Summary:

-

US500 still near 3000 handle

-

Disappointing US retail sales data has little impact

-

Canadian CPI misses forecasts

Stock markets across the pond have begun the new session not far from where they ended the last with the major benchmarks still near recent highs and not too far from their record peaks. Some positive trade in Europe with several indices hitting new 2019 highs is helping to boost sentiment while the pound also appears to be focusing on the good at the expense of the bad as far as recent Brexit stories go.

US100 has retested prior resistance around 7980 that has attracted sellers once more. A break above there would target a move up to the all-time high of 8050. Source: xStation

The latest figures on consumer spending were quite a bit worse than expected with both the headline and core retail sales releases missing forecasts. The data was as follows:

-

US September advance retail sales M/M: -0.3% vs +0.3% exp. Prior revised to +0.6% from +0.4%

-

Ex autos: -0.1% vs +0.2% exp. Prior revised up to +0.2% from 0.0%

When the upwards revisions to the prior are taken into account they don’t look so bad but this is still the first decline in 7 months. The next Fed meeting is at the end of the month (30th Oct) and after this all the main economic releases are out. There is little doubting the notion that the US economy has slowed somewhat and is far from firing on all cylinders, but it remains to be seen whether this is enough to see an additional rate cut and hints towards another before the year is out.

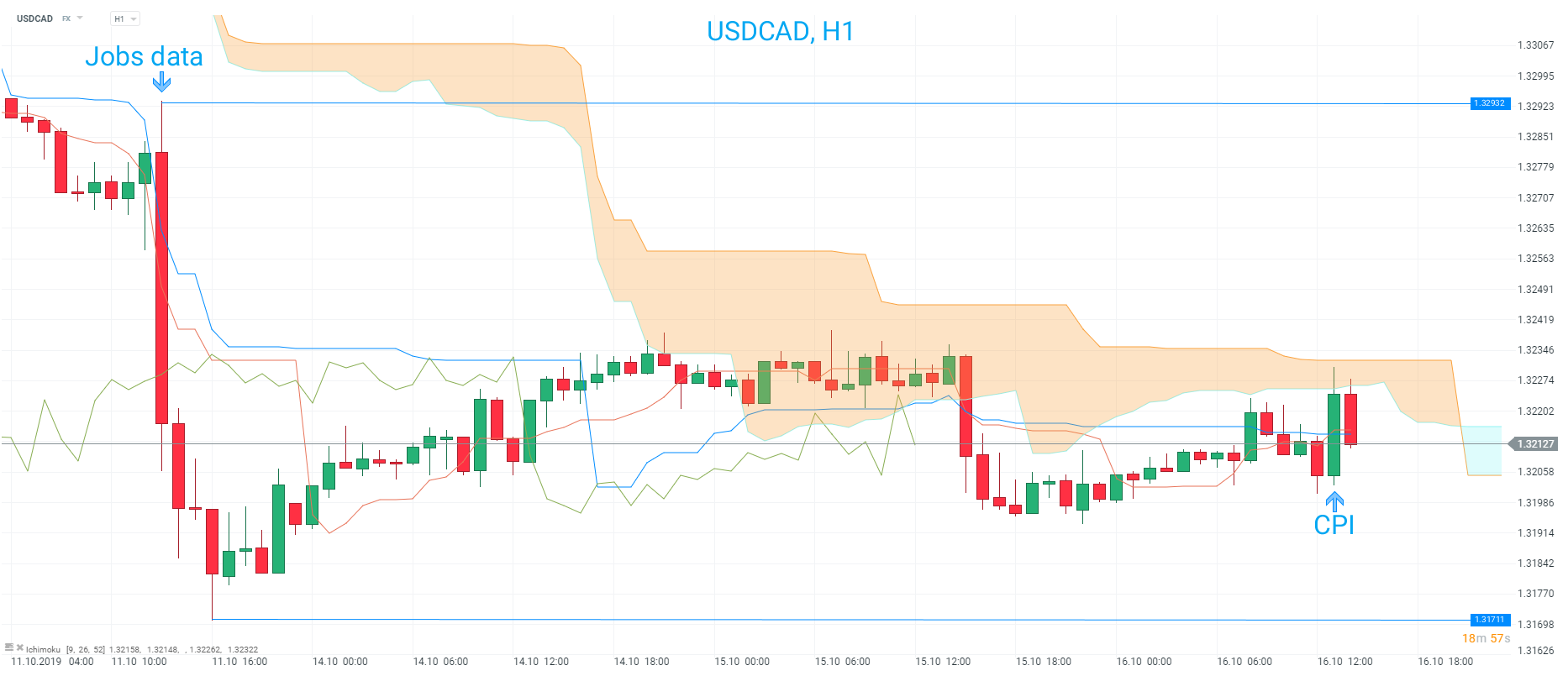

At the same time as the US data dropped we also got the latest look at price pressure north of the border with Canadian CPI coming in below forecasts. The CPI Y/Y remained at +1.9% despite expectations for an increase to 2.1% while the average of the 3 core measure came in at 2.1%. Overall these remain around the middle of the bank’s 1-3% target and while there was some initial weakness in the loonie, presumably on the headline miss, this has been subsequently pared somewhat.

USDCAD gained after the dual data releases but failed to break above the H1 cloud which resides around 1.3235. This is a possible region of resistance to watch going forward. Source: xStation

USDCAD gained after the dual data releases but failed to break above the H1 cloud which resides around 1.3235. This is a possible region of resistance to watch going forward. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.