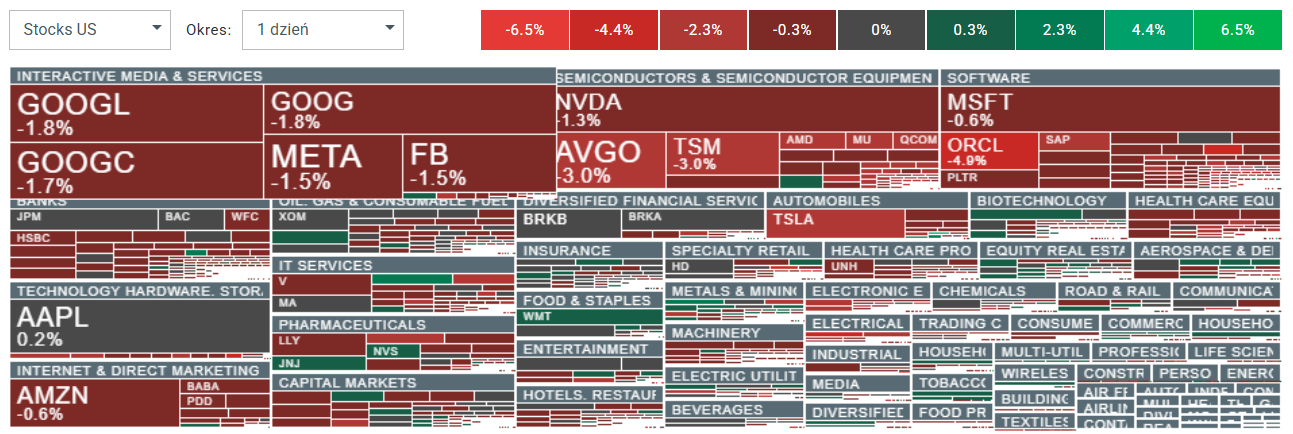

U.S. indices are falling as the dollar strengthens, driven by robust GDP growth, firm durable goods orders, and lower jobless claims. Investors are questioning whether the Fed will really continue monetary easing this year at the previously expected “fast pace.”

-

US500 down more than 0.9%, US2000 drops nearly 2%

-

Lithium Americas rallies on speculation of a potential U.S. government stake

-

Oracle shares react negatively to a Rothschild & Co Redburn report

-

The U.S. dollar gains and Treasury yields climb after Q2 GDP came in at 3.8% YoY, beating forecasts of 3.3%

-

Jobless claims fell to 217K, compared with expectations of 233K and 233K previously

-

Consumer spending rose 2.5% in Q2, well above the 1.6% forecast and just 0.5% previously

US500 Technical View (D1)

The US500 is trading nearly 1% lower today. Key support appears near 6,500 points, where the 50-day EMA (orange line) is located. The index has tested this level three times in recent months. On the upside, resistance is defined by the recent price reaction around 6,800 points.

Source: xStation5

Source: xStation5

Company News

-

Immuneering Corp. (IMRX) down ~15% after reporting an 86% overall survival rate at nine months in pancreatic cancer patients treated with atebimetinib plus mGnP. The positive news triggered profit-taking.

-

Jabil (JBL) falls nearly 9% even though the manufacturing services company posted Q4 results that beat analyst estimates.

-

Lithium Americas (LAC) jumps almost 12% following reports the Trump administration is considering taking a stake in the company.

-

Oracle (ORCL) drops nearly 5% amid broader tech sector weakness. Rothschild & Co Redburn initiated coverage with a sell rating, arguing the market is significantly overestimating the value of the company’s cloud revenues. Shares remain well above the 50-day EMA but are testing recent local lows below $300.

Sources: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.