As Wall Street opened, a distinct turn away from risk assets was observed, driven by growing concerns that Ukraine peace talks may yield no concrete results, potentially dragging on for months rather than weeks.

Adding to the uncertainty, investors are also awaiting the release of the FOMC minutes, though their impact may be limited ahead of Fed Chair Jerome Powell's highly anticipated speech at Jackson Hole on Friday. Speculation is mounting that Powell will use the address to temper market expectations for imminent interest rate cuts. In other news, Donald Trump's latest attempt to force another resignation at the Fed, citing recent allegations against board member Lisa Cook, is seen as a move to exert greater influence over the central bank.

Market Performance Highlights

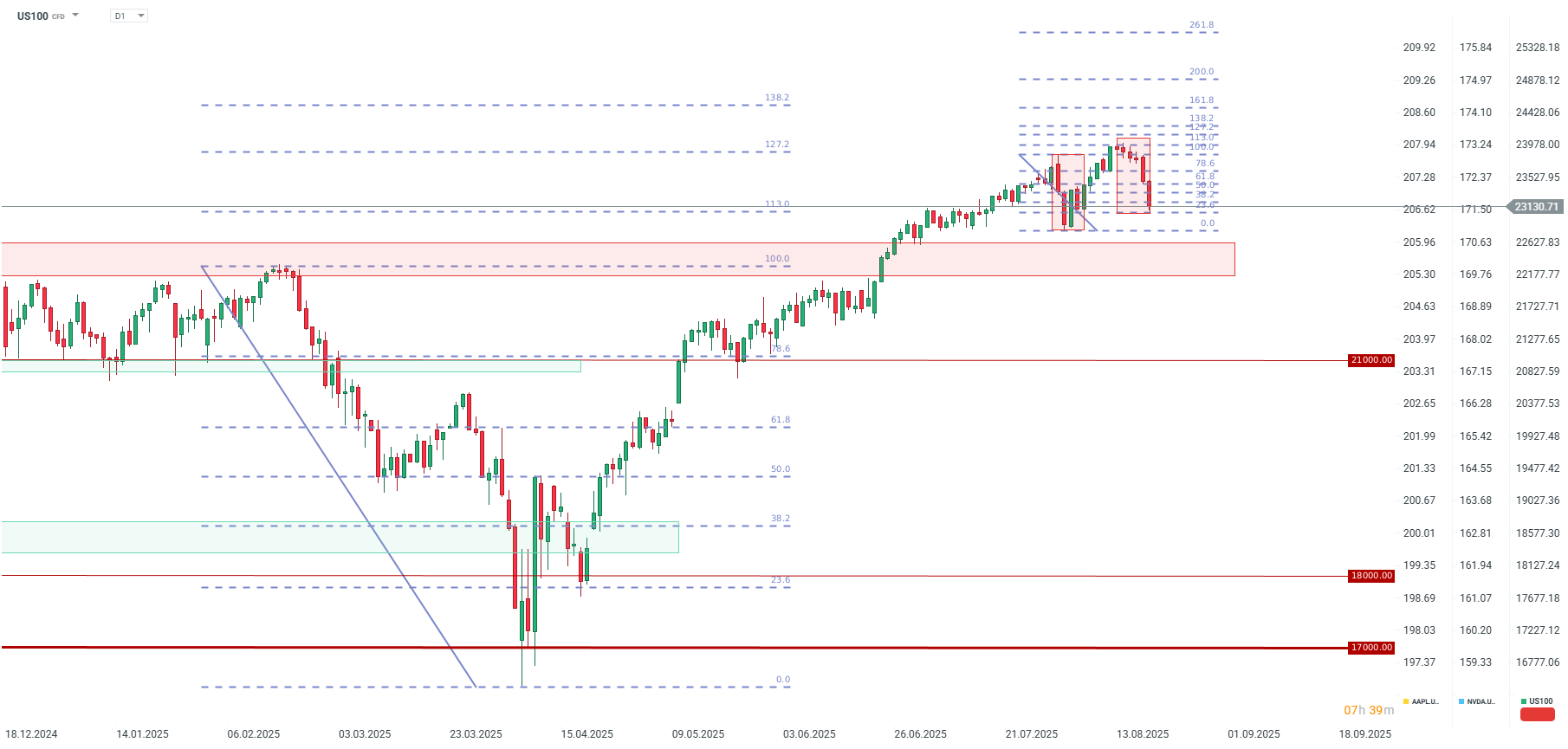

US100 fell by more than 1.5%. The recent retreat mirrors the pullback seen in late July and early August. A break below the 23,000-point level could trigger the largest correction since March.

Gold gained more than 0.7%, rebounding from its lowest level since August 1. Increased market uncertainty is once again driving investors towards safe-haven assets.

Bitcoin is experiencing its largest correction since August. A break below the $112,000 level could see a decline towards the next key support at $107,000, a level that coincides with the 38.2% Fibonacci retracement of the last wave and local peaks from late 2024 and early 2025.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report