EURUSD ended after 6 hours rather lower in the latest minutes releases, although on average EURUSD gained, but this is the result of reactions from October, November and January.

Source: Bloomberg Financial LP

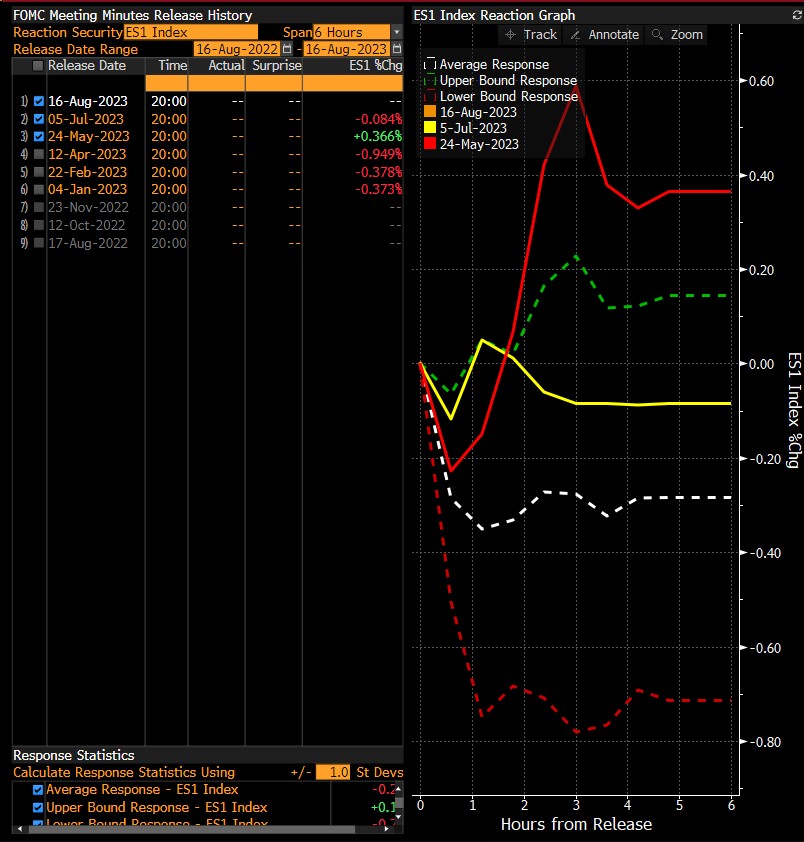

The July minutes following the June decision did not bring volatility to the US500. In contrast, we saw a sizable increase in May, but for the most part the US500 lost during the minutes, including during the first minutes after the publication.  Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

It is worth remember that we have heavily oversold markets today: the EURUSD and the US500, so there is potential for profit-taking if the minutes are dovish. However, if they point to the need for more hikes, these markets could fall into a further downtrend this week.

Daily summary: Markets recover optimism at the end of the week

Three Markets to Watch Next Week (09.01.2026)

US OPEN: Investors exercise caution in the face of uncertainty.

BREAKING: Employment in Canada better than expected! 🍁📈