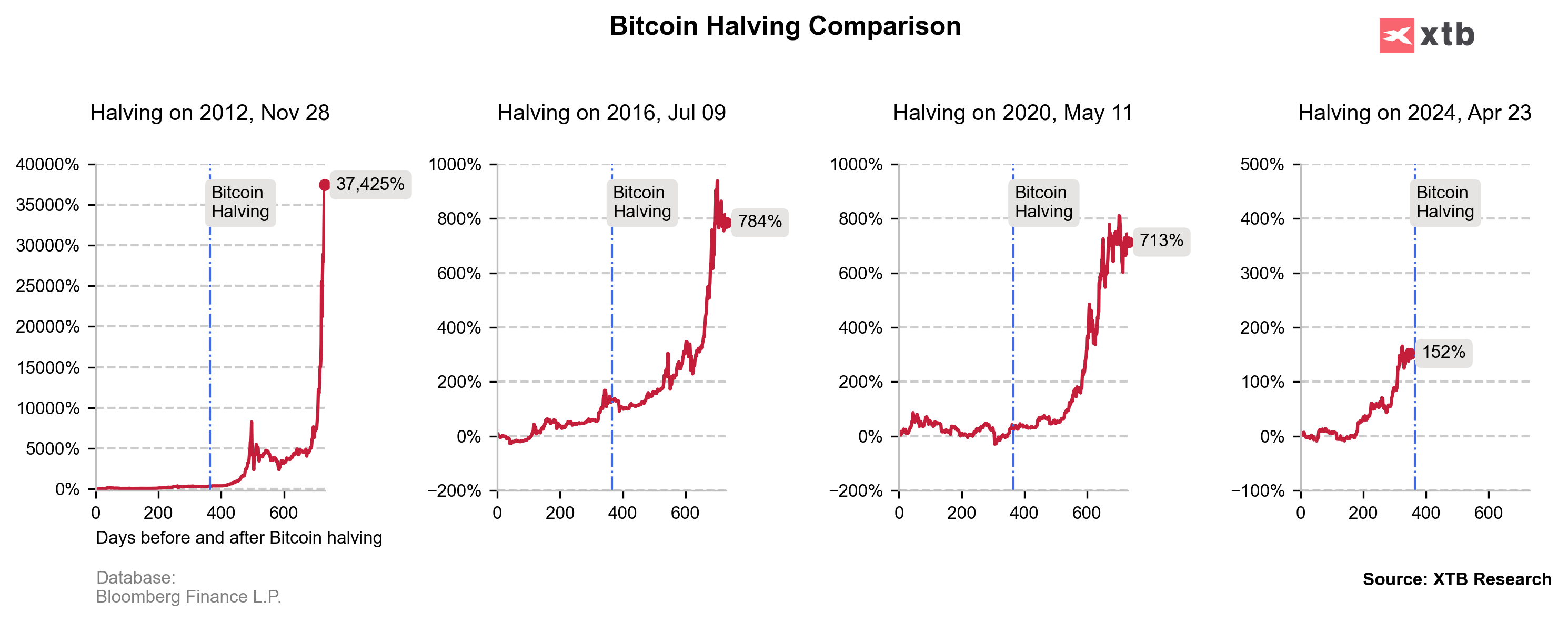

Bitcoin begins the new trading week with a dynamic upward movement, breaking above the level of $72,400. The popular cryptocurrency enters a key phase just before the halving, which is estimated to occur on April 20, 2024. Looking at historical data, the price of BTC tended to increase before the event, followed by a short period of consolidation after the halving.

If the current cycle were to repeat this pattern, we could expect a positive mood in the market in the coming days. Then, after April 20, the market's enthusiasm may stabilize, leading to a short-term correction or consolidation period. Source: XTB Research

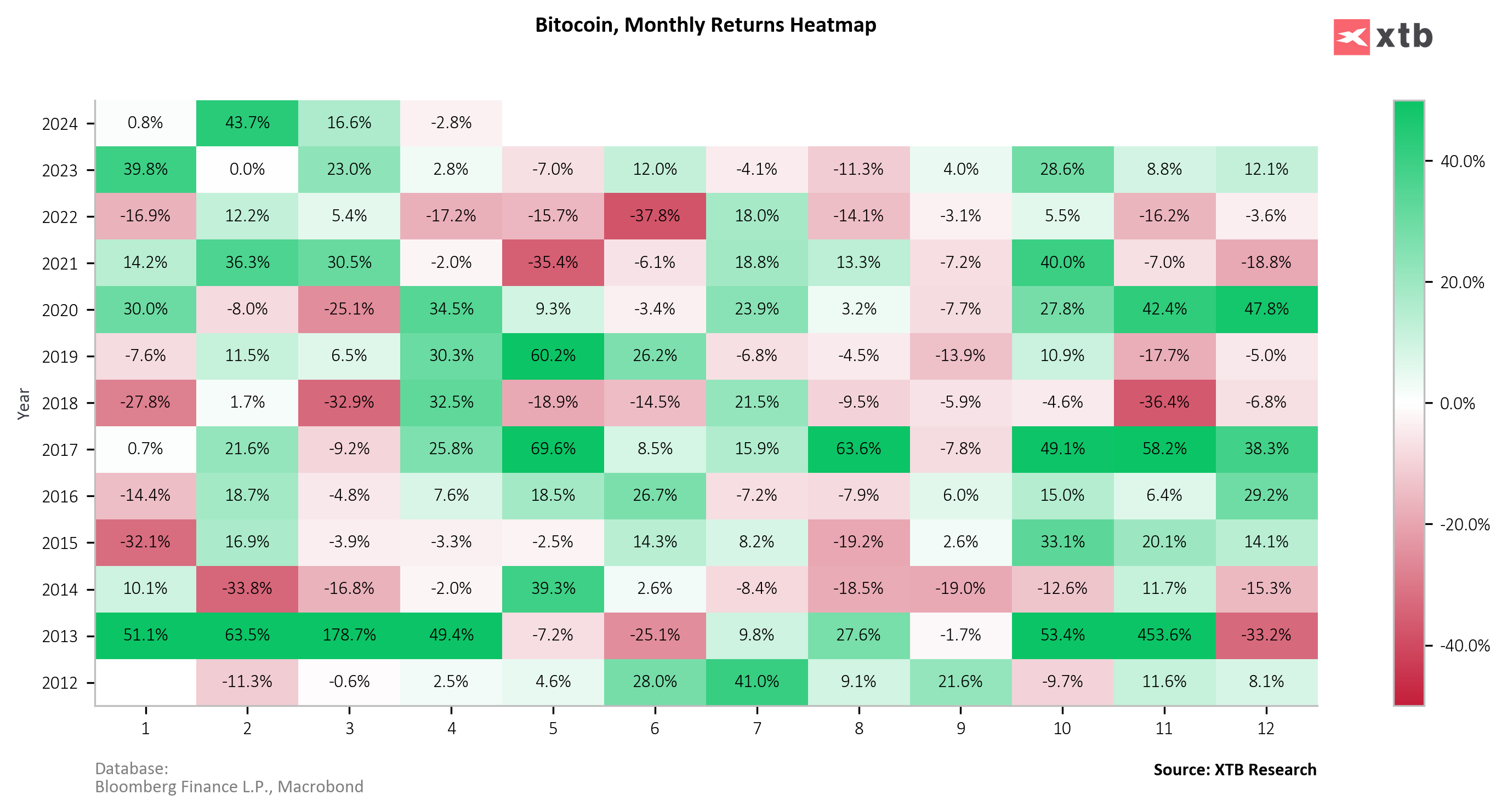

Bitcoin has had 7 consecutive months of growth, and at the time of publication, the 8th month (April) is also close to exceeding the threshold of a positive return rate. Source: XTB Research

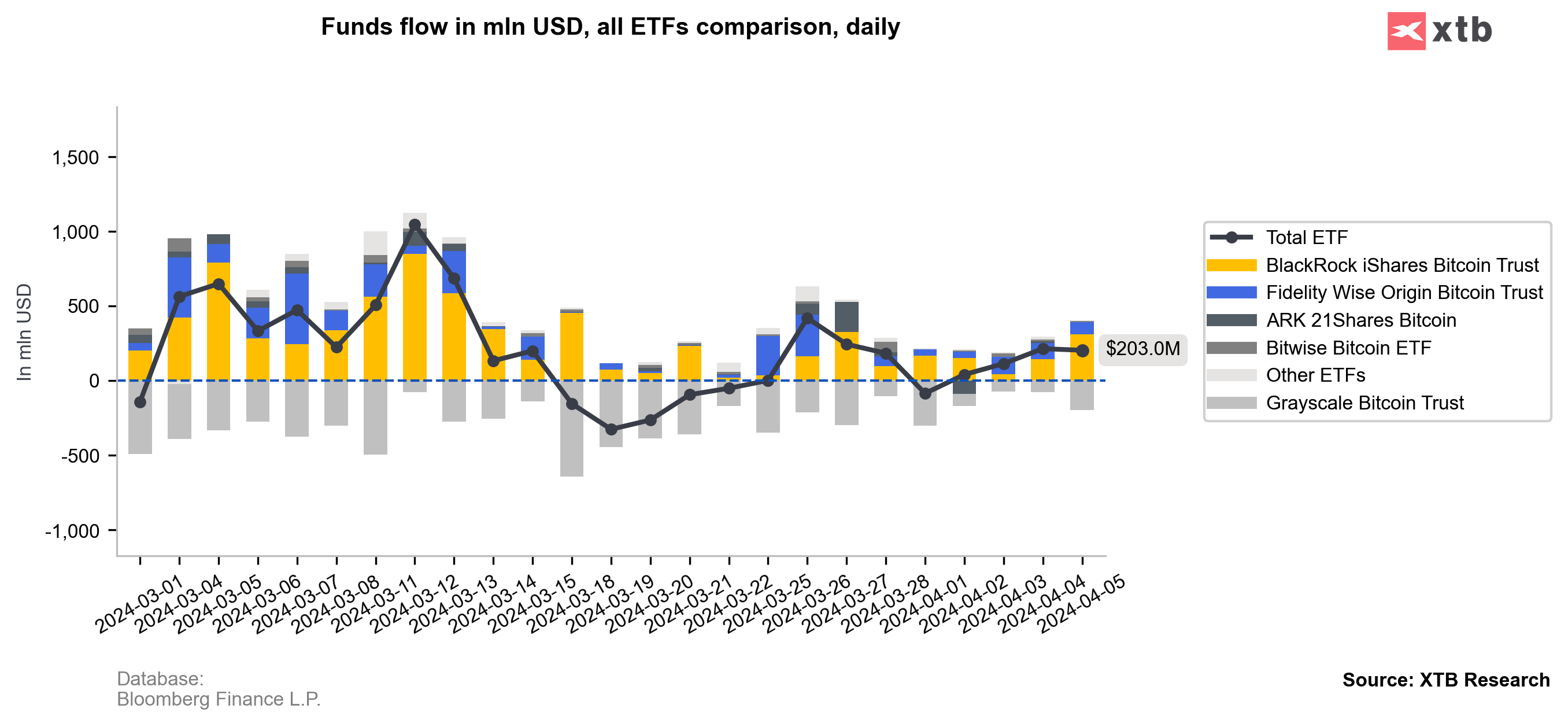

Market sentiment is supported by positive inflows into ETFs. Although the values are no longer as significant as in the first weeks, they are still high amounts on a daily basis, supporting the demand side. Source: XTB Research

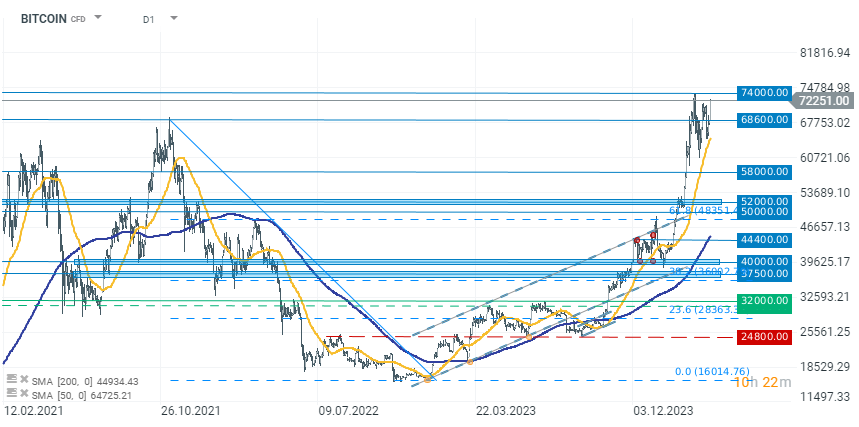

The popular cryptocurrency has shown tremendous upward pressure in the last 4 hours, which has managed to push BTC above the $72,000 barrier. Bitcoin is now only 2% short of reaching new historical highs.

The popular cryptocurrency has shown tremendous upward pressure in the last 4 hours, which has managed to push BTC above the $72,000 barrier. Bitcoin is now only 2% short of reaching new historical highs.

Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?