American Express (AXP.US) launched today's trading with a bearish price gap and reached the lowest levels in 10 months. This comes following the release of Q3 2023 earnings report today before the opening of the Wall Street session. Overall, the report was pretty solid but there were some worrying signs.

American Express reported record revenue for the sixth consecutive quarter in a row, which was also slightly better than expected by analysts. EPS also beat expectations by over 10%. However, provisions for credit losses were higher than expected and almost 60% higher than a year ago. This pick-up in provisions for credit losses can be linked to a concern that some customers may fail to repay debt amid higher interest rates. Company noted that consumer spending remained strong and that it is confident it will reach its full-year targets, which were left unchanged.

Q3 2023 earnings

- Revenue: $15.38 billion vs $15.33 billion expected (+13% YoY)

- EPS: $3.30 vs $2.95 expected (+34% YoY)

- Net income: $2.5 billion (+30% YoY)

- Provision for credit losses: $1.23 billion vs $1.18 billion expected (+58% YoY)

- Discount revenue: $8.41 billion vs $8.47 billion expected

- Card reward expenses: $3.79 billion vs $4 billion expected

- Total expenses: $11.05 billion vs $11.35 billion expected

- Effective tax rate: 20.9% vs 23.3% expected

- Network volume: $420.2 billion vs $424.8 billion expected (+7% YoY)

Full-2023 forecasts

- Revenue growth: 15-17%

- EPS: $11.00-11.40

2024 targets

- Revenue growth exceeding 10%

- EPS growth in mid-teens

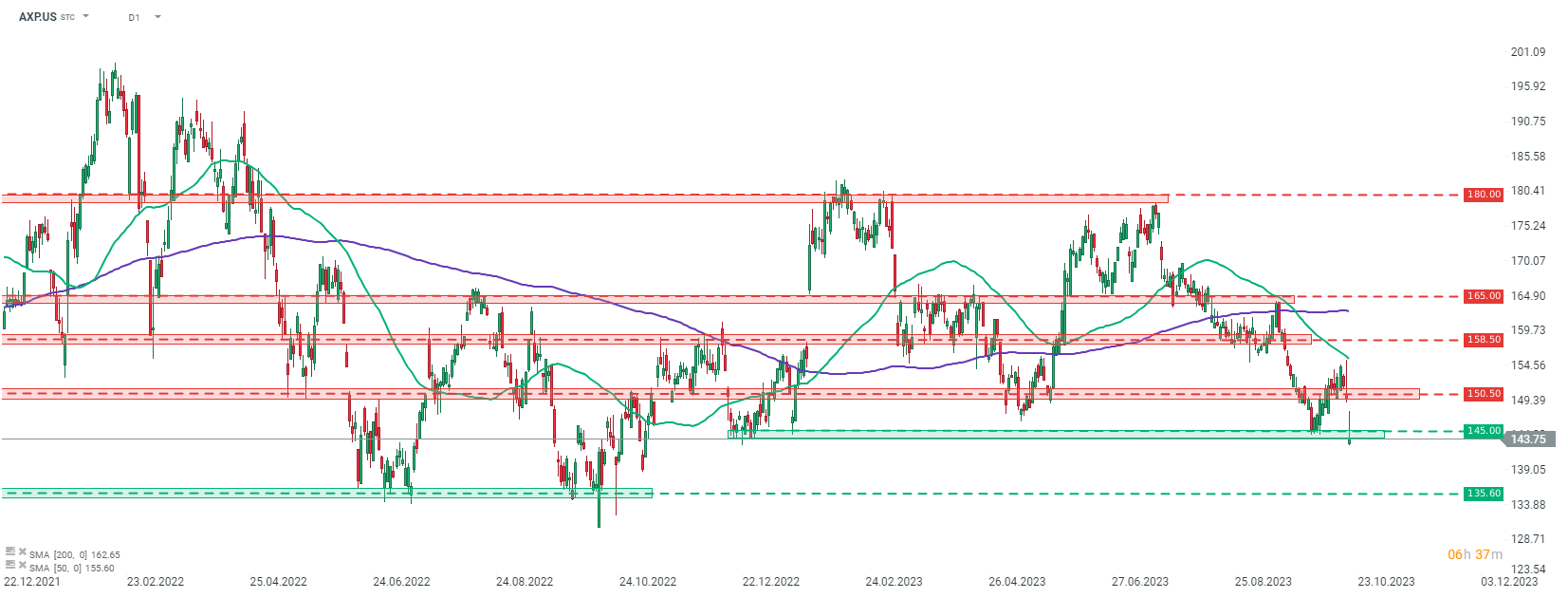

As one can see, results were quite solid and therefore today's drop in share price of American Express can be attributed to an overall weaker performance of equity markets ahead of the week. Taking a look at the American Express (AXP.US) chart at D1 interval, we can see that the stock launched today's trading with a bearish price gap and moved to levels not seen since late-December 2020. Stock attempted to climb back above the $145 support zone during the cash trading but the attempt turned out to be a failure. Should we see the stock continue to move lower in-line with short-term trend, the next support to watch is $135.60 area, marked with local lows from June and September 2022.

Source: xStation5

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood