Abbott Laboratories (ABT.US) stock fell over 2.0% in pre-market despite the fact that medical devices and health care companies posted quarterly figures which topped market estimates.

- Company earned $1.73 on revenue of $11.9B boosted mainly by high demand for its COVID-19 test kits and other medical devices. Meanwhile analysts expected earnings of $1.47 on revenue of $11.04B.

- Abbott expects a full-year 2022 diluted EPS on a GAAP basis around $3.35 and projected adjusted diluted EPS of at least $4.70 remains unchanged.

- Guidance for the current fiscal year includes projected COVID-19 testing-related sales of approximately $4.5 billion, which Abbott expects to largely occur in the first half of the year and will update on a quarterly basis.

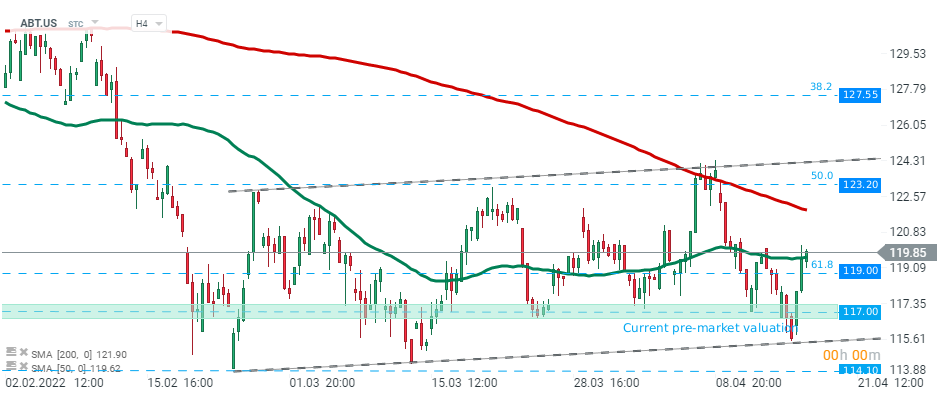

Abbott Laboratories (ABT.US) stock has been moving within an ascending channel since the end of February 2022. However price moved lower following the releases of quarterly figures and is currently approaching the lower limit of the formation. Should break lower occur, downward move may accelerate towards local support at $114.10. Source: xStation5

Abbott Laboratories (ABT.US) stock has been moving within an ascending channel since the end of February 2022. However price moved lower following the releases of quarterly figures and is currently approaching the lower limit of the formation. Should break lower occur, downward move may accelerate towards local support at $114.10. Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning