Boeing dips another 1.00% today following further reports of safety and aircraft quality issues. The company is investigating a new quality issue with the 787 Dreamliner after discovering that hundreds of fasteners were improperly installed on the main bodies of some undelivered planes. This issue, involving more than 900 fasteners per plane, does not pose an immediate flight safety threat, but the company is working to understand the cause. Boeing is cooperating with customers and the FAA and has recently presented a plan to the FAA to improve product safety following a structural failure in a 737 Max 9 aircraft in January.

Another information that was revealed today refers to the fatal 737 MAX crashes. The company told the US Justice Department it did not violate a deferred prosecution agreement. This response follows the Justice Department's determination in May that Boeing violated the 2021 DPA by failing to maintain a proper compliance and ethics program. Boeing maintains transparency with the Department and is working to address these concerns.

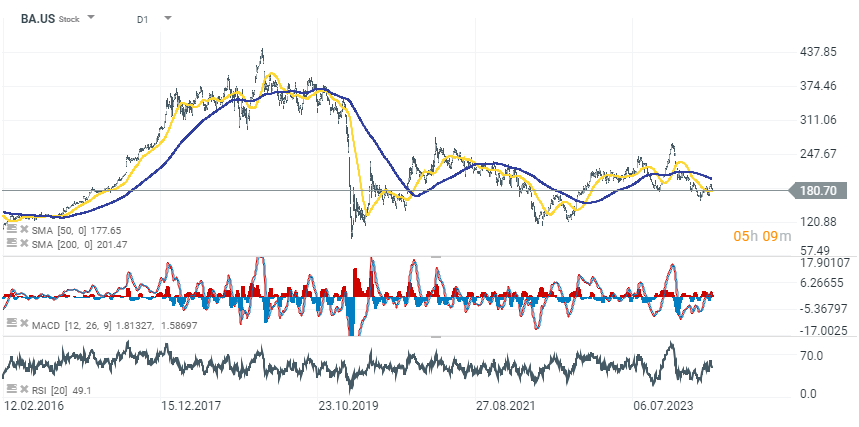

Boeing is currently in the aftermath of a series of bad events acting to the detriment and reputation of the company. The share price has remained at the bottom of its consolidation range for several years and the lack of strong catalysts has prevented the bulls from attempting a return to growth. However, despite this, the company managed to beat investors' expectations in its Q1 2024 results.

24 April 2024 - Q1 earnings summary

- Boeing shares gained nearly 3% due to a better-than-expected Q1 earnings report.

- Technical problems with the 737 Max are being addressed.

- Boeing is intentionally slowing production to ensure safety.

- Key financial results:

- Revenue: $16.57 billion

- Adjusted EPS loss: $1.13

- Negative free cash flow: $3.93 billion

- Backlog: $529 billion

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood