Adobe Systems (ADBE.US) stock plunged 10% on Wednesday after the software maker issued a disappointing financial outlook, which overshadowed upbeat quarterly results.

-

The company earned $3.37 per share, slightly above analysts’ estimates of $3.34 per share, while revenue rose 9% from a year ago to $4.26 billion and slightly beat market projections of $4.24 billion.

-

Adobe Chief Executive Shantanu Narayen said the company delivered record revenue because its Creative Cloud, Document Cloud and Experience Cloud products are all pivotal in driving the digital economy.

-

However, Adobe lowered expectations for a key subscription revenue measure, expecting a $75 million after the company halted all new sales of its products and services in Russia and Belarus in response to the Ukrainian conflict.

-

The company will continue to provide digital media services in Ukraine, however annual recurring revenue from this country will most likely drop to around $12 million. The result will be a total revenue shortfall of $87 million for the full year, Adobe said.

-

For the second quarter, Adobe expected revenue of $4.36 billion and adjusted earnings of $3.30 per share, below analyst estimates of $4.39 billion revenue and earnings of $3.35 per share.

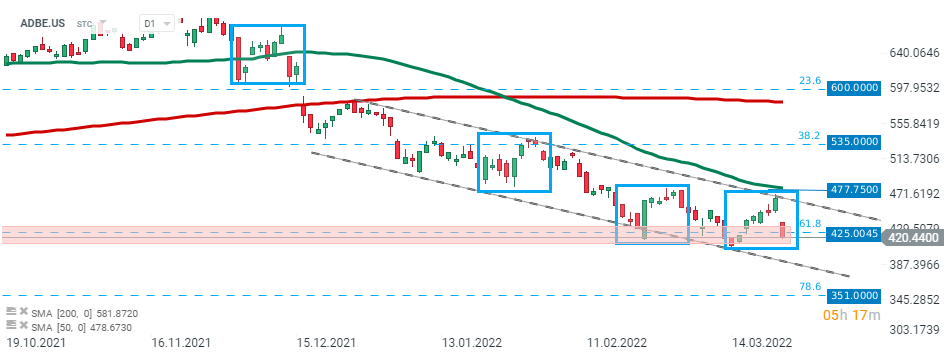

Adobe Systems (ADBE.US) stock fell sharply on Wednesday and is currently testing major support zone around $425.00, which is marked with previous price reactions, lower limit of the 1:1 structure and 61.8% Fibonacci retracement of the upward wave launched in March 2020. Should break lower occur, the next target for sellers is located around $351.00. However, if buyers manage to halt declines, then another upward impulse towards major resistance at $477.75 may be launched. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈