The market and statistical institutions have not yet fully managed to cope with the volatility and data gaps resulting from the previous, record-long government shutdown. By the end of January 2026, however, the U.S. government had already entered a second shutdown period.

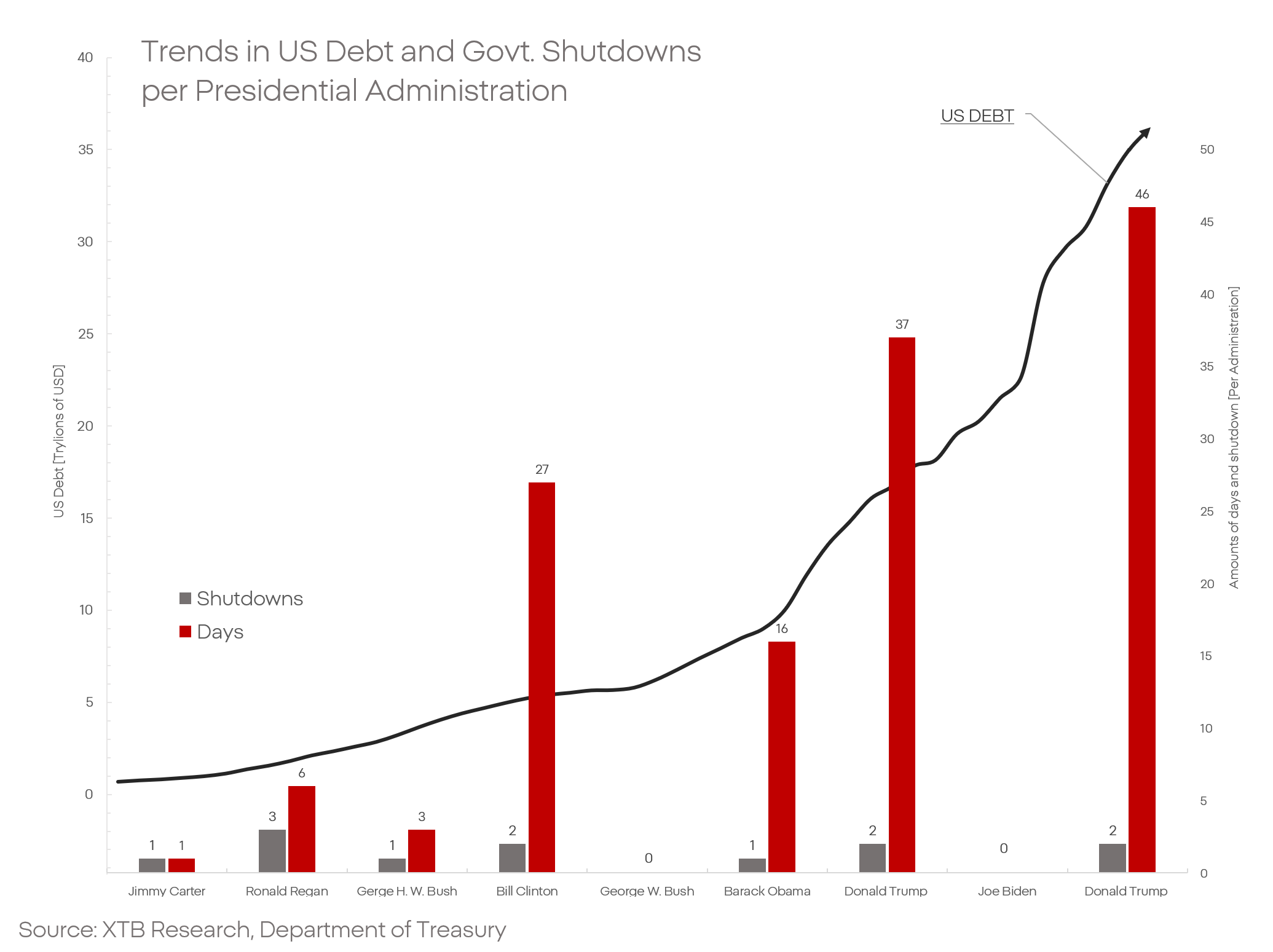

Donald Trump has officially surpassed Ronald Reagan’s record in terms of the number of government funding crises triggered. What is the source of this latest fiscal crisis, when could it end, and what might it mean for financial markets?

Source of the Problem

At the outset, it should be noted that the previous shutdown was resolved through a provisional, temporary agreement, signed thanks to a small group of Democratic senators who broke with their party’s negotiation strategy. The gap between the objectives and demands of Democrats and Republicans is vast and continues to widen, and the agreement signed in November did not address the underlying disputes in any meaningful way.

The U.S. budget process is divided into a series of smaller appropriations bills that determine funding for specific areas of government operations. The previous dispute concerned funding for one of the healthcare programs; the current one is significantly broader. The debate now centers on funding for the Department of Homeland Security (the American equivalent of an interior ministry).

A wave of protests is sweeping across the United States against the presidential administration and the ICE agency, responsible for implementing the new migration policy. In light of recurring reports of fatalities, unlawful entries, wrongful detentions, and disappearances allegedly linked to the agency’s activities, the Democratic Party is demanding reforms and stronger oversight before agreeing to further funding.

Government shutdowns are not new in American politics. They have typically lasted several days or weeks, with relatively limited economic consequences. However, Donald Trump broke with this status quo. Shutdowns during both his first and second terms rank among the longest in history and have had tangible economic effects.

The Congressional Budget Office estimated that the 2025 shutdown cost the U.S. economy approximately 1.5% of GDP. Similar estimates were presented by JP Morgan and Goldman Sachs.

No Prospects for Compromise

What may raise concern is that the current administration has, in principle, refused any negotiations, compromise, or reforms. It expects unconditional approval of its proposals in Congress and the Senate. The 2025 dispute was resolved only thanks to a small group of Democrats who changed their voting position without securing significant concessions.

The U.S. government has given no indication that the situation would unfold differently this time. In 2025, time was not working in the Republicans’ favor. Today, however, the administration’s position is deteriorating from weak to critical.

The attention of the American political establishment and the public is already focused on the midterm elections scheduled for November this year. These elections will determine control of the Senate and the House of Representatives. While even pessimistic scenarios suggest Republicans may retain their expected majority in the Senate, the situation in the House appears fundamentally different.

A wave of protests is sweeping the country, and positive economic data are difficult to identify in consumer sentiment and labor market indicators, which remain at their weakest levels in years, if not decades. Mounting scandals, controversies, and military interventions further weigh on the administration. The prevailing consensus and electoral trends point toward a near-certain Republican defeat in the House elections. What does all of this mean for the stock market?

How Are Markets Responding?

If the shutdown ends within several days or weeks, the impact on financial markets is likely to remain limited. However, if it extends beyond 30 days, markets may become noticeably more nervous, and U.S. economic indicators could begin to align more closely with deteriorating public sentiment about the state of the economy.

Another shutdown would entail the gradual suspension of statistical institutions, increasing uncertainty across broader markets. This is particularly significant amid ongoing turbulence surrounding the Federal Reserve. A prolonged shutdown could also lead to another wave of furloughs for federal employees, followed by disruptions in air traffic. All of these factors would result in delayed payments and suspended contracts, ultimately translating into weaker consumption and higher unemployment.

At the same time, investors may start increasingly question the stability of the U.S. financial system. The U.S. government is already grappling with elevated debt levels and rapidly rising servicing costs. Another shutdown could worsen the situation and, in a worst-case scenario, evolve into a full-scale financial crisis.

Nevertheless, investors appear to be focusing primarily on the midterm elections. An expected Republican defeat could result in legislative gridlock, effectively limiting Donald Trump’s ability to pursue further trade wars, undermine institutions, or antagonize allies. Such an outcome could be perceived by markets as stabilizing and supportive for asset valuations.

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?

Oil drops over 2% on possible Iran Deal 🛢️🔥

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?