven by renewed optimism surrounding large-cap technology firms. The S&P 500 (US500) is testing the 7,000-point threshold, largely shrugging off the reduced likelihood of immediate rate cuts in favour of a brighter outlook for US economic growth.

A daily close above the 7,000 level would likely clear the path toward fresh all-time highs, particularly as markets look ahead to Nvidia's earnings report in two weeks. Conversely, a failure to hold this level could trigger a retreat toward the 23.6% Fibonacci retracement of the most recent downward wave.

Corporate Highlights

- Sentiment has turned positive for US technology giants following yesterday’s minor correction. Nvidia is spearheading the rally, gaining more than 1%, followed by solid advances for Amazon, Microsoft, and Meta (all up approx. 0.5–0.6%). Apple and Tesla are seeing more modest gains.

- T-Mobile US (TMUS.US): Shares fell by more than 5% at the open following a fourth-quarter miss on net subscriber additions. While the company announced a new live translation service supporting 50 languages, the news has pressured shares of Duolingo (DUOL.US).

- Moderna (MRNA.US): Shares tumbled nearly 10% after US regulators refused to review its novel mRNA flu vaccine, a significant blow to the firm’s efforts to diversify revenue streams beyond its Covid-19 franchise.

- Gilead Sciences (GILD.US): The stock shed more than 1% as its financial results and 2026 outlook failed to meet Wall Street expectations.

- Kraft Heinz (KHC.US): Shares dropped over 6% on the news that the company has halted its widely anticipated plan to split into two separate entities. Management also announced a $600 million investment programme aimed at accelerating top-line growth.

- Ford (F.US): The carmaker saw fractional gains despite a disappointing fourth-quarter 2025 performance. While revenue of $45.89 billion beat expectations, it represented a 4.8% year-on-year decline. Sentiment remains tempered by continued los

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.