Table of contents

- A brief historical overview of the commodities market

- What does the term "commodities" mean?

- Different categories of the commodity market

- Characteristics of commodity trading

- How to trade commodities with XTB?

Trading in the commodity market is an interesting and specific type of investment, which is in many respects similar to stock trading. Both stock and commodity markets are closely linked, and news on the commodity market can also help individual investors in the stock market. In the commodity market, trading is focused on raw materials, such as precious or industrial metals, unlike on the stock exchange, where the main subject of trade are shares of individual companies. As for the similarities, both stocks and commodities are traded on stock exchanges and their prices are subject to periodic fluctuations, which both long-term investors and traders who only open short-term positions try to take advantage of.

A brief historical overview of the commodities market

The commodity market is one of the oldest financial markets. From a historical point of view, the trade in goods dates back to ancient times. In the beginning, people exchanged goods for goods (the so-called barter). Later, around 4500 BC, the first primitive money was introduced in Sumer (present day Iraq). People exchanged clay tablets in exchange for goods. Subsequently, commodity trading has evolved over the centuries, but the turning point was the creation of the Chicago Board of Trade (CBOT) in 1848. Next, CBOT merged with the Chicago Mercantile Exchange (CME) in 2007 to form the CME Group. Today, it is one of the most popular types of markets to trade, whether by individual investors, large financial institutions or speculators.

Another important institution in the world of commodity trading is the New York Board of Trade (NYBOT). This exchange was established in 1870 under the name the New York Cotton Exchange. In 2004, NYBOT merged with the Coffee, Sugar and Cocoa Exchange (CSCE). In 2006, it became part of the Intercontinental Exchange (ICE). Currently, NYBOT mainly deals with futures and options on physical commodities such as cocoa, coffee, cotton, sugar and orange juice. The exchange also deals with trading currencies, interest rates and market indices. Thanks to these financial instruments, the producers and buyers of these commodities have an opportunity to lock in prices ahead of time in order to protect against unforeseen volatility or production shortages.

As for other significant stock exchanges, the New York Mercantile Exchange (NYMEX) was established in 1872 and focused on the dairy trade. In 1994, the largest physical commodity exchange in the world of that time was established, after NYMEX merged with the Commodity Exchange (COMEX). Then in 2008, it merged with the CME Group of Chicago. In Europe, most transactions on the commodity market take place on the London International Financial Futures and Options Exchange (LIFFE), the London Metal Exchange, while the Tokyo Commodity Exchange is a major player in Asia.

NYMEX trading floor. Source: jp.reuters

NYMEX trading floor. Source: jp.reuters

What does the term "commodities" mean?

Before we delve into the world of commodity trading, it is necessary to clarify what actually lies behind this phrase. A commodity is a basic physical asset, often used as a raw material in the production of other goods or services. The commodity category includes agricultural products, mineral ores and fossil fuels - these are basically all kinds of natural resources used in our daily lives. To be traded on the markets, a commodity must be interchangeable and standardised with another commodity of the same type and species. Thus it is irrelevant where the commodity was produced or by whom, since two equivalent units of the commodity should have roughly the same quality and price. So, regardless of whether 1 ounce of gold was mined in the USA, Russia or South Africa, it will have the same value. In the past, commodity trading was done physically, while today most commodity trading is conducted online.

If you would like to start trading some of the most popular commodities online, then XTB is the place to be! We offer a wide variety of commodities to trade online through CFDs, including gold, oil, natural gas, coffee, and even copper or palladium! Find out more about trading gold below.

Start trading gold CFDs with XTB

Different categories of the commodity market

Investors usually separate commodities into two groups. The first one is "Hard commodities" and refers to metals or energy resources that need to be mined or extracted from natural resources. This category includes, among others, iron ore, crude oil and precious metals. These goods generally have a long shelf life. The second group is "Soft commodities" and consists mostly of agricultural products such as wheat, corn, coffee, cotton, and livestock, including lean hogs and live cattle. Soft commodities are usually seasonal and often deteriorate quickly.

Another common classification of commodities is the division into 4 groups:

- Agricultural - cocoa, sugar, cotton, coffee, etc.

- Energy - petrol products like oil and gas

- Metal - precious metals such as gold, silver and platinum, but also base metals like copper, iron, etc

- Livestock - live cattle and general livestock and meat commodities

Source: XTB

Source: XTB

There is now a long list of different commodities traded, however investors, especially beginners, should focus on the most liquid markets, as this affects the ease of opening and closing trades. In other words, liquidity reflects how many entities are willing to buy and sell a given commodity, and whether transactions can be easily conducted.

Below, one can find a list of the most actively traded commodities according to the Futures Industry Association (FIA) data:

- WTI Crude Oil

- Brent Crude Oil

- Natural Gas

- Soybeans

- Corn

- Gold

- Copper

- Silver

Characteristics of commodity trading

Commodity prices are constantly changing due to fluctuations in demand and supply, both in the economies of individual countries and around the world. Drought could lead to higher grain prices, while geopolitical tensions in the Middle East could push oil prices up. Other factors that affect commodity prices include:

- currency movements

- global economic growth

- natural disasters

- transportation and storage costs

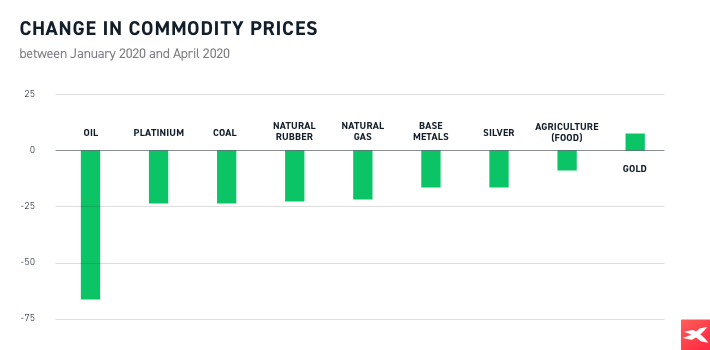

Change in commodity prices between January 2020 and April 2020. Source: Bloomberg

Change in commodity prices between January 2020 and April 2020. Source: Bloomberg

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Therefore, commodity traders try to use the current trends in supply and demand, as well as other above-mentioned factors in order to generate profits. In turn, another part of market participants enter this market to diversify their portfolios by adding different asset classes to reduce exposure to the stock market. Also, another group of investors sees commodities as protection against inflation, because historically commodities have performed well in an environment of rising prices and low interest rates.

Most commodity trading involves the buying and selling of futures based on the price of the underlying physical commodity, although physical trading and derivative trading are also common.

After analysing, traders use contracts to take positions according to their thoughts about the future value of a given commodity. If they think that the price of a commodity will rise, then they buy futures, that is, they take a long position. If, in their opinion, the price of the commodity might fall in the future, then they are selling the futures - or going short. During the working week, traders can invest in commodities almost 24 hours a day.

How to trade commodities with XTB?

Nowadays, there are many different ways for investors to trade commodities, from traditionally investing in the physical commodity itself, to trading futures or commodity options. However, the most popular way to invest in the commodity market are instruments called CFDs (Contracts for Difference) and ETFs (Exchange traded funds). CFD is a derivative instrument that is considered an efficient way to trade popular commodities due to access to leverage, which enables an investor to use less capital to gain greater exposure to an underlying instrument (which is associated with the risk of losing capital faster). Thanks to CFDs investors may profit from falling markets as well as rising ones. Through XTB, traders have access to a wide range of CFDs, including agricultural commodities (e.g. CORN, SOYBEAN), energy commodities (e.g. OIL, NATGAS), industrial metals (e.g. COPPER, ALUMINIUM), precious metals (e.g. GOLD, SILVER) and many others.

What Is CFD Trading?

Moreover, various ETFs enable investors to gain exposure to some commodities e.g. gold, silver, industrial metals or natural gas. Apart from that, investors might also seek indirect exposure to the prices of commodities. Investing in stocks, whose prices are heavily dependent on certain commodities, is another way of creating a diversified portfolio. As an example, copper mining companies rely on copper, which means that their shares are positively and significantly correlated with copper prices. The same scheme can be applied to other commodities (e.g. gold miners or oil producers). It is worth pointing out that such a solution may have an important advantage over direct investment in commodities as some companies may also pay dividends.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Our ETF scanner may be found helpful when looking for ETFs based on commodities. Source: xStation 5

However, remember to carefully analyse commodity price charts and other forms of research before making any transactions. The commodity market is very volatile, which often leads to sharp price movements that can lead to high profits as well as losses, therefore investors must be highly risk tolerant. In addition, an investment in commodities should only be part of an overall portfolio.

Oil demand fell sharply back in March 2020, when the pandemic started. Declines deepened in April 2020, when an oversupply of oil led to an unprecedented collapse in oil prices, forcing the contract futures price for West Texas Intermediate (WTI) to plummet from $18 a barrel to around -$37 a barrel. For comparison, gold (blue chart) also fell sharply in March 2020, along with other commodities. However it managed to regain ground in April 2020. This shows how the commodity market can be volatile at times.

Oil demand fell sharply back in March 2020, when the pandemic started. Declines deepened in April 2020, when an oversupply of oil led to an unprecedented collapse in oil prices, forcing the contract futures price for West Texas Intermediate (WTI) to plummet from $18 a barrel to around -$37 a barrel. For comparison, gold (blue chart) also fell sharply in March 2020, along with other commodities. However it managed to regain ground in April 2020. This shows how the commodity market can be volatile at times.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. Source: xStation5