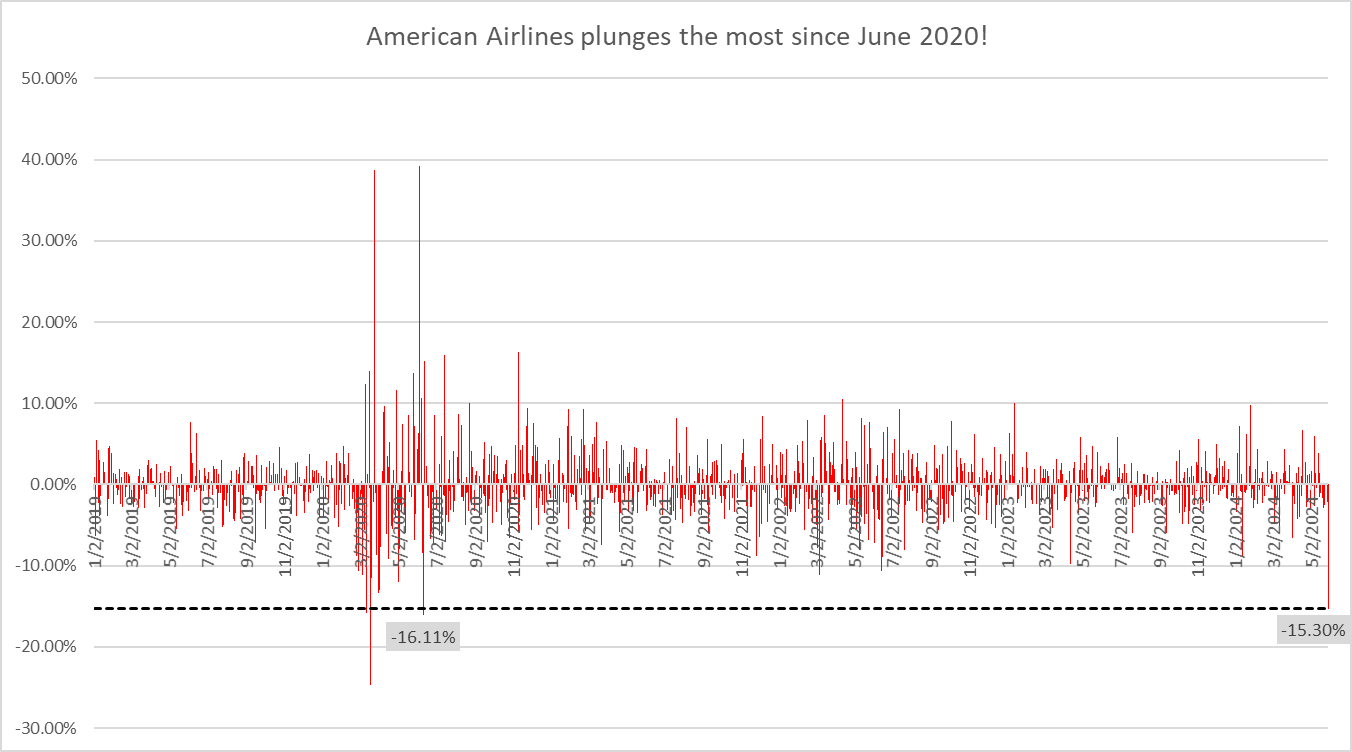

American Airlines (AAL.US) are plunging around 15% today, with company's share price dropping to the lowest level since the beginning of November 2023. Company announced a cut to its profit outlook yesterday in the evening as well as departure of one of key executives, who helped reshape company's strategy.

American Airlines now expects lower adjusted EPS in Q2 2024. Forecast was lowered by around 17.3% based on forecast range midpoints. Meanwhile, total revenue per available seat mile is expected to see a deeper drop than previously assumed. While the company expects a slower cost growth, this is not enough revenue drop, leading to lower expectations for margins.

Company also said that Vasu Raja, Chief Commerical Officer, who helped refocus that company on leisure destinations will step down next month, in a sign that the latest strategy change of the airline may have been poorly received.

American Airlines Q2 outlook

- Adjusted EPS: $1.00-1.15, down from previous forecast of $1.15-1.45

- Total revenue per available seat mile: 5-6% decline, compared to previous forecast of 1-3% decline

- Cost per available seat mile, excluding fuel: 0-1% growth, compared to previous forecast of 1-3% growth

- Adjusted operating margin: 'about 8.5-10.5%', down from previous forecast of 'about 9.5-11.5%'

Source: XTB Research

Source: XTB Research

American Airlines (AAL.US) slump 15% after lowering Q2 guidance and are trading at the lowest level since the beginning of November 2023. Source: xStation5

American Airlines (AAL.US) slump 15% after lowering Q2 guidance and are trading at the lowest level since the beginning of November 2023. Source: xStation5

The launch of Xeon 600 and cooperation with SoftBank. Is this a breakthrough for Intel?

US Open: US100 slides 0.5% under pressure from IT sector 📉ServiceNow drops 6%

Palantir after earnings: another quarter, another record

Merck: Mixed Results, but Key Drugs Continue to Drive Growth