Advanced Micro Devices (AMD.US), US semiconductor company, is trading around 9% lower today after reporting Q1 2023 earnings yesterday after session close. Company's results were slightly better than expected with adjusted EPS coming in at $0.60 (exp. $0.56) and revenue reaching $5.35 billion (exp. $5.30 billion). However, on an unadjusted basis, AMD reported a net loss of $139 million, or $0.09 per share. Also, revenue - although slightly higher than expected - was 9% year-over-year lower.

AMD reported a 65% sales drop in a unit that sells PC processors - from $2.1 billion in Q1 2022 to $0.74 billion in Q1 2023. Data center segment generated $1.295 billion in sales - more or less flat compared to $1.293 billion in Q1 2022. Gaming segment, that includes GPUs, saw sales drop from $1.88 billion to $1.76 billion. On a positive note, segment including sales of chips for networking saw sales surge from $0.59 billion in Q1 2022 to $1.56 billion now. However, this increase can be explained by acquisitions that AMD made in the segment.

AMD provided a lackluster outlook for the current quarter, projecting sales at around $5.3 billion in Q2 2023. This is below $5.48 billion suggested by analysts' median estimate. Nevertheless, company executives said they expected growth in the second half of 2023 as markets for PC and servers improve. Company expects that the bottom in PC processor business was reached in Q1 2023 and now sales should start to slowly improve.

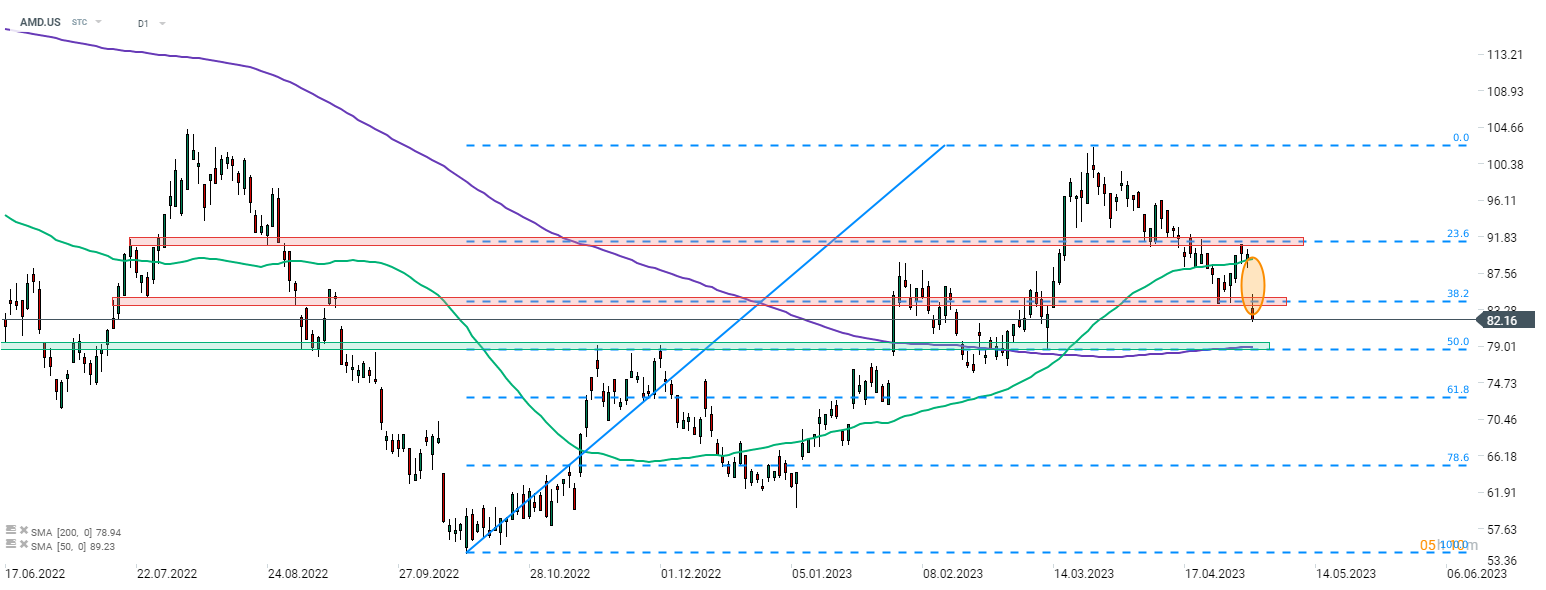

In spite of slightly better-than-expected results, AMD is trading around 9% lower today as Q2 2023 outlook disappointed. Stock launched today's trading with a big bearish price gap and is trading below price zone marked with 38.2% retracement of recent upward impulse. The next potential support zone to watch can be found in the $79.00 area, where 200-session moving average and 50% retracement can be found.

AMD.US at D1 interval. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales