The US inflation report for June came in better than expected. Monthly headline inflation fell 0.1%, which lowered the annual rate of inflation to 3% from 3.5% in May. The annual core rate of inflation also fell to 3.3% from 3.4%. This is the first monthly decline in price growth since 2020, and the lowest rate of headline inflation for 12 months. The deflationary trend is back on, and this is spurring a decline in bond yields, the 2-year Treasury yield fell 12 basis points on the back of this data release, the dollar is lower and US stock index futures are rising sharply in early morning trade.

Fed rate cut expectations explode after CPI

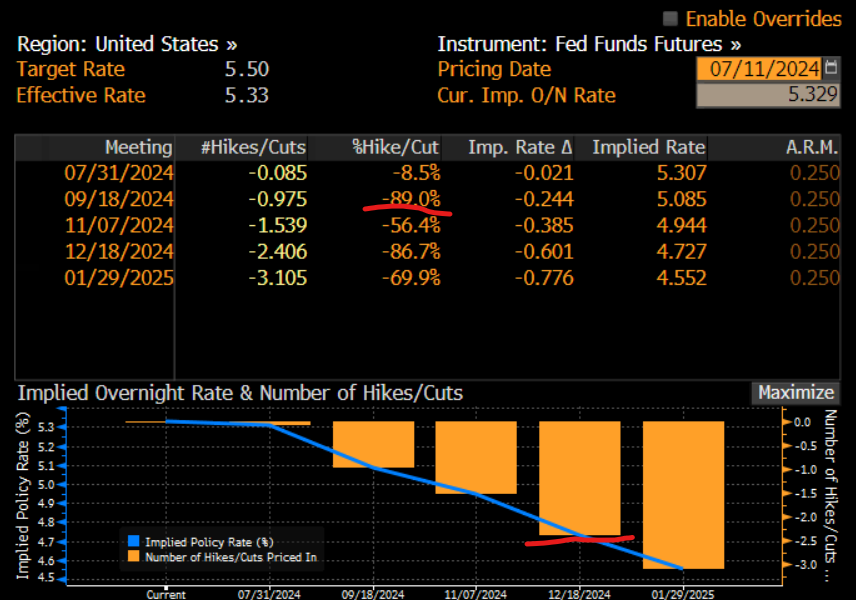

The decline in prices last month in the US has given the green light to traders to fully price in a rate cut from the Fed in September. There is now a greater than 80% chance of a rate cut priced in for two months’ time, before the CPI was released the chance of a rate cut was approx.70%. The market is also pricing in more than 2 rate cuts this year, not long ago only 1 rate cut was priced in by the market. This data release was seen as crucial for the timing of rate cuts from the Fed, after Jerome Powell said that the US central bank still wanted to see progress made on inflation before cutting interest rates. This is the progress that they will want to see.

Chart 1: US rate cut expectations

Source: XTB and Bloomberg

The deflation trend further entrenched in the US economy

The declining price of gasoline was a key driver of the weaker US inflation report. Gasoline prices fell 3.8% in June, after declining 3.6% in May. The core rate of inflation saw price rises for shelter, motor insurance, household furnishings and medical care. However, airline fares, used cars and communications saw their prices decrease over the month. It is worth noting that shelter costs, which have been one of the big drivers of core inflation in the US in recent years, rose at a 0.2% monthly pace, the slowest monthly gain of the year so far. Core service prices, which are considered the sticky element of inflation, have also moderated sharply, rising a mere 0.1% last month. Thus, if this is a sign that shelter costs and core service prices are peaking, this could further entrench the deflation trend in the US economy and make future interest rate cuts from the Fed more likely.

Market gains in the US broadening out beyond Nvidia

Overall, this report is supportive of a Fed rate cut, and adds to the benign backdrop for stocks and risk appetite around the world. Stock markets are a sea of green on Thursday. We have pointed out in recent notes that market breadth has narrowed significantly in recent weeks. The rally in the S&P 500, which has broken to fresh record highs this week, was led by big tech, but within big tech the standout leader was Nvidia. This was a Nvidia rally, not necessarily a tech rally. The AI darling is higher again on Thursday in pre-market trading, however, we would also note that the Dow Jones index outperformed the S&P 500 on Wednesday, in a much-needed boost to the broader market. Also, 402 stocks on the S&P 500 rose on Wednesday, with only 99 decliners, which could also be a preliminary sign that the market breadth is widening out. Thus, in future, the stock market gains in the US may not only be propped up by Nvidia, especially since rate cuts could boost other sectors of the economy, such as real estate and consumer discretionary.

GBP on top of the world

Elsewhere, the pound is on a tear higher today, boosted by better than expected GDP in the UK, and weaker than expected US inflation data. $1.30 is now on the cards as this pair has rallied some 148 points in just a few hours. And the pound is back as the top performer in the G10 FX space so far this year. Looking ahead, we expect a broad-based dollar decline on the back of this surge in rate cut expectations from the Fed. However, we expect the GBP to be one of the best beneficiaries, since the real yield in the UK remains so much higher than elsewhere, at 3.25%.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Join NFP Live Now

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.