AMD, the biggest competitor to Nvidia in the production of data center and AI-related chips, while being highly competitive on price, has published its financial results for Q2 2025:

-

Revenue: Q2 2025: $7.69bn, vs. consensus of $7.43bn; Q2 2024: $5.84bn, YoY dynamics: +32%

-

Adjusted EPS (non-GAAP): Q2 2025: $0.48, vs. consensus of $0.49; Q2 2024: $0.69, YoY dynamics: –30%

-

EPS (GAAP): Q2 2025: $0.54; Q2 2024: $0.16, YoY dynamics: +238%

-

Adjusted Operating Profit: Q2 2025: $897m, vs. consensus of $903m; Q2 2024: $1.26bn, YoY dynamics: –29%

-

Net Profit (non-GAAP): Q2 2025: $781m; Q2 2024: $1.13bn, YoY dynamics: –31%

-

GAAP Gross Margin: Q2 2025: 40%; Q2 2024: 49%; a decrease of 9 pp

-

Non-GAAP Gross Margin: Q2 2025: 43%, vs. consensus of 54.1%; Q2 2024: 53%; a decrease of 10 pp

-

CAPEX: Q2 2025: $282m, vs. consensus of $176m; Q2 2024: $154m; an increase of 83%

-

R&D Expenses: Q2 2025: $1.89bn, vs. consensus of $1.72bn; Q2 2024: $1.58bn; an increase of 20%

Business Segments

-

Data Center: $3.2bn (+14%) – demand for EPYC, but slowed down by the embargo on MI308 GPUs for China.

-

Client: $2.5bn (+67%) – a record quarter thanks to new Ryzen processors.

-

Gaming: $1.1bn (+73%) – a strong rebound, with demand for Radeon cards and consoles.

-

Embedded: $824m (–4%) – the only segment to be in the red.

Forecast for Q3 2025 vs. expectations:

-

Revenue: $8.7bn ± $0.3bn (consensus: $8.37bn)

-

Non-GAAP gross margin: approx. 54% (consensus: 54.1%)

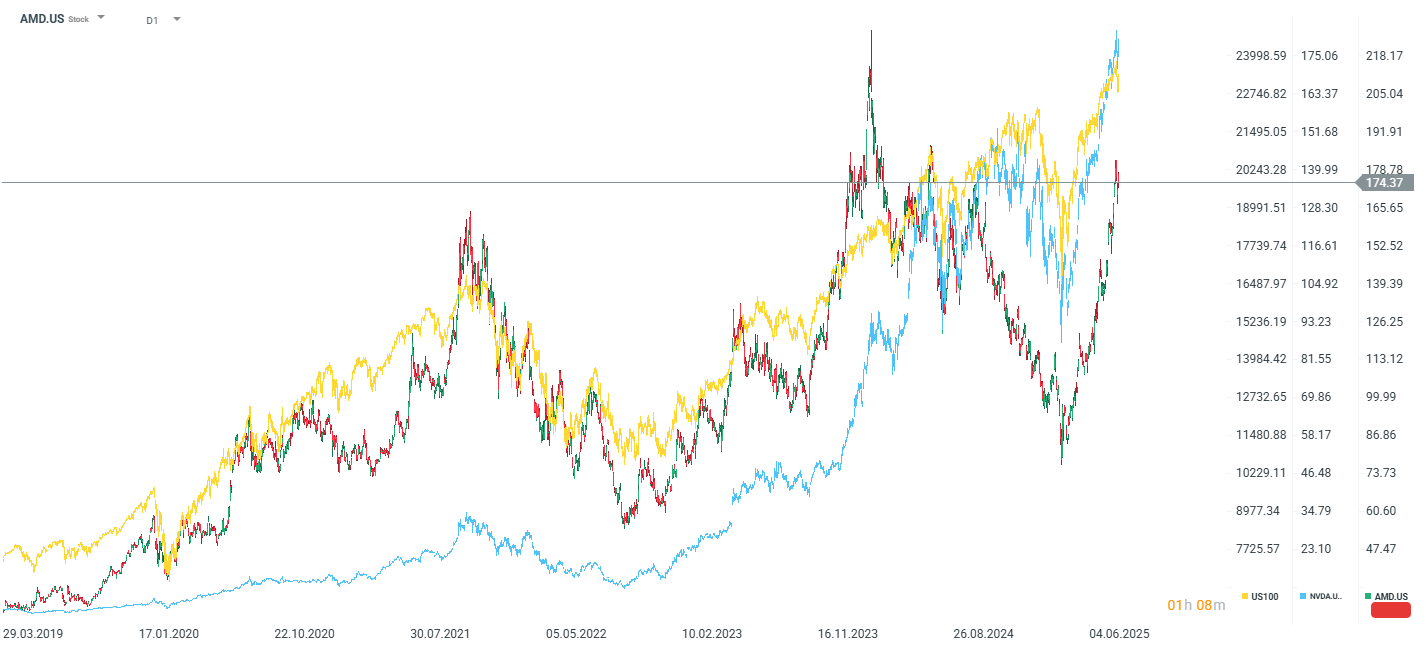

AMD loses nearly 4% after results

The company shows a non-GAAP EPS that is significantly lower than last year. There is also a decline in operating profit and margin. The sharp drop in margin is caused by one-time write-downs related to restrictions on exporting AI GPUs to China. However, this situation has a chance of changing in the near future. Nevertheless, the market is still wondering whether the restrictions on exports to China will lead to significant operational costs for the company. High CAPEX and R&D expenses are raising investor concerns about pressure on lower cash flows in the coming quarters. Despite good revenue results and an optimistic forecast for Q3, the current assessment has focused on short-term problems related to margins and uncertainty regarding China. In the initial reaction, shares lost over 5%, but the loss has now been reduced to just under 4%. The company's shares are approximately 30% below their historical highs, but have rebounded by about 130% since the low in early April.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡