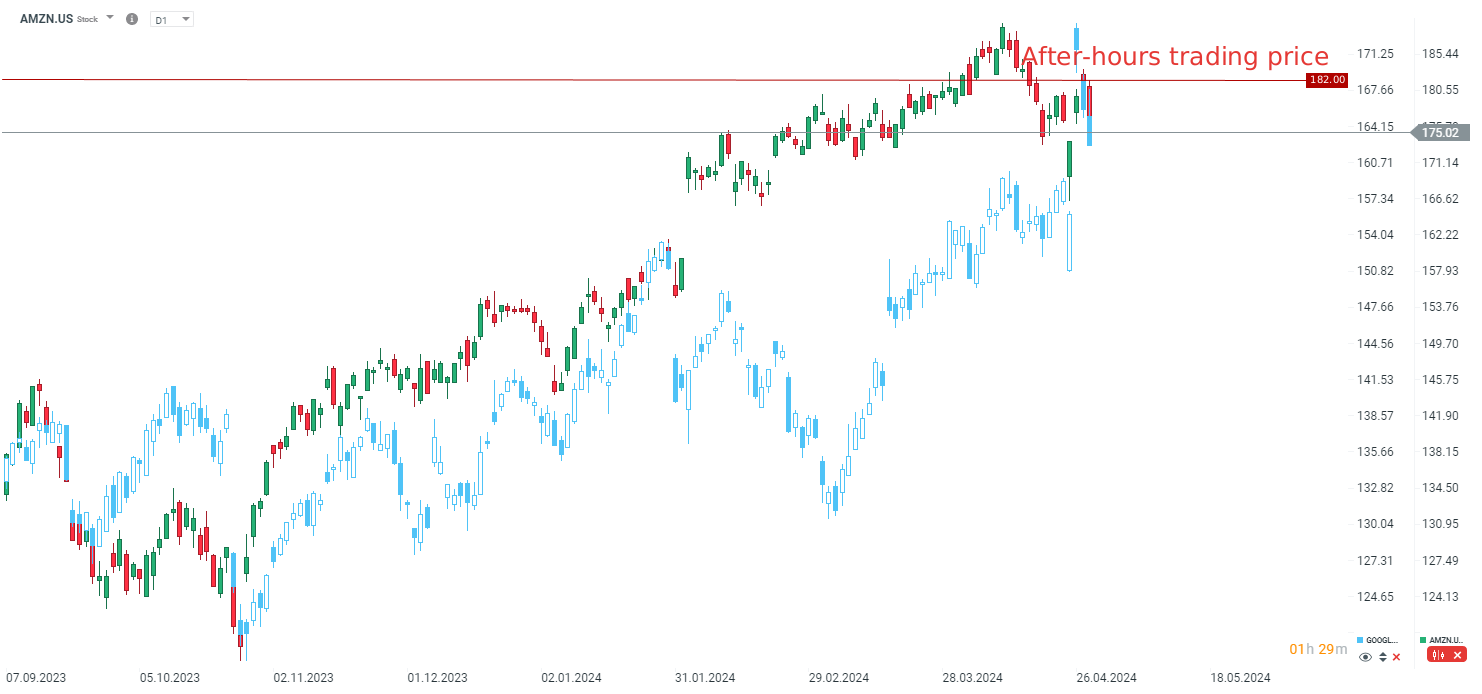

Amazon has shown very solid Q1 2024 results, once again surpassing analysts' expectations, both in terms of revenue and earnings per share (EPS). The company reported very good results for AWS cloud sales, but on the other hand, the company provided fairly conservative guidance for the next quarter. Despite this, the company's strong performance is leading to an increase in stock prices after the session, reminiscent of the situation with Microsoft and Alphabet's earnings releases. Both of these companies have (at least partially) similar businesses. Here is a summary of the key points and their impact on stock prices:

Positive aspects:

- Revenue: $143.3 billion, surpassing expectations of $142.6 billion. This is a significant year-over-year increase compared to $127.4 billion in Q1 2023.

- EPS: $0.98, surpassing expectations of $0.84. This is a significant jump compared to $0.31 in Q1 2023.

- Strong growth in all sectors: Online sales revenue increased as expected. AWS revenue also exceeded expectations, showing even stronger growth of 17% compared to the expected 14.7%. AWS revenue reached $25 billion. Advertising revenue is also on a growth trajectory, which may begin to generate a significant portion of revenue in the future.

- North American sales increased by 12% YoY to $86.3 billion.

- International sales increased by 10% to $31.9 billion, up 11% excluding currency impact.

- The company also plans to invest $750 million to ensure the security of its services.

Mixed signals:

- Q2 sales forecast: Amazon's sales forecast for Q2 of $144 to $149 billion falls short of analysts' expectations of $150.13 billion. However, mixed sales expectations take into account the negative currency impact.

- Operating income: Expected operating income range of $10 to $14 billion, when market expected $12.56 billion.

Amazon's Q1 2024 results were positive, indicating continued growth in all key areas of business. The company shows solid growth in the cloud segment and in the key sales segment. Of course, the company did not meet expectations for guidance, but it is worth noting that it cites currency exchange as the reason. Furthermore, in previous quarters, the company usually significantly exceeded its initial expectations. The company's stock gained 4.5% in after-hours trading.

The price has jumped in after-hours session. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡