- The market stands still, awaiting the rates decision or news

- Jobless claims decline again

- Meta grows despite regulatory risks

- Micron abandons consumer markets

- The market stands still, awaiting the rates decision or news

- Jobless claims decline again

- Meta grows despite regulatory risks

- Micron abandons consumer markets

The American market enters a state of anticipation during Thursday's session, as next week the market will receive information from the FED regarding interest rate levels. Currently, the market expects a 25 basis point cut with a probability of about 90%. Movements in the main indices at the beginning of the session in the USA remain negligible. Contracts on the main indices reduce price changes to a maximum level of 0.1%.

Macroeconomic Data:

Investors learned today about the weekly reading of the number of unemployment benefit claims. The published reading turned out to be below expectations at the level of 219k and amounted to 191k, falling for another consecutive month, reaching the lowest level since the beginning of last year. A strong labor market puts pressure on indices and supports the dollar by limiting pressure on the FED to cut rates.

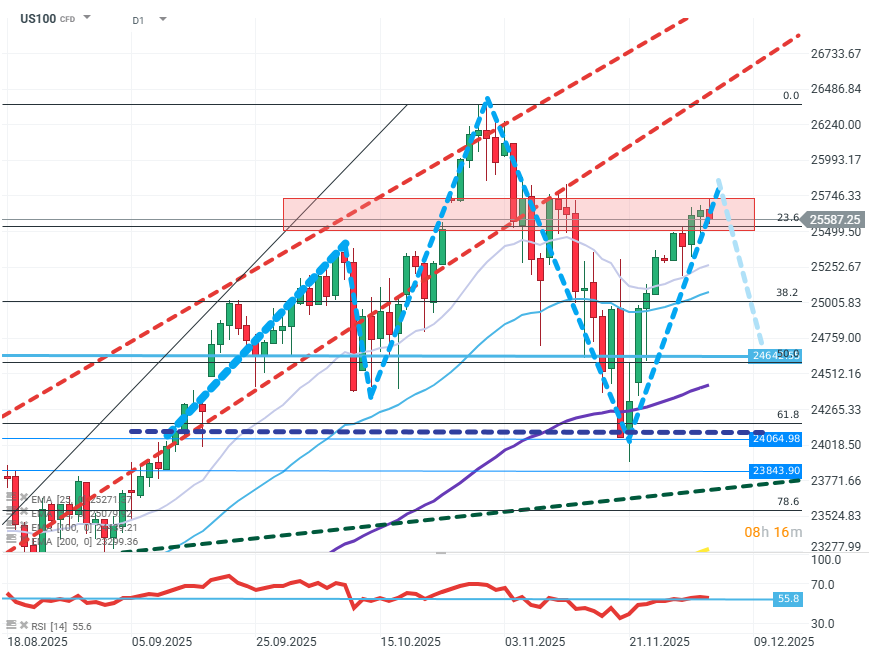

US100 (D1)

Source: xStation5

On the chart, the formation of the RGR pattern can be observed. The growth dynamics—although still upward—is clearly weakening. Currently, buyers have stopped at the FIBO 23.6 level of the last upward wave. To maintain growth, it will be necessary to overcome this barrier as quickly as possible. If the price retreats, it will open the way towards levels ~24500 and the possible realization of the trend change pattern.

Company News:

Snowflake (SNOW.US) - One of the significant players in the cloud services market is losing over 8% after results. The company showed a forecast containing a decline in margin and revenue growth.

Toast (TOST.US) - The company is up over 2% after receiving a positive recommendation from an investment bank.

Stellantis (STLA.US) - The US president has withdrawn from his earlier assurances about liberalizing regulations regarding emissions and fuel consumption, which would make European cars less competitive. The group's price is up over 3%.

Micron (MU.US) - The manufacturer, among others, of RAM announced its withdrawal from the consumer market in this segment to focus on corporate clients and AI.

Meta (META.US) - The company has once again found itself at the center of attention of European regulators amid doubts about the legality of some AI functionalities. At the same time, the company's CEO announced a reduction in involvement in the "Metaverse" project, which investors welcomed with significant relief. As a result of this news, the stock is up over 5%.

Symbotic (SYM.US) - The company is losing almost 15% after a negative recommendation from an investment bank.

Philips (PHG.US) - The company's stock valuation is down as much as 8% after an investment bank pointed out the company's troubles due to tariffs and weak growth in China.

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.