Futures on Nasdaq 100 (US100) gain today, after the weak session yesterday, trying to reverse the bearish head and shoulder technical pattern. The main resistance zone is set at 23,700 and 24,000, and if the momentum persists we may expect a rebound to 23,700 in the near-term. At 12:15 PM GMT we will learn US ADP report and right after that jobless claims, at 12:30 PM GMT. Both reports may be important to markets ahead of US NFP scheduled for tomorrow.

The most important reading today is set to release at 2 PM GMT and is US Services ISM report. Markets also await on Broadcom (AVGO.US) earnings after the session on Wall Street today. Evercore ISI analysts improved the rating for the US AI chip giant, rising price target to $342, citing strong data centres demand. This report may move almost all technology sector today, as markets remain fragile after the Nvidia slightly lower than expected report for the last quarter (demand centre revenues below expectations).

Source: xStation5

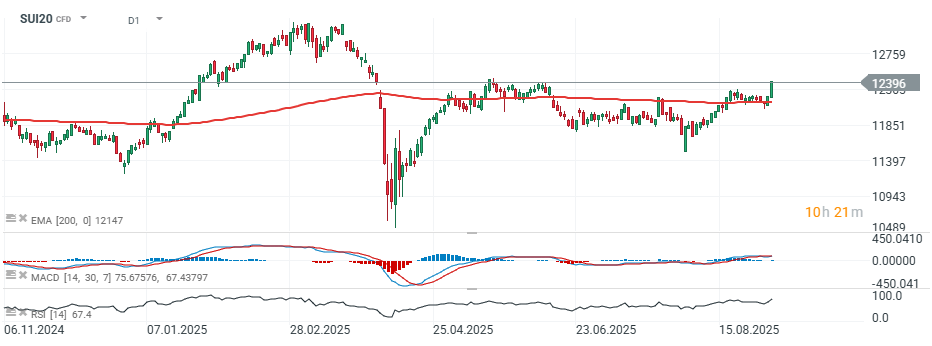

Across the European benchmarks SUI20 is today the strongest index with more than 2% gains from companies such as Roche, Givaudan, Lindt, ABB, ams and Barry Callebaut. Almost all Swiss stocks are trading higher today and as we can see below, the futures SUI20 rises above EMA200 (the red line) signalling that demand is driving a leading Swiss business stock market index to the highest level since June.

Source: xStation5

Daily Summary: CPI down, Markets Up

Procter & Gamble: After Earnings

"Mad Max" mode - Is Tesla in trouble?

Intel’s turnaround is showing results

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.