The world’s biggest brewer, Anheuser-Busch InBev (BUD.US) announced today that total revenue for the Q2 fell by 17.7%. Total global revenue from three of its big global brands, Budweiser, Stella Artois, and Corona, dropped by 16.6% for the quarter as beer volumes tumbled 32% in April and 21% in May. However the beer brewer said it saw a rebound in global beer sales in June which grew by 0.7%.

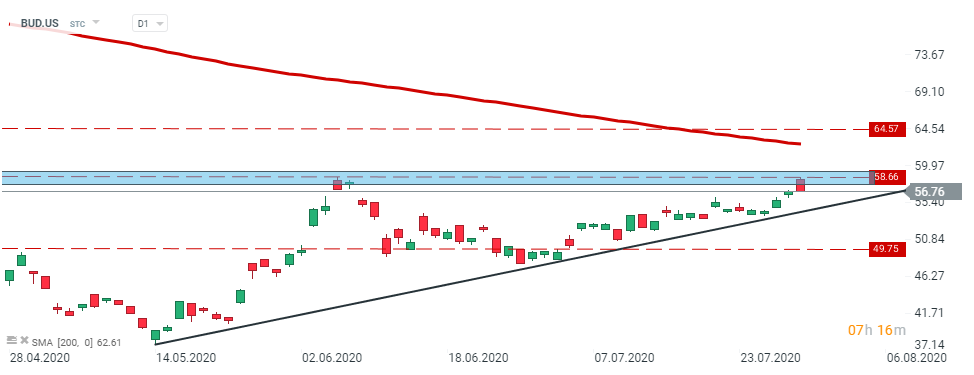

Anheuser-Busch InBev (BUD.US) - price bounced of the major resistance level at $58.66 per share and is heading towards upward trendline. Should a break below occur support at $49.75 may be at risk. However if buyers will manage to halt declines there, then upward impulse into $64.57 is possible. Source: xStation5

Anheuser-Busch InBev (BUD.US) - price bounced of the major resistance level at $58.66 per share and is heading towards upward trendline. Should a break below occur support at $49.75 may be at risk. However if buyers will manage to halt declines there, then upward impulse into $64.57 is possible. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈