- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

US equities are extending Friday’s rebound, attempting to erase the recent sell-off that even strong Nvidia earnings failed to stop. Tech leads the move higher (US100: +2%, US30: +0.3%) as risk appetite is boosted by renewed hopes for a December Fed rate cut.

Rate-cut expectations jumped above 70% on Friday after comments from the New York Fed’s John Williams, who said monetary policy remains somewhat restrictive. Another dovish signal came today from Christopher Waller — considered a contender for Fed Chair — who cited labour-market concerns and voiced support for a December cut.

The return of dovish rhetoric is giving Wall Street fresh momentum, supported further by upbeat news from key tech names, including the release of Gemini 3, Alphabet’s latest AI model. The company also announced a multimillion-dollar cloud-services contract with NATO.

Big Tech is driving the rally, including the Magnificent 7 (Alphabet: +5.4%, Amazon: +2.5%, Tesla: +6.5%, Meta: +3.4%). Nearly the entire semiconductor sector is also in the green (Broadcom: +9%, AMD: +4%, Micron: +6.7%). Interestingly, today’s tech euphoria isn’t weighing on more defensive sectors like pharmaceuticals and healthcare (Pfizer: +1.1%, Merck: +3.5%). Source: xStation5

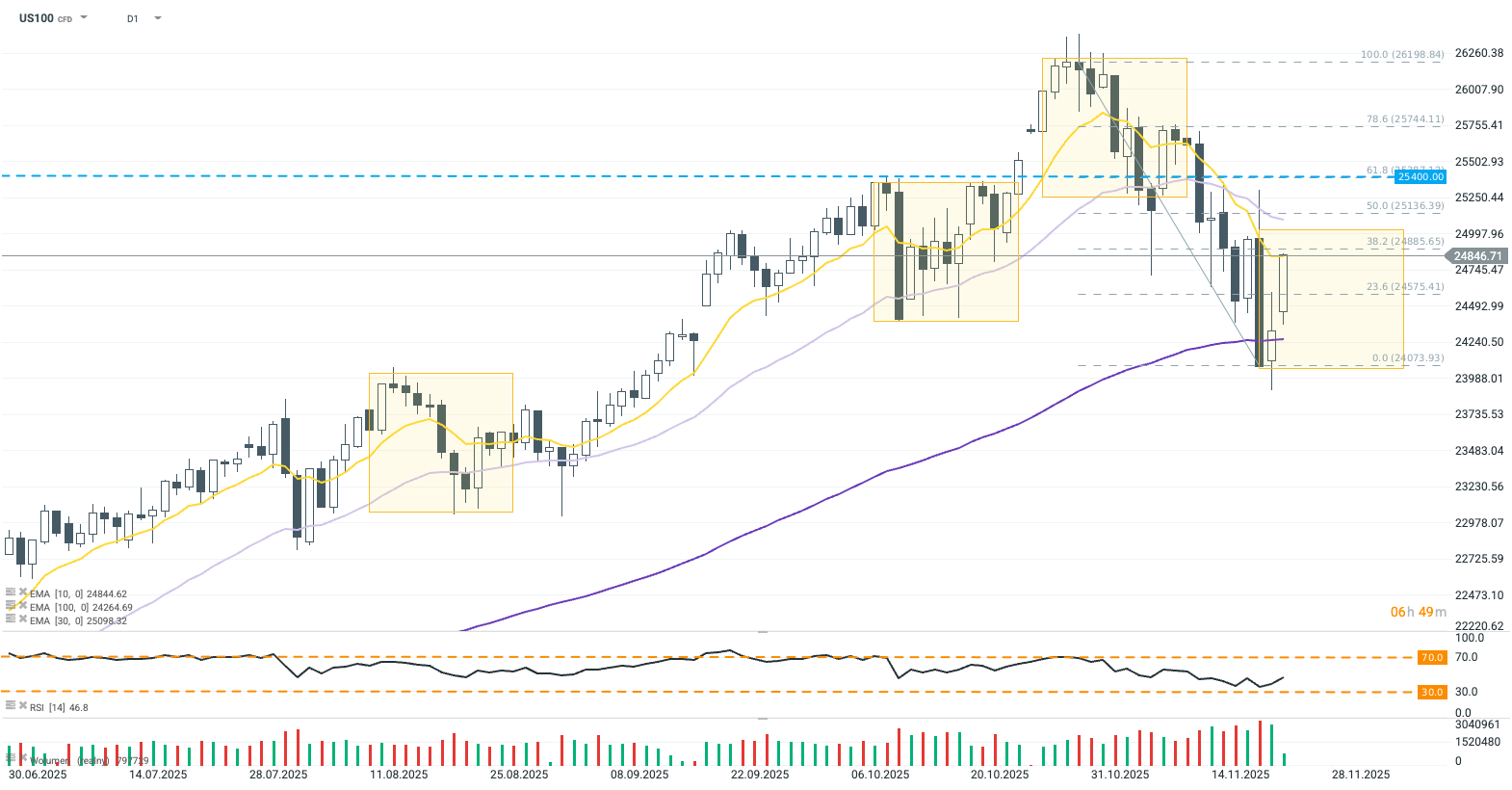

The US100 contract continues to climb despite already bullish opening. The index has broken above the 23.6% Fibonacci retracement and is pushing toward a test of the 10-day EMA (yellow), which roughly aligns with the 38.2% Fibo level and the upper geometry boundary. Erasing Thursday’s sell-off would open the door to a broader recovery on Wall Street, supported by neutral RSI. A rejection at the 10-day EMA, however, would signal growing investor caution ahead of the Fed decision. Source: xStation5

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.