Alibaba (BABA.US) stock dropped over 2.5% after Bloomberg reported that Chinese e-commerce giant is considering the sale of its 30% stake in social media advertising company Weibo (WB.US), to state-owned Shanghai Media Group. Company’s shares dropped over 50% over the last year due to a myriad of concerns such as Chinese regulatory crackdowns hurting its business and how its shares could get delisted from US bourses.

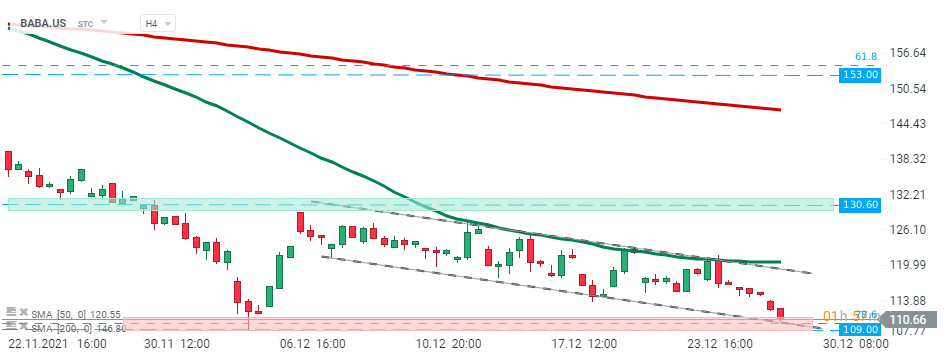

Alibaba's (BABA.US) stock launched today’s session lower and is currently testing major support zone around $109.00 which is marked with December lows, lower limit of the descending channel and 78.6% Fibonacci retracement of the large upward wave launched back in September 2015. Should break lower occur, downward move may accelerate towards psychological $100.00 level. On the other hand, if buyers manage to halt declines here, then another upward impulse towards the upper limit of the aforementioned channel may be launched. Source: xStation5

Alibaba's (BABA.US) stock launched today’s session lower and is currently testing major support zone around $109.00 which is marked with December lows, lower limit of the descending channel and 78.6% Fibonacci retracement of the large upward wave launched back in September 2015. Should break lower occur, downward move may accelerate towards psychological $100.00 level. On the other hand, if buyers manage to halt declines here, then another upward impulse towards the upper limit of the aforementioned channel may be launched. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡