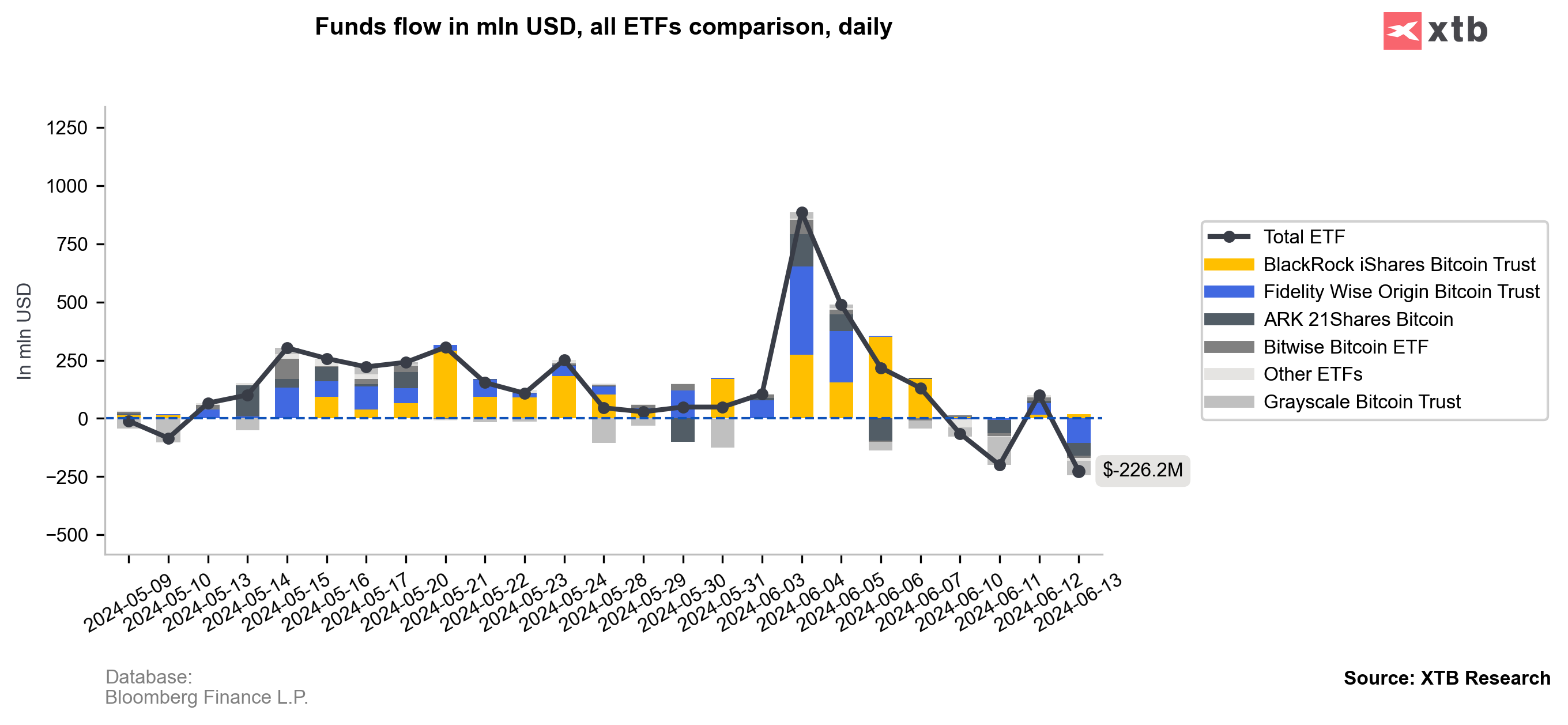

Cryptocurrencies are extending the declines at the end of the week, which has to do with the strength of the U.S. dollar and the massive declines seen in stock market indices. An additional factor causing pressure on the crypto market at the end of the week is the net outflow of funds from spot ETFs. Some of the 'trend-tracking' hedge funds are likely to realize gains through this, or short-term trading strategies involving short-selling, in the face of the underperformance of ETFs, which are often interpreted as the main 'determinant' of cryptocurrency investor sentiment. Additionally, since the halving, we have seen stronger BTC selling among miners, who are receiving lower mining rewards; in the face of lower flows into ETFs, these are not being mitigated by new capital.

ETF funds are selling Bitcoins

Yesterday, capital once again flowed out of U.S. Bitcoin ETFs; the sell-off amounted to more than $200 million. For the first time in dozens of sessions, capital flowed out of the 'low-cost' Fidelity Wise Origin BTC vehicle.

Source: Bloomberg Financial LP , XTB Research

Source: Bloomberg Financial LP , XTB Research

Bitcoin has broken out below the key support zone set by the 50-day exponential moving average and is thus losing nearly 2.10% on an intraday basis. From a technical point of view, an important support zone that could test the strength of the bears is the zone near $63,580, where the so-called Realized Price of Short-Term Holders of Bitcoin runs, which represents the average purchase price of Bitcoin for investors who are considered short-term holders. Source: xStation

Bitcoin vs USDIDX

A strong dollar (USDIDX, yellow chart) has helped push down the price of Bitcoin over the past few, trading sessions.

Source: xStation5

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

Crypto news: Bitcoin gains almost 2% despite the war in the Middle East 📈

Jane Street: Legendary market maker in the court

Morning Wrap: Nvidia's brilliant results drag the market down (27.022026)