Cryptocurrencies rose sharply during today’s session as risk-on sentiment returned to global markets.

- The total capitalization of the cryptocurrency market has risen again above $ 1 trillion. Bitcoin is trying to reverse the weakness against Ethereum and increase its dominance over other altcoins;

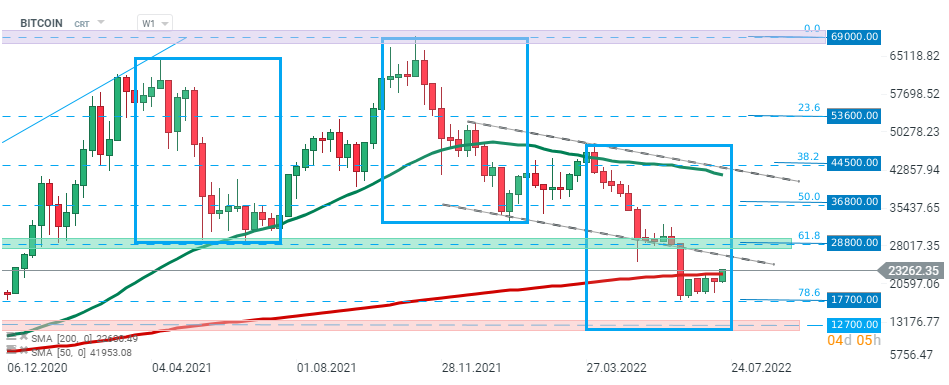

- The price of Bitcoin for the second time broke above the 200 SMA (red line) around $ 22,500, which previously acted as resistance.Yesterday's dynamic growth above it collided with strong supply, however today sellers capitulated;

- Historically, Bitcoin has only fallen below this moving average 3 times and has recovered each time. The average is widely used by analysts to determine a trend, and a break above it can encourage buyers;

- The rebound of Bitcoin is helped by rising indices on both the European and the American stock markets.

Bitcoin, W1 interval. Bitcoin's price rose sharply during today's session and broke above 200 SMA (red line). If the current sentiment is maintained, the upward move could continue towards the $ 28,800 levels, which coincide with the 38.2% Fibonacci retracement of the uptrend wave started in March 2020. On the other hand, if sellers regain control, another downward impulse towards recent lows at $ 17,700 may be launched. Source: xStation5

Bitcoin, W1 interval. Bitcoin's price rose sharply during today's session and broke above 200 SMA (red line). If the current sentiment is maintained, the upward move could continue towards the $ 28,800 levels, which coincide with the 38.2% Fibonacci retracement of the uptrend wave started in March 2020. On the other hand, if sellers regain control, another downward impulse towards recent lows at $ 17,700 may be launched. Source: xStation5

Daily summary: Wall Street, precious metals and EURUSD surge📈Bitcoin under pressure

Key support on Ethereum 💡

Technical analysis: DE40 sell-off deepens 🚨German stocks under pressure

Bitcoin: Could Davos prove a turning point for cryptocurrency legislation? 💰