European stock market indices and US index futures trade lower on Friday ahead of the release of US retail sales data for December. The US dollar is trading mixed against major peers following strong declines earlier this week. Market expects headline retail sales growth to be flat month-over-month (0.0% MoM) while gauge excluding transport is expected to jump 0.2% MoM. The reading will be closely watched as investors will assess how big of an impact elevated inflation has on the US consumer. A disappointing reading could have a negative impact on equities moods as it would highlight that consumers are struggling amid high price growth. Meanwhile, it would also highlight the need for quicker tightening, what could be positive for the US dollar.

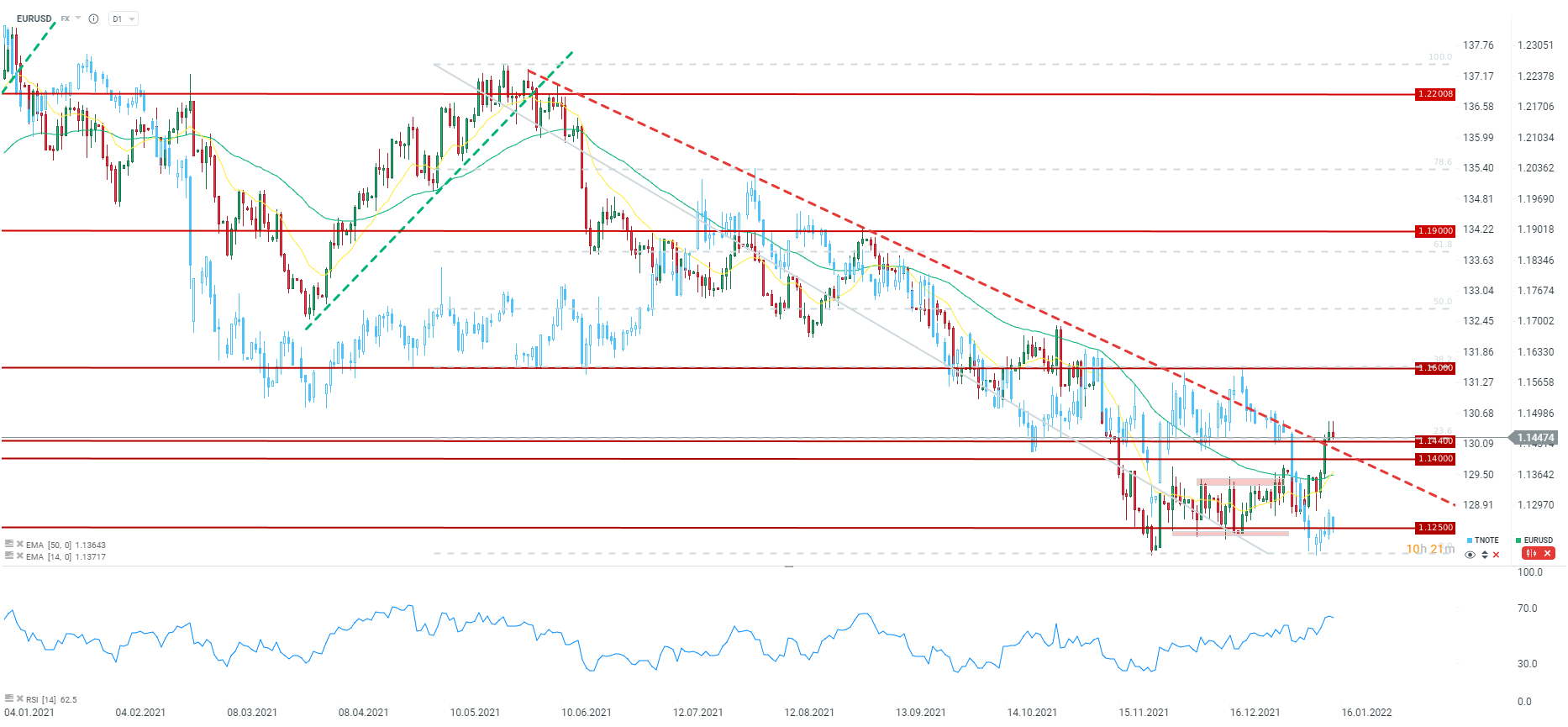

The US dollar has been trading lower this week in spite of hawkish comments from Fed members, allowing EURUSD to jump above the 1.14 mark. The pair is attempting to break above the mid-term downward trendline - a move that could pave the way for a bigger rally.

Source: xStation5

Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

Daily summary: Markets capitulate under the influence of the Persian Gulf

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.