- Growth in AV adoption has been impressive and is projected to keep rising

- However, regulatory issues still persist

- Growth in AV adoption has been impressive and is projected to keep rising

- However, regulatory issues still persist

Autonomous vehicles have become established on roads, mainly in Asia and South America, and there is no indication that they will disappear from them anytime soon. The pace of adoption of this technology supports the theses of enthusiasts of this solution, which is reflected in the valuations of companies in this sector.

Analyst coverage of this industry is comprehensive today. Most of them predict almost hyperbolic growth in the share of autonomous vehicles both in road traffic and in the structure of the entire automotive market. It is becoming increasingly clear that this segment is no longer a futuristic curiosity but is starting to play the role of a real growth engine for technology corporations and investors in the mobility sector.

Although for many, Tesla remains synonymous with autonomous vehicles, it is worth noting that a potentially serious competitor is slowly emerging on the horizon. Waymo, a subsidiary of Alphabet (Google), is developing in a more methodical, focused, and specialized manner than the market leader. This approach may pose serious problems for Tesla in the long term.

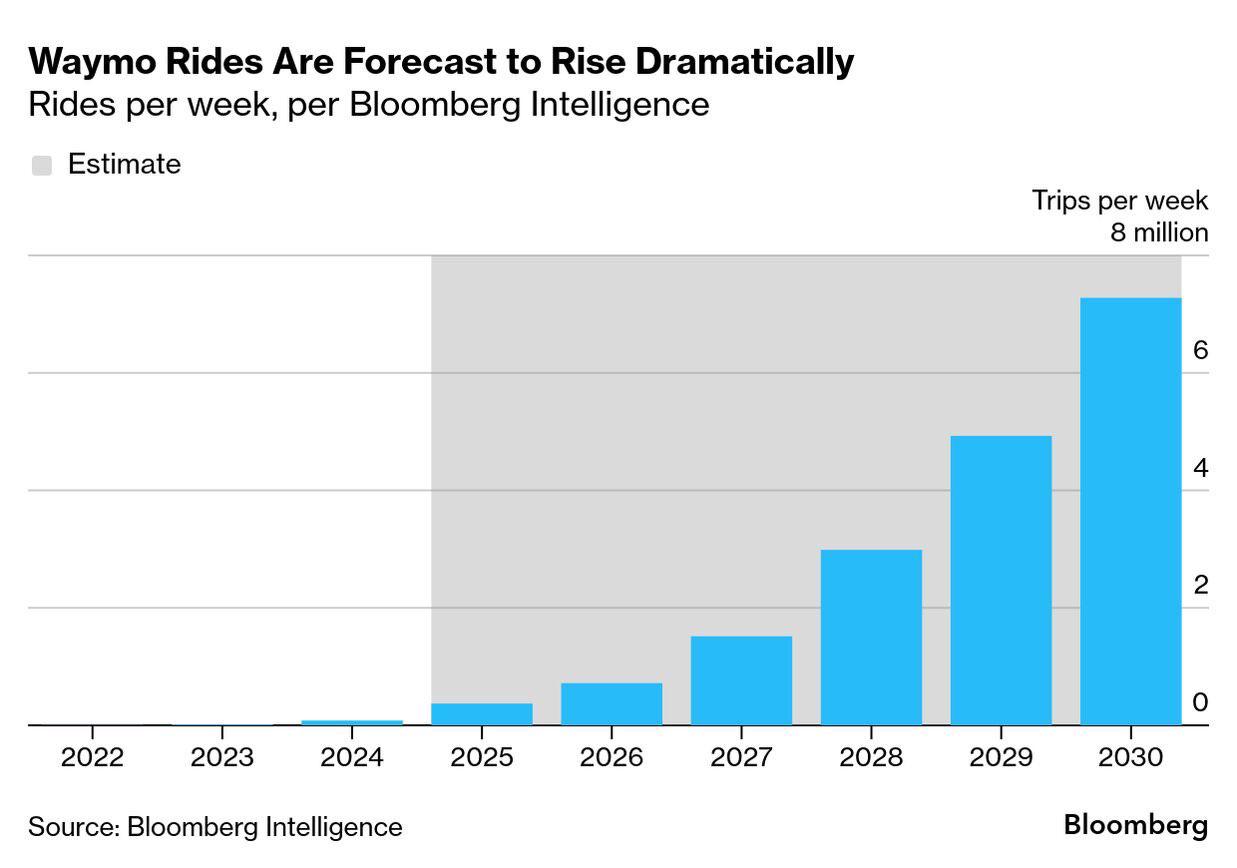

Source: Bloomberg Finance Lp

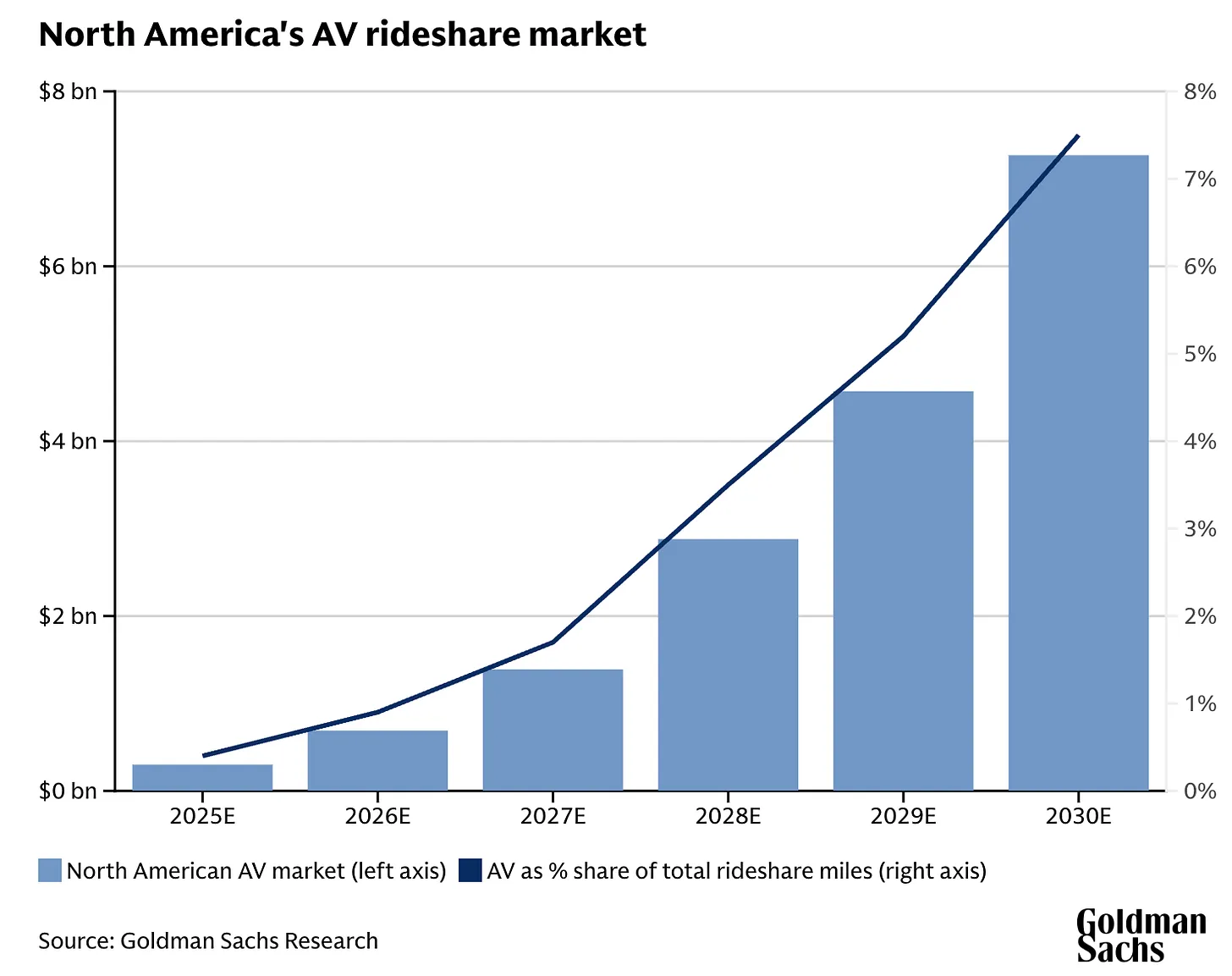

Source: Goldman Sachs

According to Bloomberg's analysis, the number of rides carried out by Waymo is expected to increase to over 6.5 million, while Goldman Sachs analysts estimate that the share of autonomous vehicles in total road traffic will exceed 7%, translating into a market value reaching up to $6.5 billion.

However, regulatory concerns persist. Even in the United States, a liberal country generally favorable to untested, potentially risky innovations in road traffic, the behavior of autonomous vehicles is raising more and more doubts.

To such an extent that the National Highway Traffic Safety Administration (NHTSA) has launched an investigation into nearly 2,000 Waymo vehicles. This number includes the vast majority of the company's fleet, whose exact size remains unknown. The investigation is prompted by reports of dangerous behaviors of autonomous systems near school buses, incidents that the regulator believes require immediate clarification.

For now, the market is reacting calmly. There are no significant movements before the market opens on Alphabet or even Tesla shares, but the NHTSA investigation itself is another risk factor that investors should consider in their valuation models.

Regulatory tensions around autonomous mobility may become one of the main sources of volatility in the sector in the long term, especially if further incidents or administrative decisions impact the pace of widespread implementation of this technology.

A serious accident involving autonomous cars and, for example, children could change the sentiment of society and regulators for many years. New restrictions and reduced demand could seriously shrink company margins and completely close markets less inclined to experiment with their road safety.

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

Palantir after earnings: another quarter, another record

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.