- Wall Street trades slightly lower on the opening

- Investors eagerly await the results of Powell's testimony

- FedEx declined due to lower-than-expected forecasts for the year 2024

Investors remained cautious after a pause in interest-rate hikes, as Federal Reserve Chair Jerome Powell's remarks indicated the expectation of higher interest rates to control inflation and reduce US growth. The second-quarter stock rally appeared to be fizzling out due to factors such as crowded bullish positioning, high valuations and a growth outlook.

- Wall Street opened with losses as investors showed concern over signs of rampant inflation in major economies, indicating that central banks may not be close to winding down their tightening cycles. The S&P 500 and Nasdaq 100 both fell 0.4%, while the Dow Jones Industrial Average declined 0.5%.

A surge in US housing starts in May indicated strong demand outstripping supply, potentially fueling economic growth. Citigroup analysts believe core inflation is unlikely to return to target in such an environment.

The S&P 500 (US500), with the current price at 4,415 points, has experienced a 0.4% decline today. The price retraced from a resistance level of 4,500 points, which was approximately 6.5% below the all-time high. As the market undergoes a correction, the next level to monitor is at 4,400 points. If this level is broken, the subsequent support level to watch is at 4,300 points.

The recent strong gains in the market suggest that it may be overheated, as indicated by the Relative Strength Index (RSI) around 70. Therefore, a period of consolidation and correction is deemed reasonable under these circumstances.

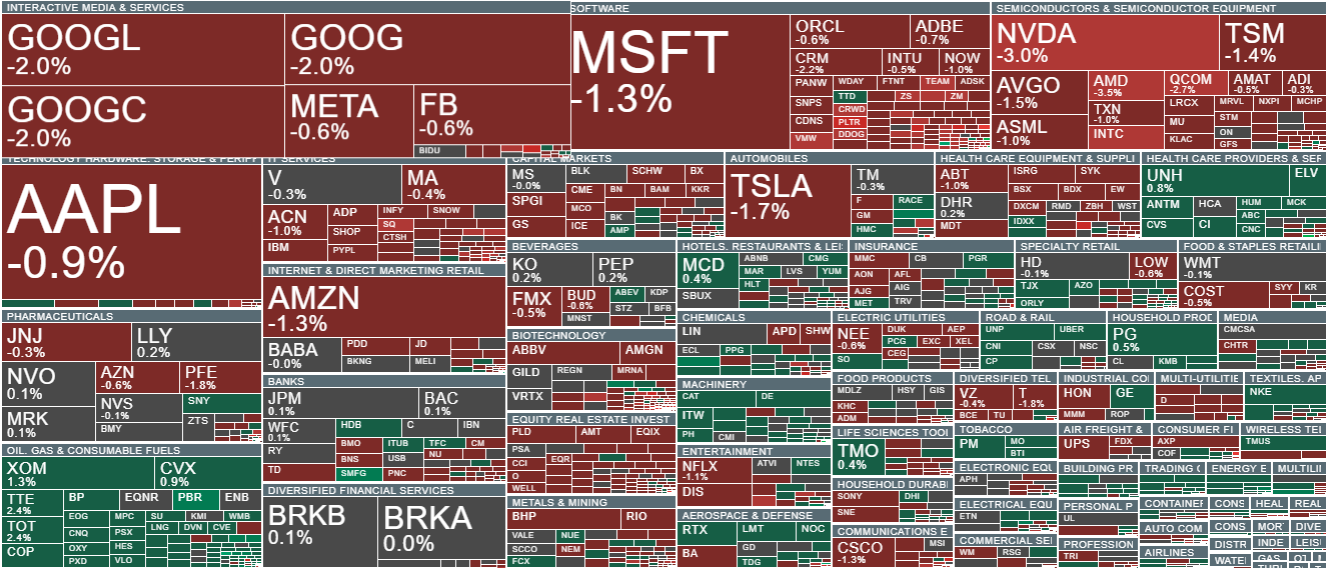

Actions from the S&P 500 index divided by sectors and industries. Size represents market capitalization. The best-performing sectors are Oil&Gas, Machinery, and Chemical, while the underperforming sector is the media and Interactive services sector. Source: xStation5.

Actions from the S&P 500 index divided by sectors and industries. Size represents market capitalization. The best-performing sectors are Oil&Gas, Machinery, and Chemical, while the underperforming sector is the media and Interactive services sector. Source: xStation5.

Company news:

- Adobe (ADBE.US) is up 0.5% after BMO Capital Markets upgraded the software company, expecting it to outperform market expectations. They believe that generative AI and Adobe Express will help increase annual recurring net revenue and growth.

- FedEx (FDX.US) shares are down 1.26% after the package delivery company provided a forecast for 2024 that fell below analysts' expectations. Additionally, fourth-quarter revenues were below consensus. Analysts noted that the macro environment remains challenging, and the downbeat forecasts will put pressure on the stock.

- Nikola's (NKLA.US) shares are up 11.6%, marking the ninth consecutive day of gains for the electric truck manufacturer.

- Peloton Interactive (PTON.US) shares are down 9.8% after Wolfe Research initiated coverage on the company and downgraded its recommendation.

Navigating Middle East uncertainty and tariff risks

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.