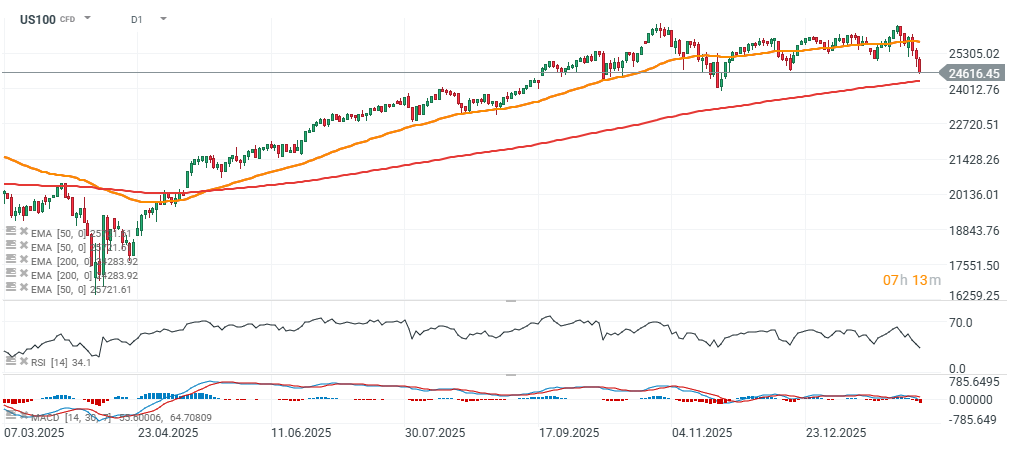

Nasdaq 100 (US100) futures are extending the early-week sell-off and are down more than 2% today. Weak sentiment in the technology sector has been further intensified by weaker-than-expected labor market data. Jobless claims rose more than forecast, while Challenger-reported layoffs surged by over 200% year-on-year in January. As a result, US100 is now trading only about 300 points above the 200-session exponential moving average (EMA200), marked by the red line. Cash indices are also under pressure: the DJIA and S&P 500 are down around 1.2%, while the small- and mid-cap Russell 2000 is down more than 1.3%.

Key US labor-market figures

• Initial jobless claims: 231k vs 212k expected and 209k prior week

• JOLTS (December): 6.54m vs 7.25m expected and 7.14m prior

• Challenger (January): 108.4k vs 35.5k in December

US100 (D1 timeframe)

The daily RSI for Nasdaq 100 futures is falling to around 34 today, a level not seen since the autumn correction. The EMA50 is located near 25,700 points.

Source: xStation5

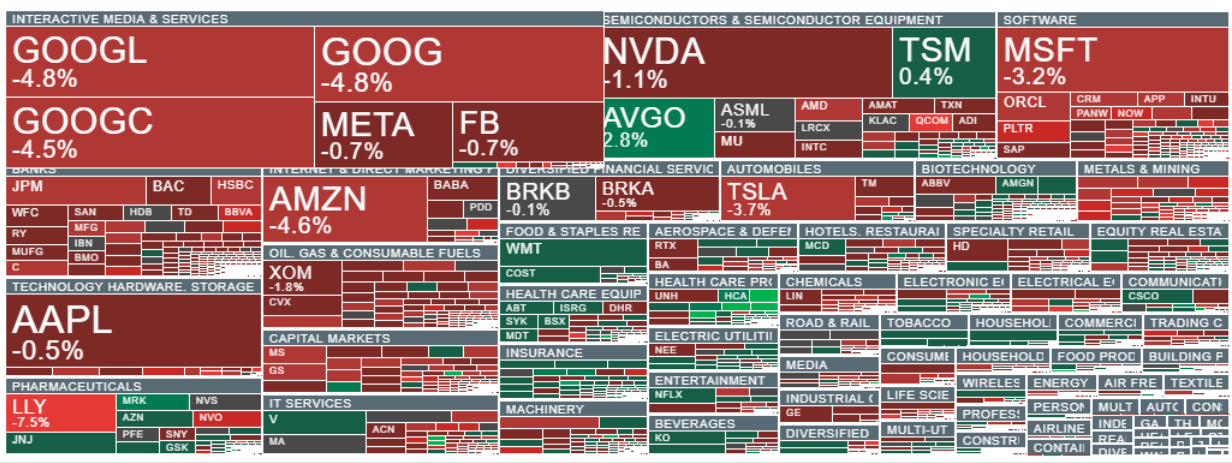

Negative sentiment in the software space has now spread across the broader tech sector, and the pullback is visible across almost all sub-sectors. Semiconductors are also declining, with Broadcom (AVGO.US) and TSMC (TSM.US) standing out as the only notable gainers. Heavy losses are seen in major names: Amazon and Alphabet (down nearly 5%), Microsoft (down more than 3%), and Tesla (down nearly 4%). Sentiment is also weak in financials and banking, where concerns over loan exposure to the software sector and a broader deterioration in market mood have triggered profit-taking. Recent gains are reversing in obesity drug maker Eli Lilly (LLY.US) as well, with the stock down more than 7%.

Source: xStation5

Oil surges almost 2% amid US - Iran tensions 📈

📉US100 loses 2%

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

A tale of two earnings releases: Rolls Royce beats Nvidia, because its European

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.