The NFP report for April will be released today at 2:30 pm BST. Probably the market will be limited, due to the recent Fed decision and the collapse in the markets, which has been taking place since Thursday's session on Wall Street. Nevertheless, it is worth paying attention to this report as it may provide hints whether US inflationary pressures subsides and the overall condition of the labor market. What to look for in today's report?

• Bloomberg consensus points to a change in employment at 380k. with the previous reading of 431 k (the lowest forecast is 250,000, the highest 517,000)

• The ADP report showed an increase of only 247 thousand.

• Employment sub-indices from the ISM report showed massive declines. From the industrial sector to 50.9 (from approx. 56) and the service sector to 49.5 (from 54).

• The unemployment rate is set to drop to 3.5% - the lowest levels since the pandemic. March reading showed the rate at 3.6%

• Wages growth will be most closely watched taking into account inflationary pressure.

• A minimal slowdown from 5.6% y/y to 5.5% y/y is expected, on monthly basis the dynamics of 0.4% m / m is to be maintained

• The participation rate is to increase by 0.1% to 62.5%. It remains 1.0% below the pre-pandemic high

The ADP report and the employment sub-index from the ISM report are not optimistic. On the other hand, the US is expected to reach full employment, so the increase above 200,000 at the current participation rate should be satisfactory and should lead to further decline of the unemployment rate. Source: Bloomberg

Will US100 rebound?

The US100 has tested the latest local lows around 12,750 pts. This level also acted as support in Q1 of 2021. Any signal of weakening inflationary pressure should be positive for indices. On the other hand, a potential fall in employment would signal a potential weakness of the labor market. It seems, however, that it is too early for the labor market to react to interest rate hikes. Source: xStation5

The US100 has tested the latest local lows around 12,750 pts. This level also acted as support in Q1 of 2021. Any signal of weakening inflationary pressure should be positive for indices. On the other hand, a potential fall in employment would signal a potential weakness of the labor market. It seems, however, that it is too early for the labor market to react to interest rate hikes. Source: xStation5

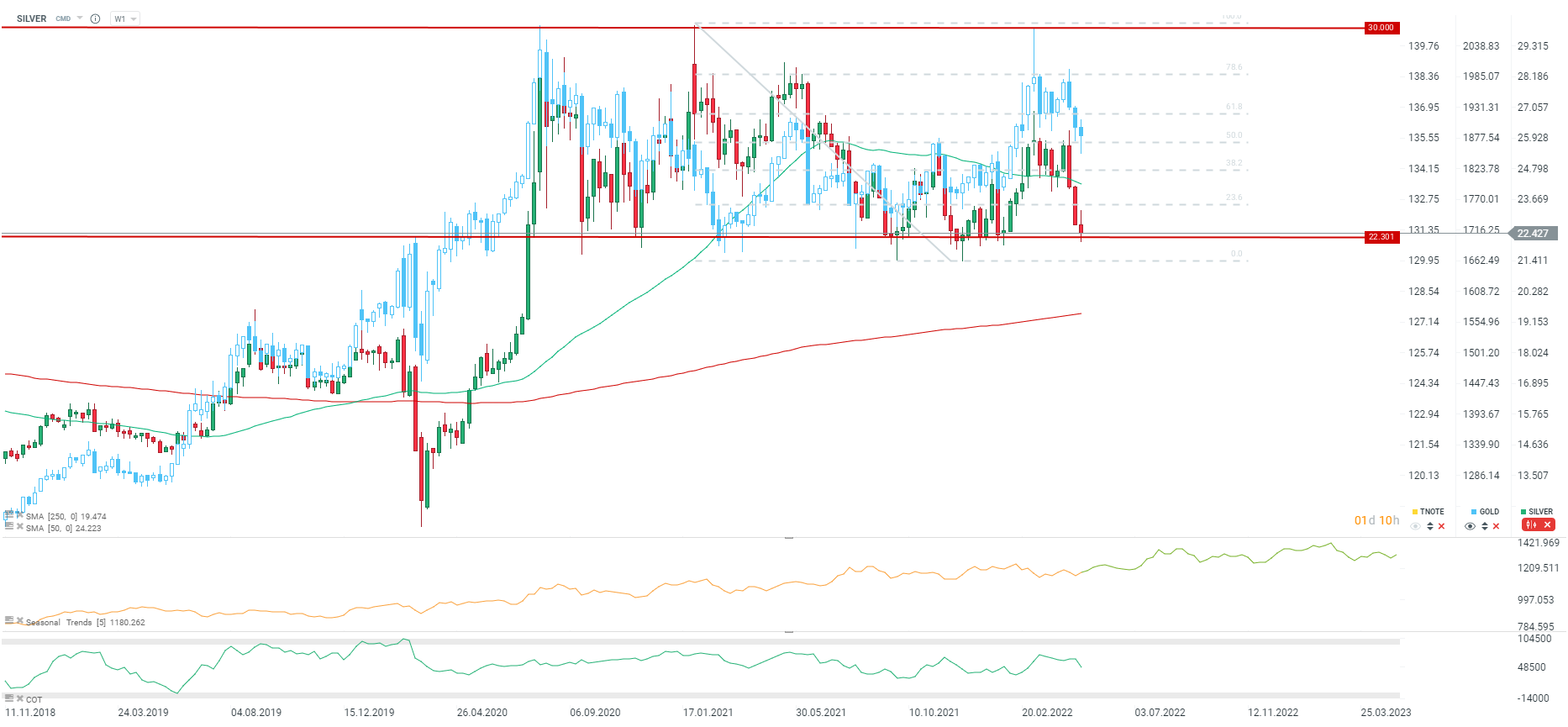

Will silver finally move higher?

Correlation between stock and the precious metals markets is getting stronger partially due to wide use of ETFs. That is why the recovery in the stock market should be positive for silver and also for gold. Precious metals will also react strongly to price movements of the US dollar and yields. Silver is facing the key demand zone around $21.5- $22.3. Should stock market sell-off deepens and price break below this level, then downward correction may deepen towards $18.5 per ounce. However, if the situation in the markets stabilize, then silver may move towards resistance at $ 25 an ounce. Source: xStation5

Correlation between stock and the precious metals markets is getting stronger partially due to wide use of ETFs. That is why the recovery in the stock market should be positive for silver and also for gold. Precious metals will also react strongly to price movements of the US dollar and yields. Silver is facing the key demand zone around $21.5- $22.3. Should stock market sell-off deepens and price break below this level, then downward correction may deepen towards $18.5 per ounce. However, if the situation in the markets stabilize, then silver may move towards resistance at $ 25 an ounce. Source: xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.