Bitcoin is extending its losses toward the $81,000 area, returning to recent local lows as the probability of Kevin Warsh being selected as the new Fed chair continues to rise.

Prediction markets have rapidly priced Warsh in as the clear frontrunner, strengthening the US dollar and once again putting pressure on cryptocurrencies. His reputation as a supporter of tighter monetary policy, a smaller Fed balance sheet, and higher real interest rates has unsettled investors, who typically view Bitcoin as a beneficiary of loose financial conditions. As his odds increased, BTC slid into the $81,000–82,000 range, losing more than 3%.

Historical background

Kevin Warsh’s “hawkish” reputation largely stems from his time on the Federal Reserve Board during the 2008–2009 financial crisis, when he repeatedly warned about inflation risks even as the economy was sliding toward deflation and rising unemployment. After the collapse of Lehman Brothers, Warsh argued that the Fed should not abandon its vigilance on inflation.

It is this history that makes markets today associate his potential return with higher real interest rates, a smaller Fed balance sheet, and reduced liquidity — conditions generally unfavorable for assets like Bitcoin, which tend to perform best in periods of cheap money.

Warsh on Bitcoin

Warsh has also been skeptical of speculative excess fueled by loose monetary policy — a category he has at times included cryptocurrencies in. While he is not openly anti-Bitcoin, he has publicly criticized its volatility and the broader digital asset boom during periods of aggressive central bank stimulus.

Does Warsh still hold the same views?

This time, however, the situation may be different for several reasons. First, the Fed chair does not act alone — policy decisions are made by the entire FOMC, and recent votes under Powell have shown significant internal disagreement.

Second, political pressure within the Trump administration is likely to lean strongly toward rate cuts and pro-growth policies, regardless of who leads the Fed. Warsh could therefore soften his hawkish stance if financial conditions tighten too much or recession risks rise.

Finally, today’s economy is structurally different from that of 2008 — with higher debt levels, greater sensitivity to interest rates, and a financial system that reacts far faster to liquidity changes. While Warsh’s reputation explains the current Bitcoin selloff, the long-term impact of his policy approach may prove less restrictive than markets currently fear.

Crypto legislation breakthrough in the shadow of a new Fed frontrunner

At the same time, the United States is moving closer to establishing a clear regulatory framework for cryptocurrencies. A Senate committee has advanced the most comprehensive market structure bill to date, aiming to clearly define supervisory responsibilities between agencies such as the SEC and CFTC, and to replace today’s legal “gray zone” with concrete operating rules for digital asset firms.

The biggest sticking point remains stablecoins — specifically whether crypto companies should be allowed to offer interest-like yields or rewards on holdings. Banks fear this could drain deposits and threaten financial stability. To break the deadlock, the White House is convening a high-level meeting next week with major banks, crypto firms, industry groups, and policymakers to seek a compromise.

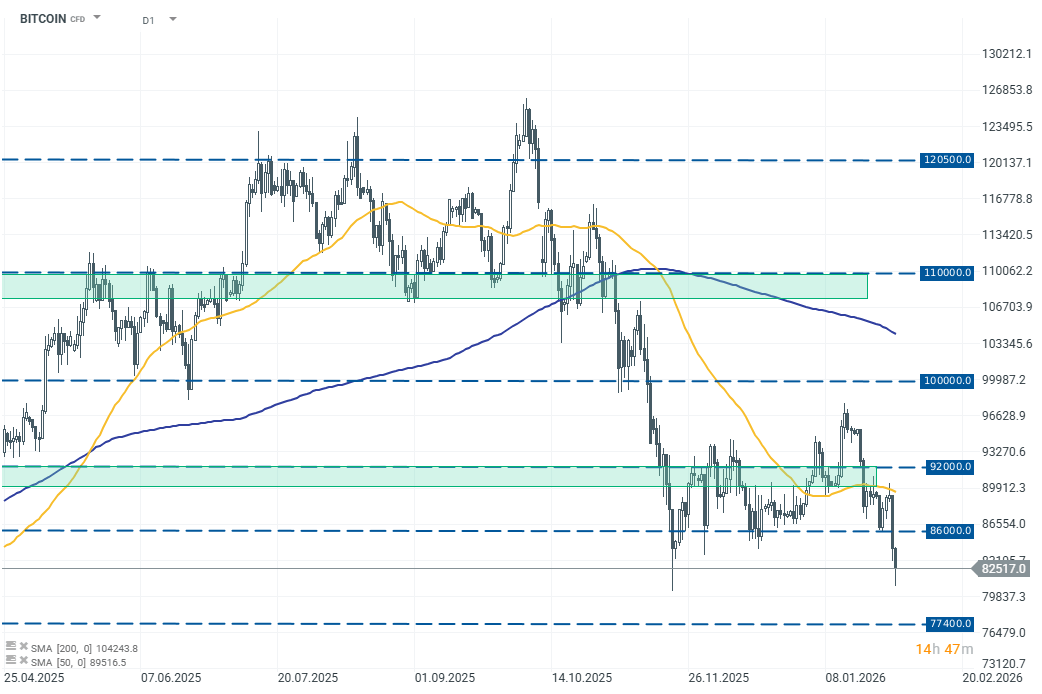

Bitcoin (D1 timeframe)

Today’s selloff has pushed Bitcoin back toward the local lows from two months ago. This is a key zone that bulls need to defend in order to reclaim the next support area around $86,000.

Source: xStation 5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)