Summary:

- Australian trade balance for September produced a higher than expected trade surplus

- Risk-off prevails this morning as the US and China may not sign an interim trade agreement until December

- Aussie dollar moves slightly lower this morning and continues its march down after nearing the important technical resistance

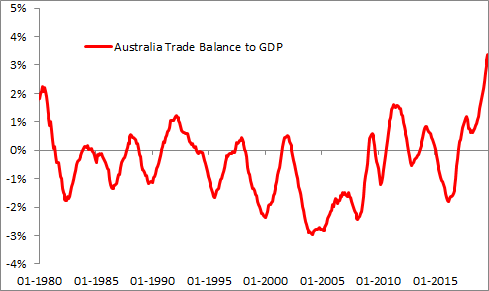

Australian foreign trade data for September came in well above expectations producing a surplus of 7.2 billion AUD while the Bloomberg median estimate had called for a 5.1 billion AUD overhang. Moreover, the data for August was revised up notably to 6.6 billion AUD from 5.9 billion AUD. On top of that, a build-up in the trade surplus last month came along with an improvement in imports and exports as both categories saw a 3% monthly jump. This suggests that both foreign and domestic demand thrived in the last month of the third quarter. Moreover, this was not a one-off but rather part of the steady trend we have been observing for months or even quarters. As a result, a trade surplus increased after September to 3.4% of GDP, suggesting a continued pick-up in rising a current account surplus. Let us remind that Australian current account balance amounted to -0.6% of GDP as of the end of the second quarter, the lowest deficit since 1974 when the Antipodean country saw a surplus. In the long-term it means less reliance on foreing funding, which is undoubtedly a positive future for the economy and should act in favour of the Aussie dollar.

Nonetheless, this is the story for quarters to come while investors are paying their attention elsewhere this morning, namely to revelations signalling that a partial trade agreement between the US and China may not be signed until December. On the face of it, it is not a big deal as long as both countries are willing to sign this agreement anyway. Albeit, it could become a major obstacle for bulls once it turns out that something has gone wrong and will be no trade deal at all. This is why today’s sell-off in riskier assets is rather moderate with the Aussie dollar losing less than 0.2% to its US counterpart.

The Australian trade surplus keeps swelling. Source: Macrobond, XTB

The Australian trade surplus keeps swelling. Source: Macrobond, XTB

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)