WalMart showed a successful financial report, which translated into an increase in the company's shares and a broader rebound among US retailers. Shares of Target and Costco are rising:

- Shares of cryptocurrency exchange Coinbase are falling after the company said it would halt deposits and withdrawals of Ethereum tokens during the cryptocurrency's scheduled September 15 Proof of Stake 'The merge';

- 'Meme stocks' continue to rise. Bed Bath Beyond's stock price rises nearly 20%; Company maintains popularity lead among investors from Reddit. Declining number of days to cover short positions with surging buying popularity among retail investors indicates potential for upward movement. The company appears poised to continue a 'short squeeze' similar to that experienced by Gamestop stock in January 2021.

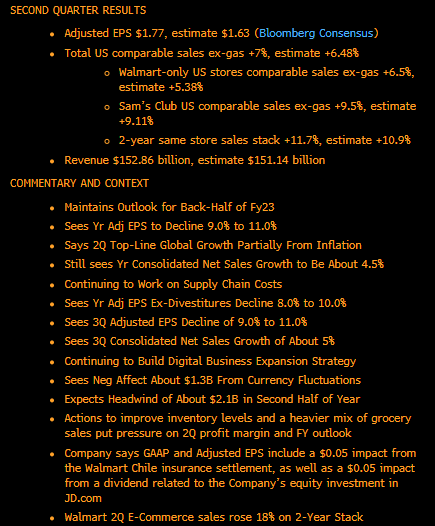

- WalMart's results positively surprised analysts and confirm the strength of US consumers:

EPS $1.77 vs. $1.78 in Q2 2021 and $1.63 forecast (Bloomberg)

Revenue $152.86 billion vs. $151.14 billion forecasts (Bloomberg)

Inventory: up 25% vs. Q2 2021

Loss due to unfavorable F/X: $1.3 billion

WalMart's (WMT.US) quarterly financial results in numbers. Source: Bloomberg

WalMart's (WMT.US) quarterly financial results in numbers. Source: Bloomberg

- The above-expectations financial results are the result of strong demand for groceries and their rising prices, which Americans continue to accept. What is noteworthy is that sales of groceries are relatively less profitable for the company compared to household appliances or apparel;

- Other sectors have seen sales decline, causing WalMart to be forced to cut back in order to stimulate demand for goods. Weaker demand for the most profitable commodities like electronics and apparel, and policies that need to reduce inventory, according to the company, are the most dragging factors on the decline in operating profit. The company intends to prepare well for the holiday season;

- The company is improving its supply chains and logistics; it reported, among other things, the cancellation of millions of orders and strong sales of summer collections, as well as school supplies that are likely to affect profitability in the third quarter of the year. Although inventories were up more than 25% from Q2 2021, growth improved from the previous quarter, management believes the company's peak is behind it;

- WalMart is competing with Amazon in the nearly $5 trillion e-commerce sales sector. The company intends to continue working on building an online business model. The company's report indicates that Americans are reluctantly refusing to reduce spending on food, but rising inflation has caused a sharp decline in demand for other goods. The condition of American consumers, however, appears to remain strong, confirming the Fed's narratives of a strong labor market, wage pressures and a still distant recession (albeit each with a different course).

Bed Bath & Beyond (BBBY.US) chart, interval H4. Shares of BBBY.US rose more than 250% during last 2 weeks. Source: xStation 5

Bed Bath & Beyond (BBBY.US) chart, interval H4. Shares of BBBY.US rose more than 250% during last 2 weeks. Source: xStation 5

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

A wild ride for markets as dizzying market U-turns dominate

A wild ride for markets as dizzying market U-turns dominate

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.