Cryptocurrencies are the worst performing asset class during the European morning trading. Digital assets are being pressured by a number of factors. While some of those are not new and have been reported last week, combination of them all looks to be denting moods among crypto investors. Firstly, US President Biden signed a $550 billion infrastructure bill that includes new requirements on crypto taxation. Secondly, the Chinese National Development and Reform Commission said that it is exploring options for levying punitive energy prices on companies and households that defy ban on industrial-scale cryptocurrency mining. Last but not least, the US financial watchdog remains reluctant when it comes to spot Bitcoin ETFs. SEC rejected spot Bitcoin ETF application from VanEck at the end of last week. However, SEC continues to green light Bitcoin futures ETFs.

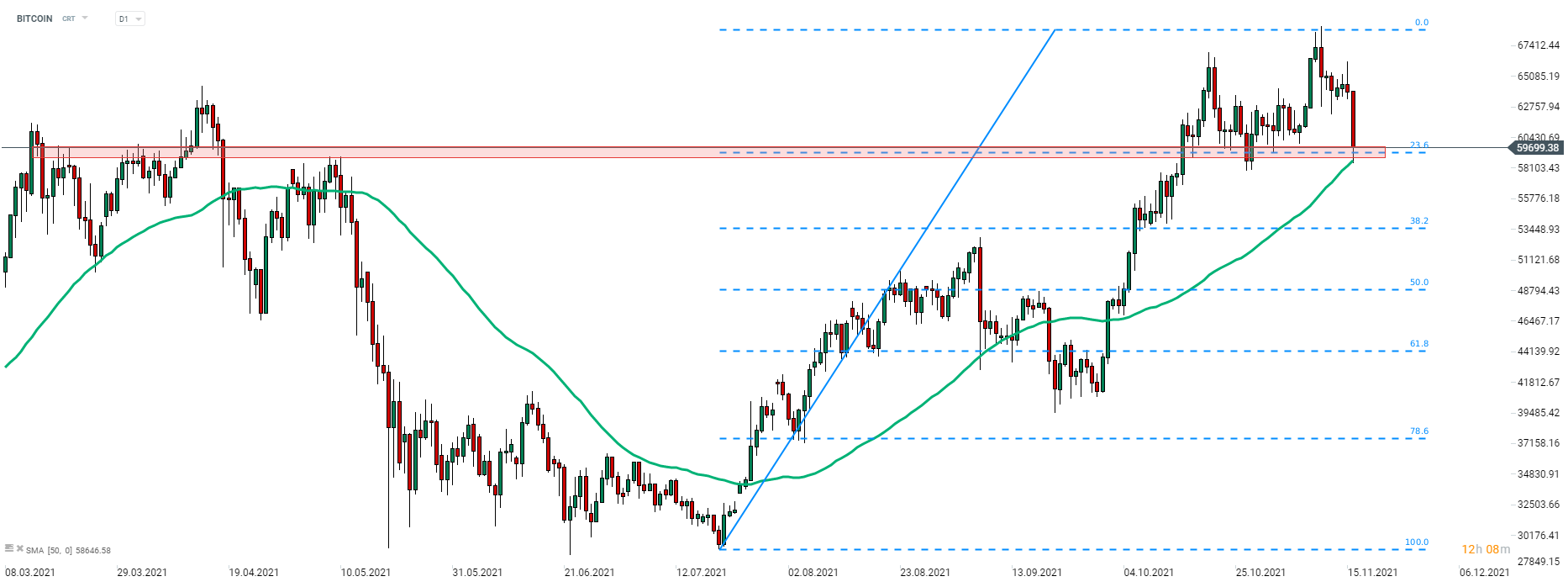

Declines can be spotted all across the cryptocurrency market today with some coins - like LITECOIN, EOS or BITCOIN CASH - dropping more than 10%. While Bitcoin is holding quite firm compared to other cryptos, it still trades over 6% lower on the day. The most famous digital currencies dipped below the $60,000 mark for the first time in two weeks today. Daily low reached near $58,500 - the lowest level since late-October. However, declines were halted at the 50-session moving average (green line) and the coin has subsequently climbed back above the 23.6% retracement of recent upward move.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?