Bitcoin’s price fell today below $70,000 and is now testing the $69,500 area, down nearly 4%. At the same time, Ethereum is approaching a test of $2,000, while the popular altcoin Ripple is down 10%, extending the sell-off. Bitcoin is trading at its lowest level since early November 2024, before Donald Trump won the election. The new U.S. administration’s crypto-friendly stance has not managed to stop the panic cycle, and the market now appears to have entered a phase of “bottom discovery.”

Bitcoin (W1 timeframe)

Bitcoin is trading about 5% below the 200-week EMA (EMA200), shown as the red line, which broadly signals a mid-phase bear market. If the 2022 scenario were to repeat, Bitcoin could still face one more downward impulse, likely toward $50,000. The decline from the peak has already exceeded 40%.

Source: xStation5

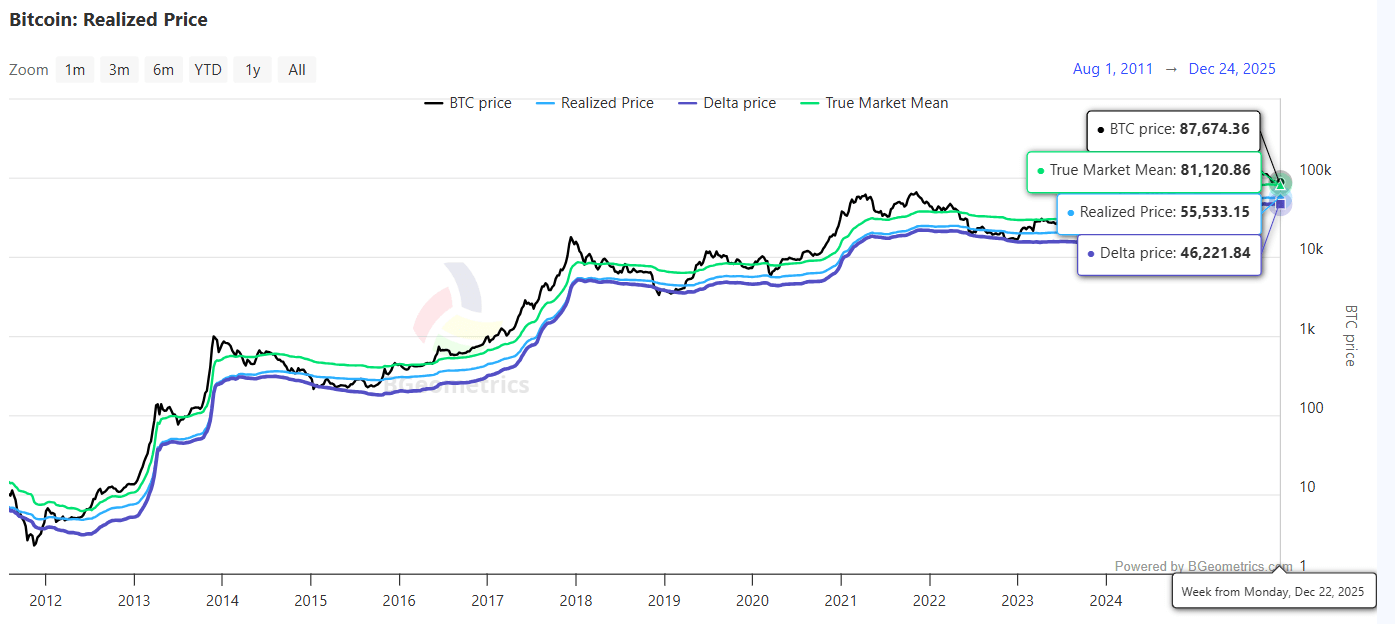

It seems that in this bear-market phase, it may be reasonable to use the previous cycle as a partial reference point. It cannot be ruled out that the price will retest the so-called on-chain price delta this year, a combined “macro” Bitcoin indicator based on long-term support zones and the averaged realized purchase price, currently around $45,000. In the two previous bear markets, the delta level acted as a macro support.

Source: BGeometrics

The weekly RSI for Ethereum stands at 33, compared with 29 for Bitcoin. Despite a 65% drop from its highs, ETH may struggle to regain strength until there is strong, fundamental demand for BTC. In previous bear markets, Ethereum typically fell much more sharply than BTC itself. The latest on-chain reports also point to sales of ETH worth millions of USD by wallets linked to the project’s founder, Vitalik Buterin.

Source: xStation5

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Chart of the day: US100 gains ahead of the Nvidia earnings 📈