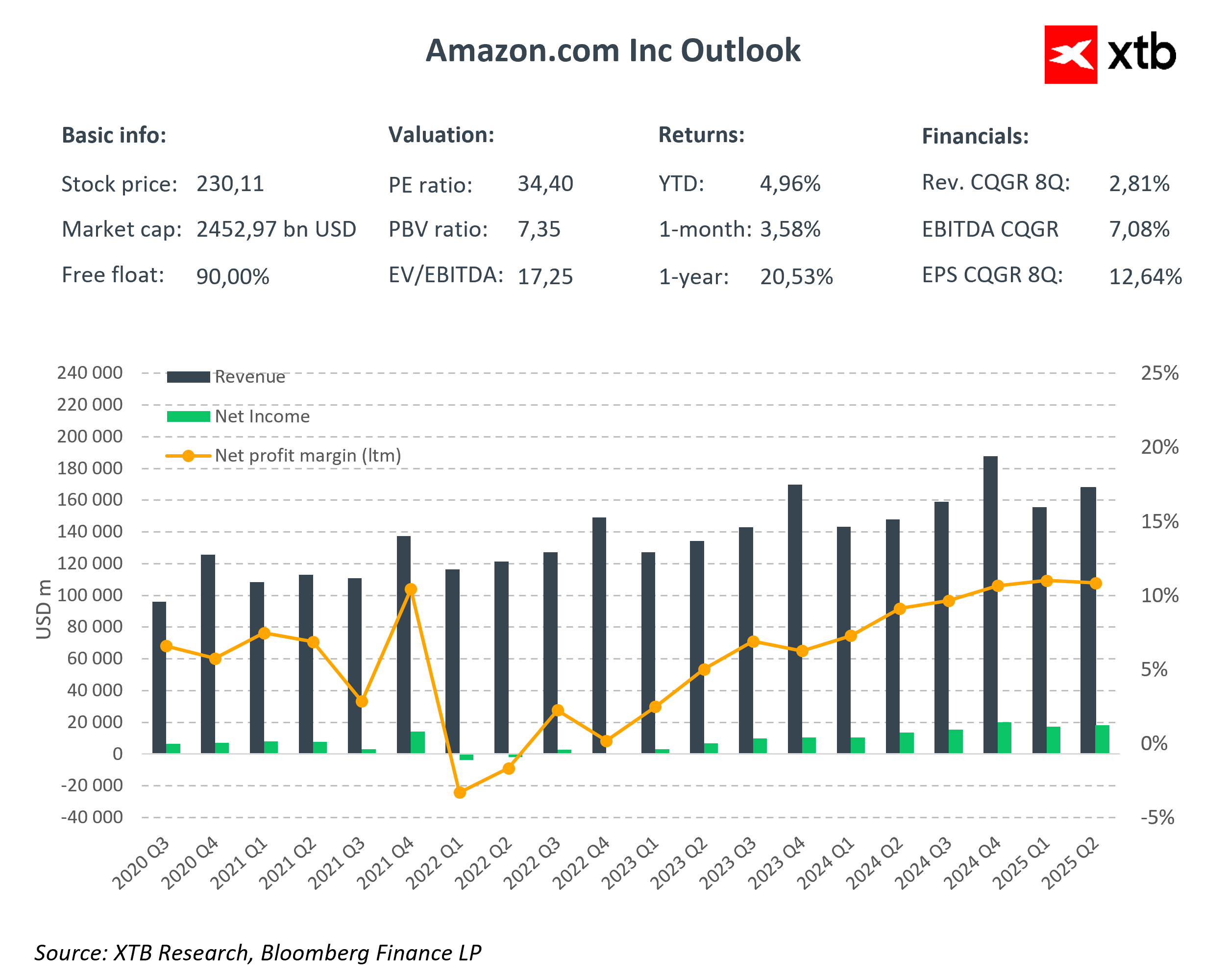

Amazon (AMZN.US) will report its Q3 2025 earnings today after the U.S. market close. Investors expect another solid quarter, though there is uncertainty surrounding the pace of cloud growth and the company’s positioning in AI. Consensus forecasts call for $177.8 billion in revenue and EPS of $1.58, up 12% and 10% y/y, respectively. This represents steady growth, though clearly slower than during the pandemic years.

The main focus will be on AWS, Amazon’s current profit engine. Although it accounts for only about 20% of total revenue, it generates around 40% of operating income. AWS’s operating margin fell last quarter from 36% to 33%, and its market share declined by roughly 2% in favor of Microsoft Azure and Google Cloud. Any sign of margin recovery or changes in AI-related market share will be crucial for sentiment.

Key expectations

- Revenue: $177.8B (+12% y/y)

- AWS revenue: $32.3B (+18% y/y)

- Advertising services: $17.3B (+21% y/y)

- Online store: $66.5B (+8% y/y)

- Third-party seller services: $41.9B (+11% y/y)

- EPS: $1.57–$1.58 (+10% y/y)

- Operating income: $23.7B (+4% y/y)

AI ambitions under scrutiny

Artificial intelligence remains the key growth driver for the entire tech sector. Investors expect management to explain how record-high capital expenditures will translate into future revenue growth. Currently, high CAPEX is weighing on free cash flow. Recent comments from Jeff Bezos emphasize that AI is the company’s “top priority,” spanning everything from logistics and automation to personalized shopping experiences.

Amazon’s stock remains below its all-time highs, unlike other Big Tech peers such as Apple, Microsoft, Alphabet, and Nvidia. Given the strong results from Microsoft and Alphabet yesterday, investors are likely to scrutinize Amazon’s report even more closely.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood