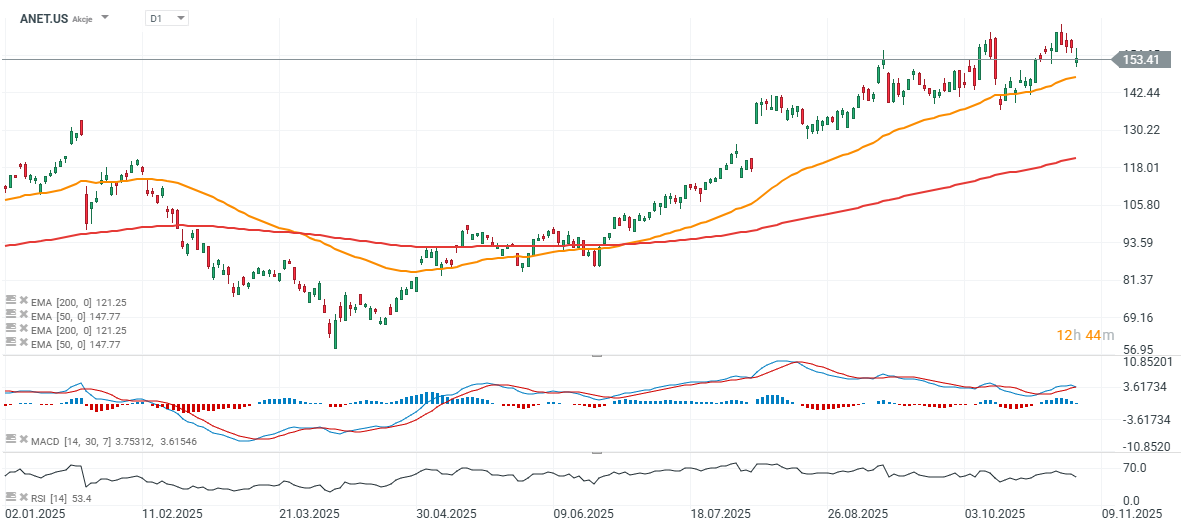

Despite stronger-than-expected revenue and profit in Q3 2025, shares of Arista Networks (ANET.US) — a leader in network switches and software for data centers — fell roughly 12% in the initial market reaction. Below are the key highlights from Arista’s third-quarter 2025 report. Year-to-date, the stock remains up over 40%, having rebounded nearly 60% since its April low. The decline reflects the company’s cautious and broadly in-line guidance for the current quarter and slightly lower margin outlook.

Strong Quarterly Results

-

Adjusted EPS: $0.75 vs. $0.71 expected (+25% YoY).

-

Revenue: $2.31 billion vs. $2.27 billion consensus, up 27.5% YoY.

Margins and Profitability

-

Non-GAAP gross margin: 65.2%, about 1 percentage point above forecasts.

-

Net income: $962 million, roughly 42% of revenue.

-

Cash and investments: $10.1 billion.

Business Momentum

-

Continued strength in cloud and AI networking, supported by partnerships with NVIDIA and OpenAI.

-

New product launches and geographic expansion reinforce Arista’s position as a key player in high-performance data-center infrastructure.

Outlook

-

Q4 revenue: $2.3–$2.4 billion (midpoint $2.35B vs. $2.33B expected).

-

Gross margin: 62–63%, slightly below the previous quarter.

-

FY 2025 revenue: around $8.87 billion (+26–27% YoY);

long-term target of $10.65 billion by 2026.

Management Commentary

-

CEO Jayshree Ullal highlighted strong execution and growing adoption of Arista’s “center-to-cloud” and AI-driven networking vision.

-

CTO Ken Duda emphasized the performance edge of Arista’s hardware in handling AI workloads.

Risks and Watchpoints

-

Component supply volatility could delay shipments.

-

Rising competition in AI and cloud networking segments.

-

Margins sensitive to product mix and broader macroeconomic softness.

Arista once again delivered a strong quarter, beating expectations on both the top and bottom lines. However, a softer margin outlook, in-line revenue guidance, and a broader tech-sector pullback prompted short-term profit-taking. Long term, Arista remains well positioned to capitalize on growing demand for AI-driven and cloud-based networking solutions.

Source: xStation5

Analyst Call Summary

Demand vs. Supply

-

Demand far exceeds supply, with shipments constrained by component availability (38–52 weeks lead time). This created temporary bottlenecks in quarterly results and led to a cautious tone in guidance.

Blue Box

-

A hybrid solution positioned between commodity whitebox systems and full Arista EOS platforms.

-

Lower margins than EOS products; expected to remain niche in 2026 (single-digit number of customers) but strategically vital for scale-up use cases.

Front-End ↔ Back-End

-

Ongoing convergence (currently 800G, moving toward 1.6T).

-

Arista stresses that servicing both layers represents a unique competitive advantage that is hard to replicate.

Product, Technology & Partnerships

-

EtherLink / ESUN / UEC: development of Ethernet Scale-Up Networking standards for AI workloads.

-

AVA (Autonomous Virtual Assist) and NetDL: leveraging AI to design, operate, and optimize networks.

-

Broad ecosystem partnerships with NVIDIA, AMD, Broadcom, OpenAI, Anthropic, Oracle Accelerate, and others.

Financial Highlights & Guidance

-

Q3: non-GAAP gross margin 65.2% (favorable mix + inventory);

net income 41.7% of sales; operating expenses 16.6% of revenue. -

Cash/investments: $10.1B; strong cash flow of ~$1.3B.

-

Purchase commitments: increased to $7B (from $5.7B) to support longer lead times and new products.

-

Deferred revenue: $4.7B; volatile due to acceptance clauses in AI contracts.

-

Q4 guidance: revenue $2.3–$2.4B; GM 62–63%; OM 47–48%; ETR ~21.5%.

-

FY 2025: growth 26–27% (~$8.87B); GM ~64%; campus $750–800M; AI ≥ $1.5B.

-

FY 2026: revenue ~$10.65B (+20% YoY); GM 62–64%; OM 43–45% (lower due to strategic investments).

Management Narrative & Takeaways

-

The company rejects the “deceleration” label, attributing fluctuations to shipment timing, not demand.

-

Product margins dip below 60% amid a heavier cloud/AI mix; software/services less profitable than some analysts expected.

-

Arista maintains a partner-led model (cabling, power, cooling, XPU integration); some sales may use JDM/Blue Box arrangements.

-

Management expects scaling to become easier after 2026–2027.

-

No visible threat from NVIDIA’s networking division in Arista’s core markets.

Bottom line: Demand driven by AI remains at record highs, but longer lead times and the AI/cloud mix are slightly compressing margins. The Blue Box strategy represents a calculated trade-off with strong long-term scale-up potential. The front/back convergence trend continues to play in Arista’s favor thanks to its comprehensive stack (hardware + EOS + software tools).

Guidance for 2025–2026 remains solid though cautious, reflecting deferred customer acceptances in AI-driven projects.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records