Wall Street enters the Fed decision week relatively stable, underpined by the uncertainty about the future guidance for the monetary policy in the US. Russell 2000 futures (US2000) gain the most (+0.6%), recovering Friday’s drop. Among big cap indices, tech-heavy Nasdaq continues to outperform (US100: +0.1%), with S&P 500 (US500) and DJIA (US30) currently trading flat.

With the December rate cut almost fully priced in, market sentiment now focuses on how the Fed will communicate the move and what actions might follow in January. This week’s meeting is likely to be marked by a new disents, as some hawkish FOMC members disagree with Chair Powell on the disinflationary impact of AI-driven productivity gains. There is also rising discussion of a cautious, “hawkish” cut, signaling that the Fed may maintain a careful approach in 2026, even under a new chair appointed by Trump.

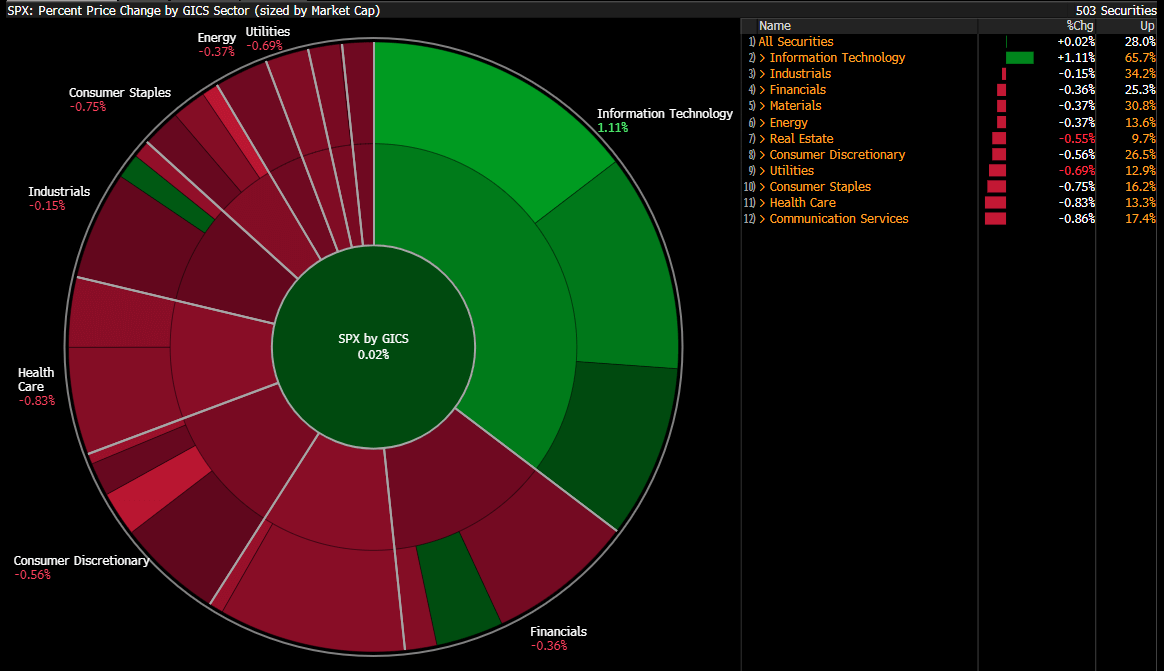

Tech stocks are driving gains once again, with the software and semiconductor sectors posting the highest gains at the start of the week. The tech risk weighs on defensive stocks (healthcare, utilities, consumer goods), which see the biggest capital outflows. Other sectors experience milder losses, with overall sentiment being relatively stable.

Volatility in S&P 500 sectors. Source: Bloomberg Finance LP

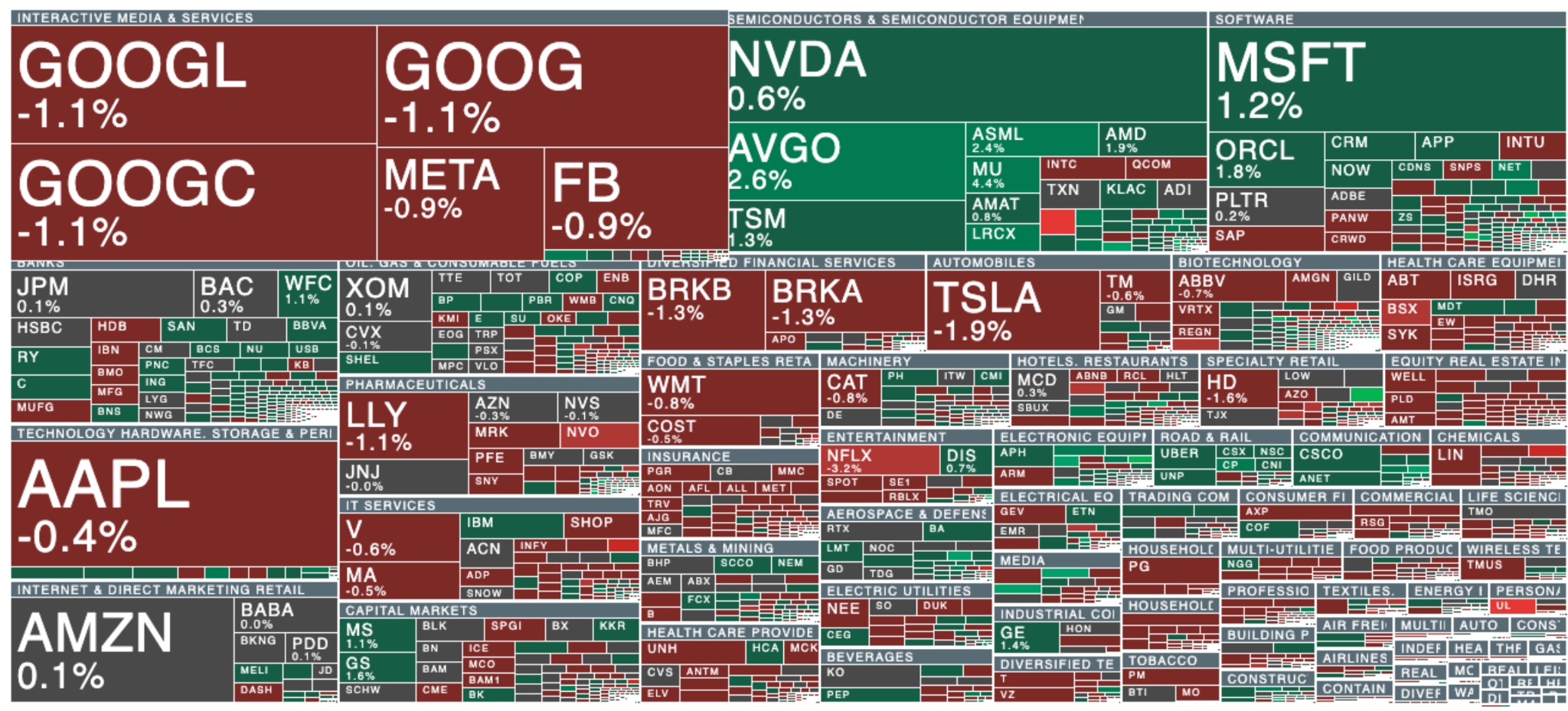

US stocks today. Source: xStation5

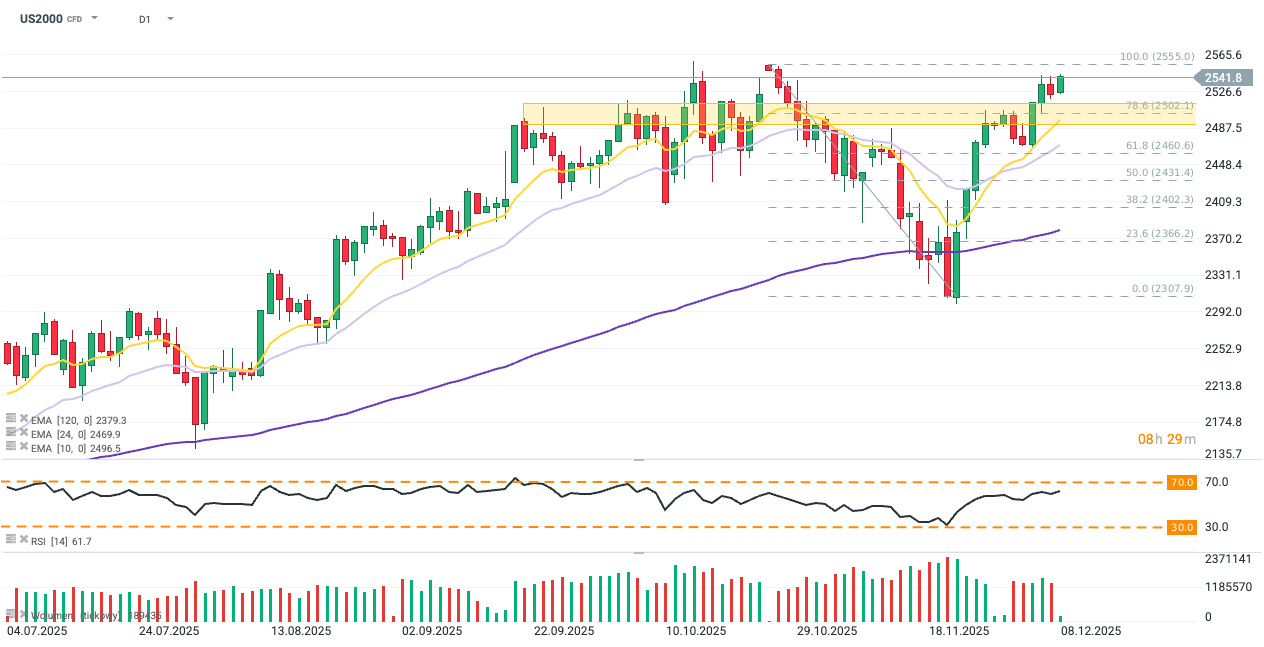

US2000 (D1)

Russell 2000 futures are approaching a key resistance near October’s all-time high, around 2,555. Immediate support is at the 78.6% Fibonacci retracement, coinciding with the psychological 2,500 level. The contract has consistently respected its 10-day EMA (yellow) as a reference for both bullish and bearish waves. Holding above this moving average could pave the way for new highs, especially as lower interest rates continue to support smaller-cap stocks. Conversely, a break below the EMA10 would likely bring back October’s consolidation.

Source: xStation5

Company news:

-

Agios Pharmaceutica is up 0.5% despite premarket losses after the FDA delayed its decision on Agios’ supplemental new drug application for mitapivat in alpha- and beta-thalassemia, with the application still under active review. No new data has been requested, and discussions focus on labeling and REMS. The FDA has not given a new decision timeline; Agios continues to work toward completion.

-

Carvana shares gained over 8% after S&P Global said the company will join the S&P 500 on Dec. 22. The move reflects the company’s sharp market-cap recovery and is expected to trigger passive inflows as index funds adjust holdings ahead of the inclusion.

-

IBM agreed to buy Confluent for $11bn, paying $31 per share — a ~29% premium — as it deepens its shift toward AI and cloud services. Confluent shares surged nearly 30% pre-market, currently up 28%. IBM expects the data-streaming platform to strengthen its generative-AI capabilities, streamline overlapping products, and contribute to profits within a year after the expected mid-2026 close.

-

CoreWeave shares are down 5% after announcing a $2bn convertible notes offering. The company plans to use part of the proceeds for capped call transactions to limit dilution or offset potential excess conversion payments, with the remainder earmarked for general corporate purposes.

-

US President Trump flagged potential antitrust concerns over Netflix’s $72bn acquisition of Warner Bros and HBO, citing its large market share. The deal, set to complete after Warner Bros splits in H2 2026, would consolidate major franchises like Harry Potter and Game of Thrones on Netflix. Industry experts expect regulatory review, possible concessions, and heightened White House involvement in the approval process. Netflix trades 3% lower today, while WBD hiked 6.6%

-

Additionally, Paramount Skydance launched a hostile $30-per-share bid for Warner Bros. Discovery after losing to Netflix in the $72bn deal for the studio and streaming assets. Backed by Ellison family equity, RedBird Capital, and $54bn in debt, Paramount argues its smaller, standalone deal would face a faster regulatory review amid antitrust concerns over Netflix’s larger acquisition.

NFP preview

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.