- US stocks under pressure ahead of the FED

- Short squeeze frenzy continues

- Boeing (BA.US) posts record loss

US indices launched today’s session sharply lower, with the Dow Jones fell 1.15%, while S&P500 and Nasdaq both lost 1.3% as investors await more big-tech earnings reports and the Fed's monetary policy decision later in the day. Tech giants - Apple, Facebook and Tesla will report their quarterly results after the closing bell. Meanwhile market participants expect that the Fed will leave the interest rate and the QE programme unchanged but will be looking for clarity on tapering. On the data front, new orders for US manufactured durable goods rose 0.2 % month-over-month in December, following an upwardly revised 1.2% increase in November, and well below analysts' expectations of a 0.9% rise.

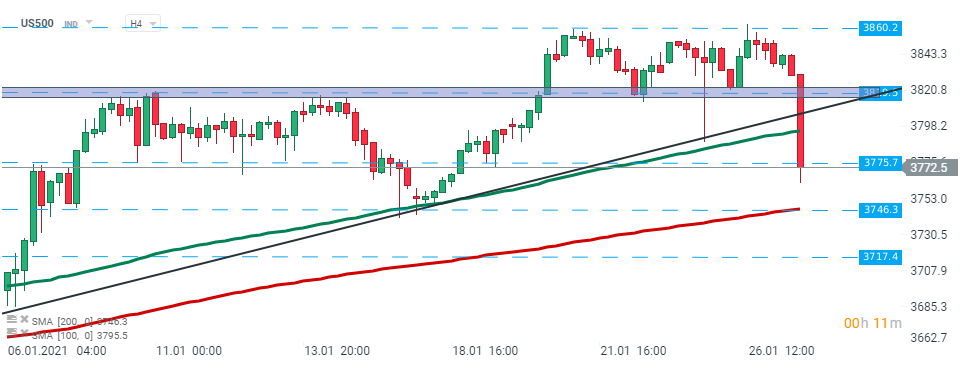

US500 – index broke below the upward trendline and smashed through the 50 SMA (green line) and support at 3775 pts. If the current sentiment prevails, then support at 3746 pts could be at risk. On the other hand, if buyers manage to bring the price above the aforementioned trendline then another upward move towards all-time high at 3860 pts could be launched. Source: xStation5

Boeing (BA.US) stock fell more than 3% after the company posted a quarterly loss of $15.25 per share, which included $8.3 billion in charges relating to the 737 Max and a delay in the 777-X program. However revenue beat market expectations. Meanwhile, EU regulators allowed the 737 Max model for a return to service in Europe.

Boeing (BA.US) - yesterday buyers failed to break above the upper limit of the descending channel and today stock launched the session below the major support at $200 which coincides with 200 SMA (red line). If the current sentiment prevails the downward move could be extended to the $191.00 handle or even support $180, where lower limit of the aforementioned channel is also located. Source: xStation5

Boeing (BA.US) - yesterday buyers failed to break above the upper limit of the descending channel and today stock launched the session below the major support at $200 which coincides with 200 SMA (red line). If the current sentiment prevails the downward move could be extended to the $191.00 handle or even support $180, where lower limit of the aforementioned channel is also located. Source: xStation5

GameStop (GME.US) shares surged 132%. Yesterday Billionaire investor Chamath Palihapitiya bought bullish options on the video-game retailer's stock at the urging of his Twitter followers, while Tesla CEO Elon Musk tweeted the word "GameStonk!!" with a link to the Wall Street Bets subreddit.

AMC Entertainment Holdings Inc (AMC.US) stock has increased by over 200%, BlackBerry (BB.US) and Bed Bath & Beyond (BBBY.US) jumped about 30% while Dillard's (DDS.US) and Ligand Pharmaceuticals (LGND.US) rose at least 10% in premarket trading on Wednesday as retail investors have been coordinating their stock purchases on Reddit forum r/Wallstreet bets, to pinpoint stocks which could bring quick profits which often leads to the so-called "short squeeze". Amateurs buy stocks that are popular shorts, as driving their stock prices up can pressure short-sellers into buying shares back to cover their positions, which sends prices even higher.

Bed Bath & Beyond (BBBY.US) is one of the companies whose stock price has recently experienced wild swing movements. Stock launched today’s session higher and is approaching recent high at $47.82. Source: xStation5

Bed Bath & Beyond (BBBY.US) is one of the companies whose stock price has recently experienced wild swing movements. Stock launched today’s session higher and is approaching recent high at $47.82. Source: xStation5

AT&T (T.US) stock dropped 2.5% in the premarket, despite the fact the quarterly figures and revenue came in above market expectations. Company also reported a higher-than-expected number of post-paid phone subscribers. However, moods worsened after Network Apps accused AT&T of stealing its device synchronization technology following the end of a joint venture between the two companies.

Microsoft (MSFT.US) reported quarterly earnings of $2.03 per share , well above analysts' expectations of $1.64 a share. Revenue also came in above market estimates, partially thanks to solid performance of Azure cloud computing unit, which revenue jumped 50% from a year earlier.

Starbucks (SBUX.US) stock fell nearly 3 % in premarket after the coffee chain reported quarterly earnings of 61 cents per share, above Wall Street forecasts of 55 cents per share. However the company's revenue came in slightly below projections as global comparable-store sales fell more than expected. Meanwhile Chief Operating Officer Rosalind Brewer will leave and take the role of Chief Executive Officer at Walgreens (WBA.US).

Thermo Fisher Scientific announces strategic collaboration with OpenAI📱

DE40: Europe moves sideways, Nestle gains

Chart of the day - US100 (16.10.2025)

Nestlé: Steady Growth and Ambitious Restructuring Drive Share Price Surge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.