- US indices launched today's cash trading higher

- US30 is testing major resistance

- Bristol-Myers Squibb (BMY.US) stock surges as FDA approves psoriasis drug

Three major US indices launched a new week roughly 0.5% higher, extending upward move from the previous week, while markets continued to assess the outlook for monetary policy. Tomorrow investors’ attention will focus on the US CPI report, which could influence the Fed's rate path before the upcoming meeting on Wednesday 21st September.

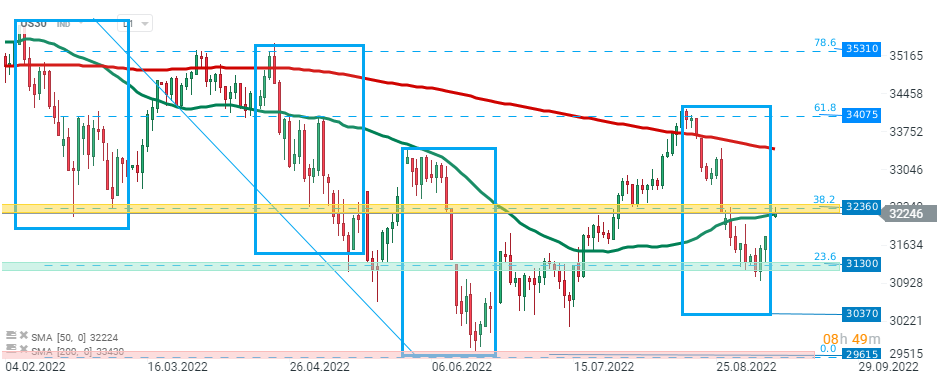

US30 surged in the second part of last week and is currently testing local resistance at 32360 pts, which is marked with 38.2% Fibonacci retracement of the last downward correction and previous price reactions. Should a break higher occur, the next target for buyers can be found around 34075 pts. On the other hand, if the market sentiment deteriorates, another downward impulse towards support at 31300 pts may be launched. Source: xStation5

US30 surged in the second part of last week and is currently testing local resistance at 32360 pts, which is marked with 38.2% Fibonacci retracement of the last downward correction and previous price reactions. Should a break higher occur, the next target for buyers can be found around 34075 pts. On the other hand, if the market sentiment deteriorates, another downward impulse towards support at 31300 pts may be launched. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Bristol-Myers Squibb (BMY.US) stock jumped over 8.0% in premarket after the U.S. Food and Drug Administration approved the company's oral treatment for adults with plaque psoriasis.

Bristol-Myers Squibb (BMY.US) stock launched today's session with a massive bullish price gap above local resistance at $74.00 which coincides with 23.6% Fibonacci retracement of the last upward wave. If current sentiment prevails, the upward move may accelerate towards the recent high at $80.50. Source: xStation5

Bristol-Myers Squibb (BMY.US) stock launched today's session with a massive bullish price gap above local resistance at $74.00 which coincides with 23.6% Fibonacci retracement of the last upward wave. If current sentiment prevails, the upward move may accelerate towards the recent high at $80.50. Source: xStation5

Twitter (TWTR.US) shares plunged over 1.0% after the social media giant said payments made to a whistleblower did not breach any conditions of its $44 billion buyout by Elon Musk, however Tesla CEO argues that these actions gives him another reason to walk away from purchase of the company.

Relay Therapeutics (RLAY.US) stock tumbled nearly 7.0% in premarket after the company said it has started an underwritten public offering of $300 million of shares of its common stock.

Carvana (CVNA.US) shares surged more than 8.0% before the opening bell after Piper Sandler upgraded its stance on the online used car retailer to ‘overweight’ from ‘neutral’, pointing to low price and great upward potential.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.