Making your first trade may seem challenging at first. However, regardless of whether you want to take a position on EURUSD via a CFD or trade Forex, most traders prefer to rely on a solid plan that can guide them through the process.

This article outlines seven steps you can take to prepare yourself before your first trade, and serves as a guide on your journey of exploring the global financial markets.

Step 1 - Log in to the Platform

Our award-winning, intuitive platform, xStation 5, was designed to help traders find everything they need quickly and easily, regardless of their level of experience.

The first step towards opening your first real trade is logging into the platform.

Trading CFDs on a leveraged basis involves a significant amount of risk. They may not be suitable for everyone, so please ensure you fully understand all of the risks.

If you need a bit of help while you get acquainted with our trading platform, feel free to explore XTB’s Trading Academy, including a range of articles on how to use xStation 5.

Download the platform today!

Trading CFDs on a leveraged basis involves a significant amount of risk. They may not be suitable for everyone, so please ensure you fully understand all of the risks.

Step 2 - Choose Your Market

Whatever your reason for joining the world of trading might be, chances are you don’t have unlimited time and resources available to help you make every single decision. This is why many beginner traders decide to limit the number of instruments they trade when first starting out.

Through our CFDs you can trade on these major group of instruments:

- Forex

- Indices

- Commodities

- Stock CFDs

- ETF CFDs

Source: xStation 5

Stock market indices are some of the most trending instruments, which many traders find appealing. On the other hand, price moves on the equity indices can to a large degree depend on the pace of economic growth and earnings of member companies.

Central banks play a key role in the forex market. Unlike with stock market indices, in the forex market traders trade FX pairs, and therefore need to choose a “winner” and a “loser”.

Moreover, commodities often attract traders who do not want to follow all the economic data, as in this case price moves often reflect changes in the availability of a particular commodity.

Traders with limited time to spend on trading often opt for starting out with stocks or ETFs.

Explore XTB’s range of trading instruments here.

Step 3 - Make a Deposit

When you’re making your first deposit, a question that frequently springs to mind is, how large should your initial deposit be? There is no simple answer to that question.

The good news, however, is that making a deposit with XTB is quick and easy, with several methods available. This includes bank transfers, credit and debit cards, Paypal, and Paysafe (formerly known as Skrill).

Read more on our deposit methods here.

Step 4 - Prepare Yourself

Modern technology has provided us with quick access to global markets, which are now always at hand’s reach for any trader. However, this has caused many less experienced aspiring traders to enter the markets without proper knowledge or strategy. Make sure you don’t make the same mistakes!

Education is crucial for any trader, especially at the start of their journey, as mistakes most often occur at the beginning of one’s trading career. Whether you trade based on fundamental (economic reports) or technical analysis (technical signals), it’s important to be perfectly clear with yourself even before the trade when you want to open a trade and under what circumstances you would be willing to close it.

Another crucial thing to keep in mind is that it's important to stay up to date with the market developments impacting prices on a daily basis. This, however, doesn’t mean that you have to follow numerous financial news services to stay updated.

XTB’s award-winning Research Team works hard to make sure you stay informed about any major moves or market moving events. You can find market research in the “News” section of the xStation trading platform. In other sections you can find an economic calendar and other educational materials.

Source: xStation 5

Step 5 - Open a Trade

Before you can start trading on the market, you first need to find your chosen market on the xStation 5 platform.

This is where the Market Watch section can come in handy. In this section, you can find markets that are available to trade through the XTB platform, including:

- Forex CFDs

- Indices CFDs

- Commodities CFDs

- Stock CFDs

- ETF CFDs

Most beginner traders choose to open a trade by using the “New Order” function. For the ticket window to pop up, you simply have to click the “Open ticket” button in the Market Watch section of the platform, or right-click on the chart and select “Open ticket”.

Source: xStation 5

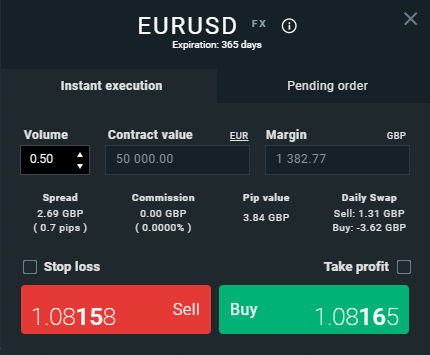

In the new order panel (shown above), you can specify the size of a position you want to open, as well as define Stop Loss (SL) and Take Profit (TP) levels.

Moreover, the built-in calculator will inform you about:

- Nominal value of the transaction

- Required margin

- Spread value

- Commission value

- Single pips value

- Daily swap value

Source: xStation 5

In case you decide to set the SL or TP levels, the calculator will also provide an approximation of loss or profit in case either of the orders is activated.

The newly opened position will appear at the bottom part of the xStation platform in the “Open positions” section.

Once you master placing orders with this method, you can try a faster one - placing orders via the “Click and Trade” panel located in the upper left corner of the chart window.

Source: xStation 5

Step 6 - Manage Your Trade

Now that you know how to open a trade, it’s time to look at what happens if the situation on the market changes. To manage your trade, you might be required to change the parameters of your trade.

To add or change your Stop Loss or Take Profit levels, simply drag the SL and TP symbols on the chart to the desired level.

You can also double your trade (open another trade of the same size) or invert it (close and open trade in the opposite direction) by clicking on the buttons on the right hand side of the open trade.

Source: xStation 5

Step 7 - Close Your Trade

Gains or losses you experience are not final until you close your position. You can either wait for the price to hit a predefined Take Profit or Stop Loss order, or close the position manually in case your view of the market changes. On the xStation platform, you can do this in a few different ways:

- Hover over your position on the chart and click the “X” button

- Click the red “X” button on the right hand side of the “Open positions” tab

Source: xStation 5

In case you have more than one position open, in the “Open positions” tab you can click the “CLOSE” button and choose whether to close: all positions, only profitable positions or only losing positions.

Source: xStation 5

Opening your first trade is not as difficult as it may seem at first glance. With proper preparation to trading, you can boost your chances of becoming more successful at what you do.