Alcoa (AA.US) stock rose nearly 8.0% after the aluminum producer announced first-quarter results that topped analyst predictions. Alcoa reported a $0.79 adjusted profit, and sales of $2.87 billion, while Wall Street expected earnings of $0.46 per share on sales of $2.65 billion. Net income was $175 million in Q1 2021. That compares with income of $80 million in Q1 2020 and $4 million net loss in Q4 2020. Company benefited from high aluminum prices amid optimism that reopening economies will spur demand for everything from automobiles to airplanes and kitchen appliances. “We had an excellent first quarter with our best quarterly result since a record-setting year in 2018,” Alcoa President and CEO Roy Harvey said. “We excelled from the top line to the bottom line, controlling production costs and capturing the benefits of improved demand and stronger prices for alumina and aluminum.”

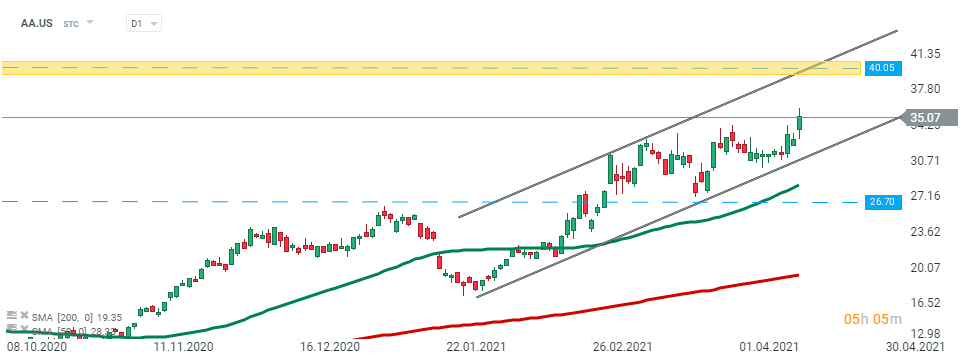

Alcoa (AA.US) stock rose sharpy following upbeat quarterly figures and is trading at the highest level since November 2018. If the current sentiment prevails then upward move may be extended to the resistance at $ 40.05 which coincides with the upper limit of the ascending channel. On the other hand, if sellers will manage to regain control and break below the lower limit of the channel, then downward impulse towards support at $27.50 could be launched. Source: xStation5

Alcoa (AA.US) stock rose sharpy following upbeat quarterly figures and is trading at the highest level since November 2018. If the current sentiment prevails then upward move may be extended to the resistance at $ 40.05 which coincides with the upper limit of the ascending channel. On the other hand, if sellers will manage to regain control and break below the lower limit of the channel, then downward impulse towards support at $27.50 could be launched. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡