Summary:

S&P500 set to open at new record high

Apple called to open 5% higher after earnings

ADP employment change smashes forecasts

US stocks are set to begin brightly this afternoon ahead of the Fed decision, with the markets surging after last night’s cash close on an upbeat trading update from Apple before a blowout employment figure reaffirmed the notion that the US labour market is strengthening ahead of Friday’s NFP report. The S&P500 actually saw some selling not long before the European cash close during Tuesday’s session but the market remains in a buy-the-dip mode and it once more rewarded traders with this approach as buyers stepped in around the mid 2920s and pushed price back to the highs before the Apple figures provided an additional boost.

The S&P500 remains well supported with dips being bought keenly and the market surged to a new record high after Tuesday’s closing bell, aided by an after hours surge in Apple. Source: xStation

The S&P500 remains well supported with dips being bought keenly and the market surged to a new record high after Tuesday’s closing bell, aided by an after hours surge in Apple. Source: xStation

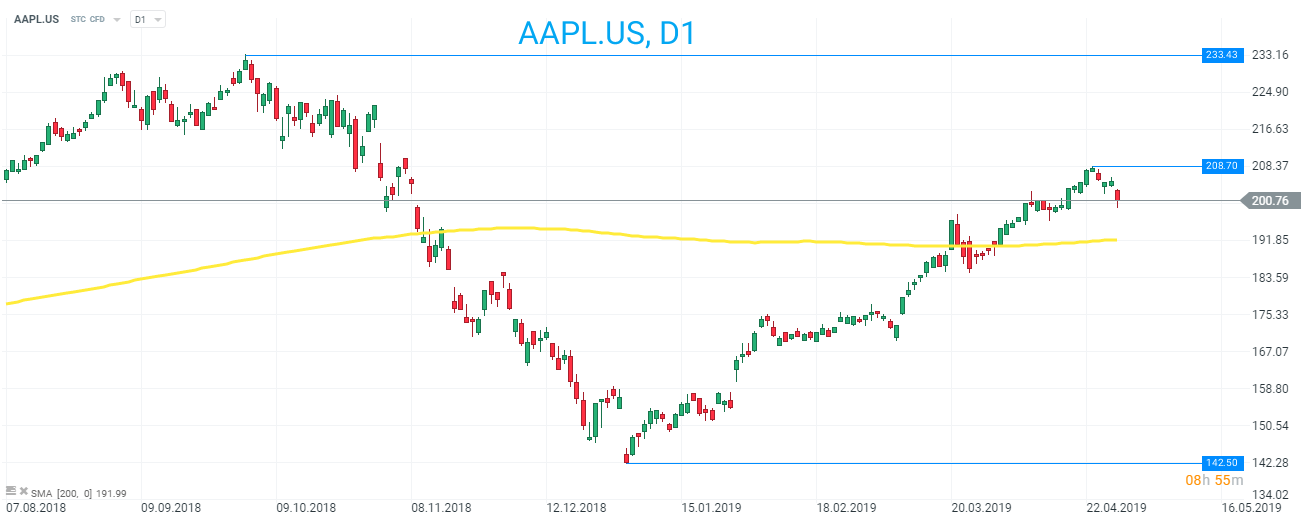

Turning attention to the Apple update, and there was a beat in both revenue and profits for the quarter with EPS of $2.46 vs $2.37 expected and revenue of $58B vs $57.49B expected. This is no doubt pleasing and goes some way to explain the jump in the stock after hours, but there was also further good news in the finer details. One of the main concerns surrounding Apple’s future performance has been nagging doubts that we have reached peak iPhone, meaning the market is saturated and there’s no room for further growth. On this front there was pleasing developments in that iPhone revenue accounted for 53.5% of Apple’s revenue for the company’s fiscal second quarter. Last year, during the same quarter, iPhones sales were 61.4% of sales, and in the most recent quarter that ended in December, it accounted for 61.7% of Apple’s total sales. Shares in Apple are called to open higher by around 5% in the region near 210 at the bottom of the hour.

Apple shares are set to begin at their highest level of the year this afternoon with price called to move back to around the 210 mark and start some 5% on Tuesday’s close. Source: xStation

Apple shares are set to begin at their highest level of the year this afternoon with price called to move back to around the 210 mark and start some 5% on Tuesday’s close. Source: xStation

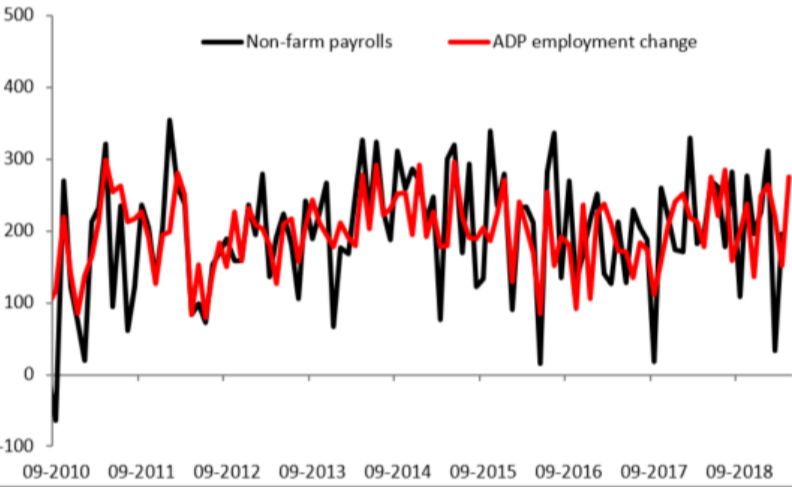

Finally, the fate for US stocks in the upcoming session will likely be determined in how they react to the Fed rate decision at 7PM. Having said that there are a couple of other data points to note that will no doubt have played on the rate-setters minds in deciding the latest monetary policy. At 3PM there’s the ISM manufacturing release but we’ve already had a blowout ADP reading which raises expectations ahead of Friday’s NFP and suggests a continued strength in the US labour market. A build of 275k for April was the highest since last July and well above the 181k expected. What is more, the soft prior reading of 129k was revised up to 151k which further supports the stellar NFP print for March.

ADP employment change recovered strongly in April with a sizable upwards revision to the March data to boot. This will raise hopes of a strong NFP number come Friday. Source: xStation

ADP employment change recovered strongly in April with a sizable upwards revision to the March data to boot. This will raise hopes of a strong NFP number come Friday. Source: xStation