- Bitcoin and Ethereum are falling after the rebound attempt

- Whale address 0xb317 opens a new short position on BTC

- Sentiments on Wall Street are weakening again

- Bitcoin and Ethereum are falling after the rebound attempt

- Whale address 0xb317 opens a new short position on BTC

- Sentiments on Wall Street are weakening again

Bitcoin’s price is once again falling toward $111,000, and the current correction suggests that bears may have an appetite to test recent lows around $108,000. Market sentiment on Wall Street is weakening, and additionally, the whale address 0xb317 — known for its $192 million short bet on Bitcoin, opened just before Donald Trump’s tweet on Friday — has now opened another short position worth $163 million. The position currently shows about $5 million in unrealized profit, with a liquidation price at $125,500. This development has fueled market speculation about potential insider trading by the 0xb317 address.

Source: xStation5

Ethereum has fallen below the key $4,000 level and has failed to break above the 50-day EMA to regain sustained bullish momentum. The current key support level is at $3,600 (200-day EMA).

Source: xStation5

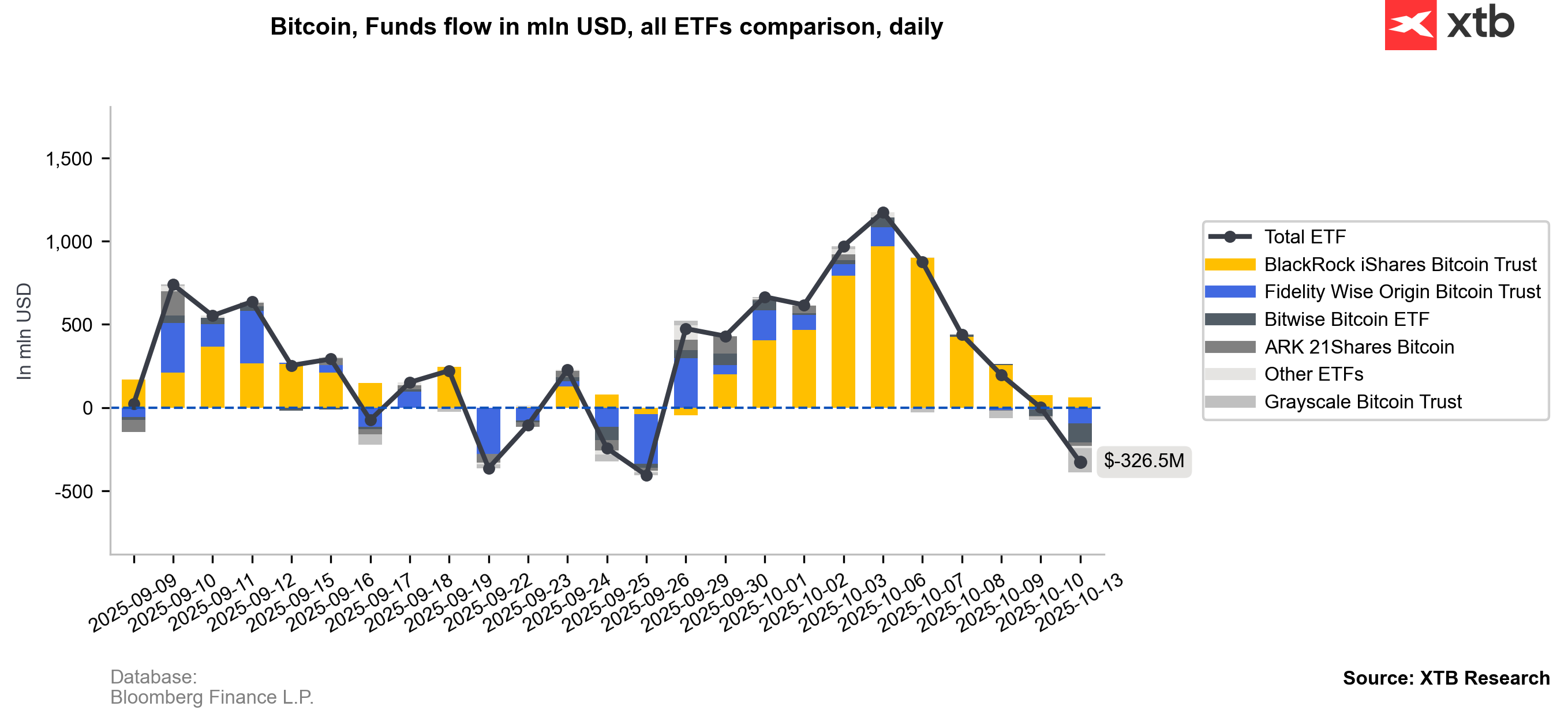

ETF inflows to Bitcoin were negative on Friday, and Monday (-326M).

Source: Bloomberg Finance L.P., XTB Research

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments