FOMC announced another 75 basis point rate hike today, pushing Fed funds to the 3.00-3.25% range. Such a decision was expected therefore focus was on the accompanying statement as well as a new set of economic projections.

When it comes to statements, there is little to talk about as there were barely no changes to the text. However, the same cannot be said about economic projections as those have seen quite big revisions compared to June forecasts.

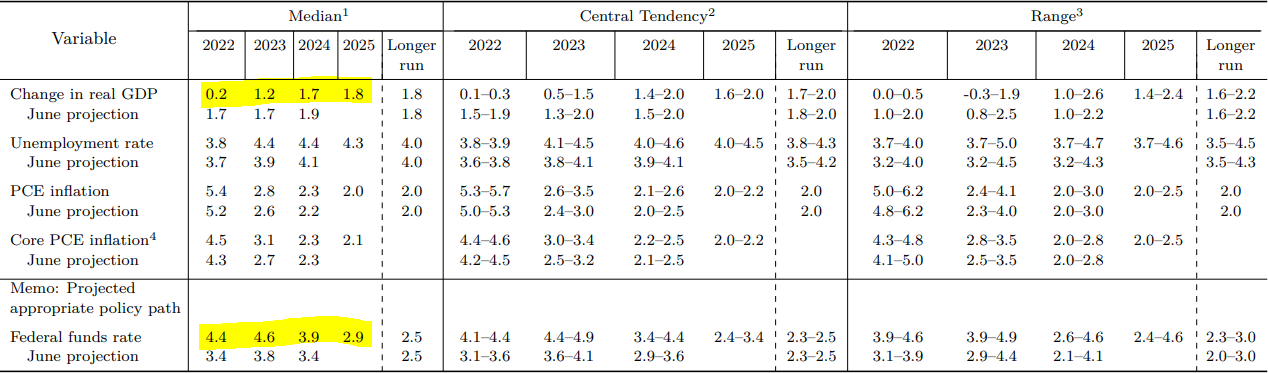

Real GDP is now expected to increase just 0.2% in 2022, down from 1.7% in June forecast. Lower growth is also expected in 2023 and 2024 while long-term forecast was left unchanged at 1.8%.

Headline and core PCE inflation forecasts were also boosted for 2022 and 2023 but the scale of upward revision was not significant. Interestingly, the Fed does not expect core PCE to drop back to the 2% over the forecast horizon. Another point to note is that the Fed expects the unemployment rate to pick-up quite noticeably in 2023, to 4.4%.

Last but not least, Fed funds projections are super-hawkish. Fed now expects rates to reach 4.4% at the end of 2022, up from 3.4% seen in June. Terminal rate of the current rate hike cycle is still expected to be reached in 2023 but level jumped from 3.8 to 4.6%, showing that Fed is far from being done.

New economic projections show a much lower real GDP growth this year with forecasts for the coming years also being lower than in June. Much higher interest rates are also forecast - 4.4% at end-2022 and 4.6% terminal rate in 2023. Source: Federal Reserve

New economic projections show a much lower real GDP growth this year with forecasts for the coming years also being lower than in June. Much higher interest rates are also forecast - 4.4% at end-2022 and 4.6% terminal rate in 2023. Source: Federal Reserve

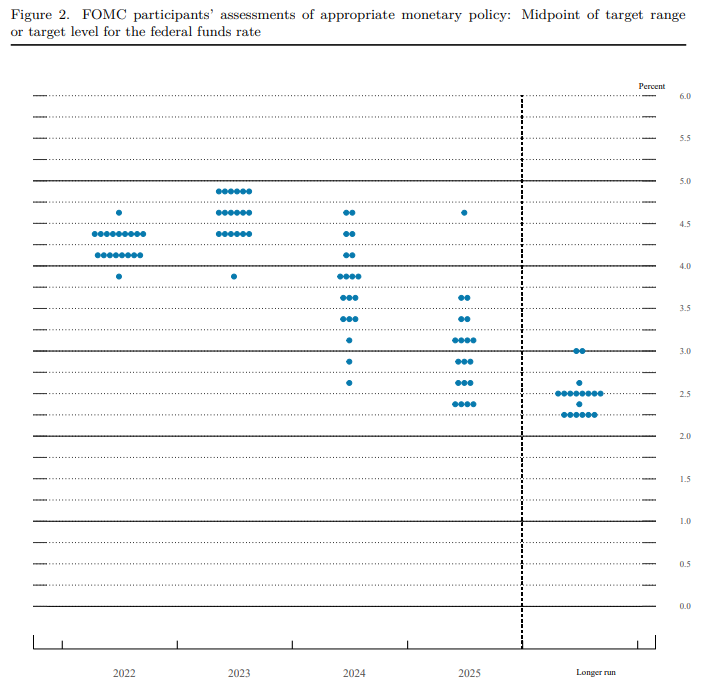

New dot-plot shows higher rates in 2022 and 2023. However, dots for 2024 and 2025 show that different Fed members have very different views on where rates should be. Source: Federal Reserve

New dot-plot shows higher rates in 2022 and 2023. However, dots for 2024 and 2025 show that different Fed members have very different views on where rates should be. Source: Federal Reserve

BREAKING: US CPI below expectations! 🚨📉

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected