- European equity markets ended the session higher — Germany’s DAX gained nearly 1%. Sentiment around the European stocks improved on hopes of a potential end to the war in Ukraine. Earlier, NBC News reported — citing sources within the U.S. administration — that the Ukrainian delegation had agreed to the terms of a U.S.-backed peace proposal. Meanwhile, shares of German defense manufacturer Rheinmetall fell to their lowest levels since April, reflecting weakening momentum across the defense sector.

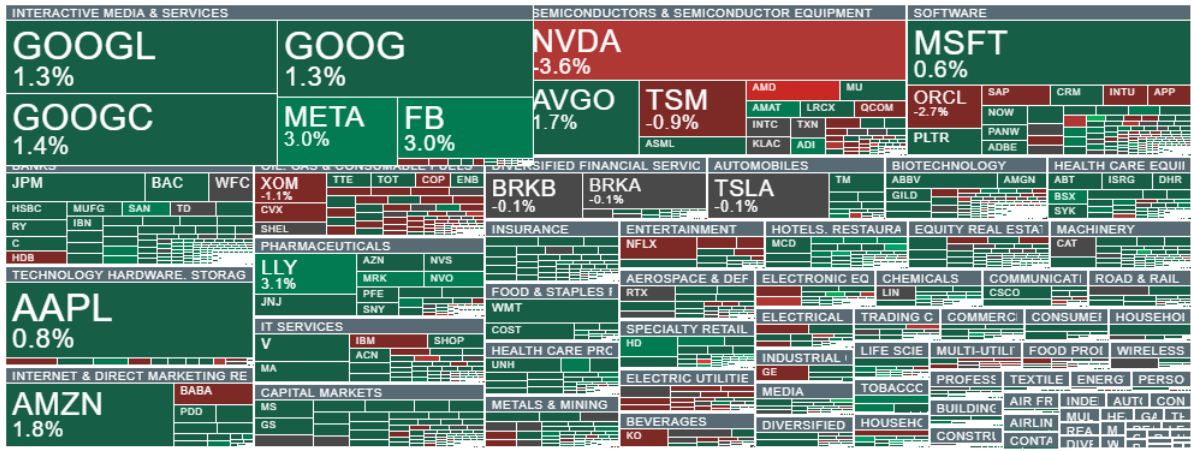

- Market sentiment on Wall Street continues to show a strong appetite for gains, despite Nvidia’s shares initially plunging nearly 7%. The decline in NVDA has now eased to around 3%, and the tech sector is rebounding; losses in Taiwan Semiconductor, AMD and Oracle have also slowed. Meta Platforms and Eli Lilly are trading higher, while Alphabet has reached new all-time highs. Nearly all equity sectors are in the green.

- Semiconductor stocks reacted negatively to reports that Meta is considering using Google’s TPU chips instead of Nvidia’s GPUs. This narrative struck at Nvidia’s perceived “monopolistic” market position and boosted optimism around Alphabet, which, alongside Broadcom, is increasingly viewed as a major challenger to Jensen Huang’s company.

The U.S. dollar is weakening today following soft retail sales data and a drop in consumer sentiment in the Conference Board survey. Wall Street is increasing its bets on a December rate cut, and EURUSD is up 0.4%, rebounding from key support at the 200-day EMA and testing the 1.158 area. Below is today’s U.S. macro data:

-

Conference Board Consumer Confidence: 88.7 (Forecast: 93.3, Previous: 94.6, Revised: 95.5)

-

Pending Home Sales Index: 76.3 (Forecast: –, Previous: 74.8, Revised: 71.8)

-

Retail Sales YoY: 4.3% (Forecast: –, Previous: 5.0%)

-

PPI YoY: 2.7% (Forecast: 2.6%, Previous: 2.6%)

-

Core PPI MoM: 0.1% (Forecast: 0.2%, Previous: -0.1%)

-

Core PPI YoY: 2.6% (Forecast: 2.7%, Previous: 2.8%)

-

PPI MoM: 0.3% (Forecast: 0.3%, Previous: -0.1%)

-

Core Retail Sales MoM: 0.3% (Forecast: 0.3%, Previous: 0.7%, Revised: 0.6%)

-

Retail Sales MoM: 0.2% (Forecast: 0.4%, Previous: 0.6%)

-

Business Inventories MoM: 0% (Forecast: 0%, Previous: 0.2%)

-

Pending Home Sales Change MoM: 1.9% (Forecast: 0.2%, Previous: 0.0%, Revised: -0.1%)

-

Richmond Fed Manufacturing Index: -15 (Forecast: -5, Previous: -4)

-

House Price Index YoY: 1.7% (Forecast: –, Previous: 2.3%)

-

House Price Index MoM: 0% (Forecast: 0.2%, Previous: 0.4%)

-

Case-Shiller 20-City Index YoY: 1.36% (Forecast: 1.4%, Previous: 1.6%)

-

Redbook YoY: 5.9% (Previous: 6.1%)

- ICE coffee futures are rising for the third consecutive session, rebounding after the recent sell-off. The main driver behind the rally is drought in Brazil’s key growing region, Minas Gerais, where rainfall is only around 50% of the historical average.

- Natural gas futures are down more than 2.5% as forecasts for cold weather across many U.S. states have eased, though they are recovering part of earlier losses after dropping over 4.5% in the afternoon.

- Cryptocurrency prices are falling despite improving sentiment in equity markets. Bitcoin is holding around $87,000 and has failed to climb back above $90,000 despite a solid stock market rebound. Ethereum is trading just below $2,900.

- Scott Bessent noted that hearings for Federal Reserve chair candidates are still underway; the White House intends to complete them before the holidays. According to anonymous sources, Kevin Hassett—considered loyal to Donald Trump—has recently gained the upper hand.

- Trump stated that a peace agreement between Russia and Ukraine is “close,” while Ukraine’s President Zelensky expressed his willingness to meet with the U.S. President as soon as possible.

- FedEx shares are up nearly 3% today; the company will invest $200 million to modernize its logistics hub in Anchorage, Alaska — including a new sorting facility and additional aircraft parking capacity.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war