Bitcoin, as well as other cryptocurrencies, trades higher today. The world's most famous cryptocurrency is trading 1.5% higher today and tests the $49,000 area. This is the zone that halted advance back in the first half of January. However, the coin enjoyed strong bullish momentum recently and a more sustained break above the $49,000 handle cannot be ruled out.

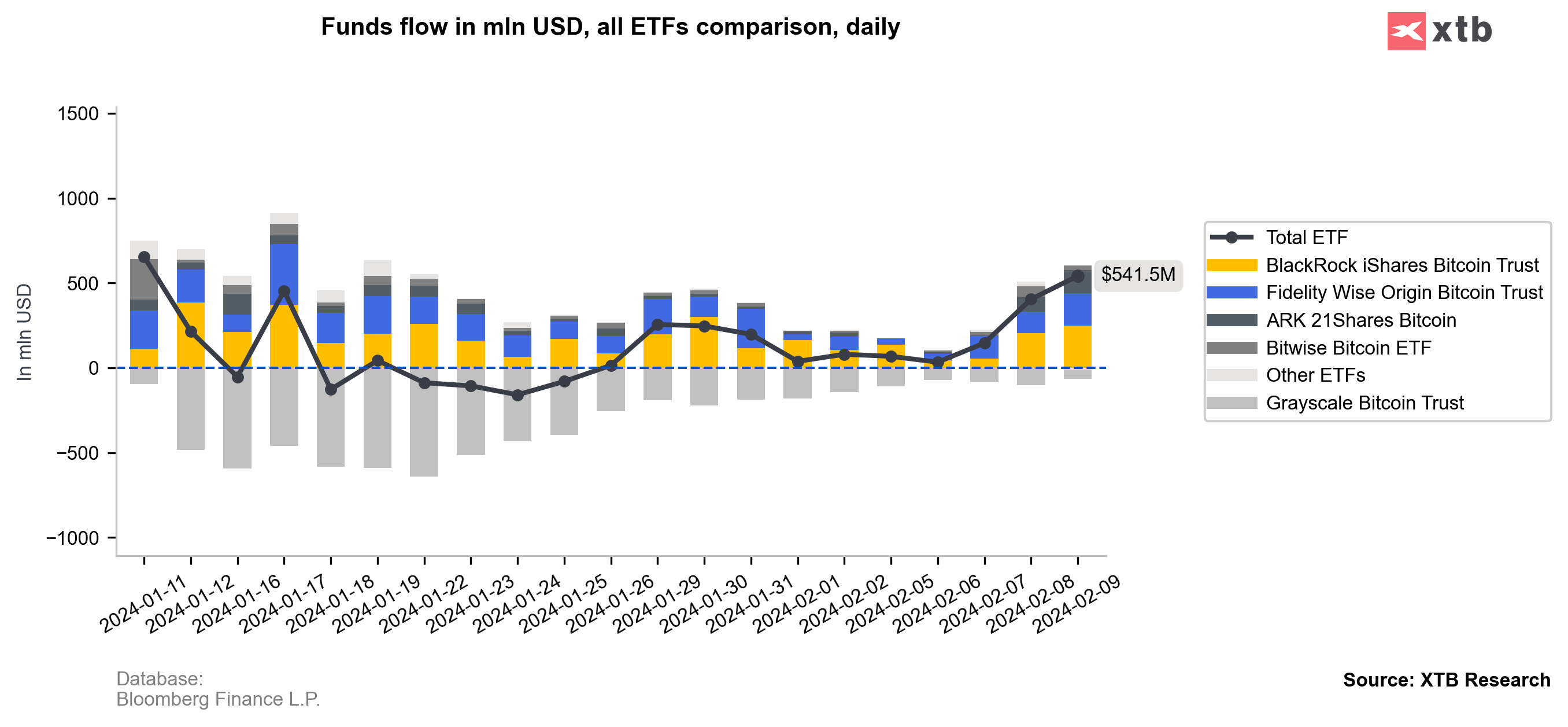

Sentiment on the cryptocurrency market has been supported by the launch of Bitcoin spot ETFs. More precisely, data continues to show strong inflows into cryptocurrency ETFs. Combined, 9 Bitcoin spot ETFs that launched trading on January 11, 2024 have already attracted over $9 billion in investors' capital. Moreover, market insiders are hinting that institutional investors are also piling into those investment vehicles.

Taking a look at BITCOIN chart at H4 interval, we can see that the coin is trading over 26% above late-January 2024 lows. Price has briefly traded above the $49,000 area earlier today but has pulled back slightly since.

Source: xStation5

Source: xStation5

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?